May 12, 2025 a 09:17 am

Material Stocks - Performance Analysis

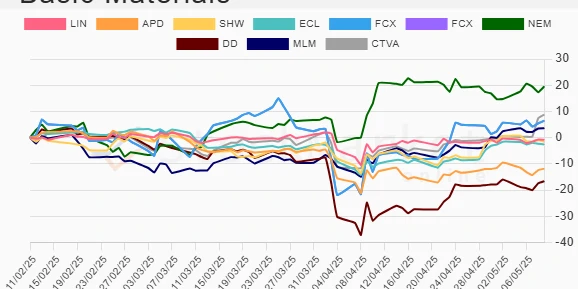

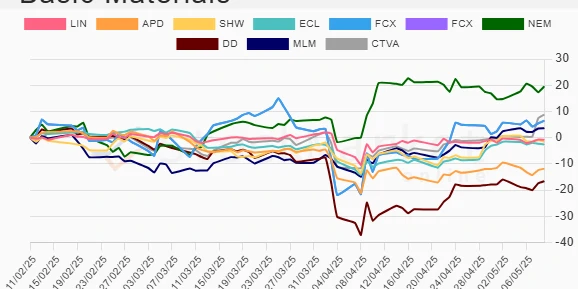

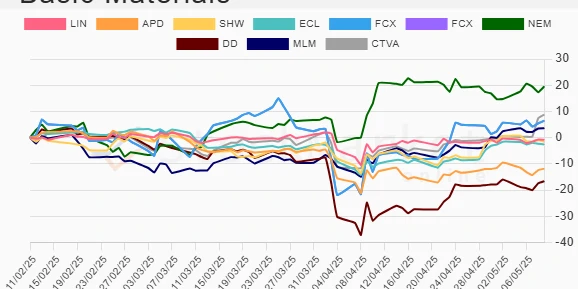

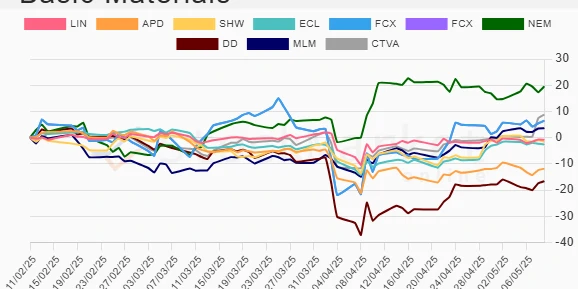

The materials sector has experienced dynamic shifts over the recent weeks and months. Analyzing the performance of the leading stocks within this sector reveals diverse trajectories and emphasizes the importance of tracking short- and long-term trends. In this report, we explore the performance over a week, a month, and three months to gain insights into market movements, identify top performers, and provide a comprehensive sector outlook.

📊 Material Stocks Performance One Week

During the past week, the materials sector saw mixed performances among its leading stocks. Notable gainers include Corteva, Inc. (CTVA) with a particularly impressive surge, while Sherwin-Williams Co. (SHW) experienced substantial declines amidst broader market fluctuations.

| Stock | Performance (%) | Performance |

|---|---|---|

| CTVA | 8.51 | |

| DD | 2.25 | |

| NEM | 1.85 | |

| FCX | 1.41 | |

| LIN | 0.04 | |

| MLM | -0.05 | |

| APD | -0.36 | |

| ECL | -0.96 | |

| SHW | -2.21 |

📊 Material Stocks Performance One Month

The monthly overview reveals significant upward trends, particularly for CTVA and FCX, showcasing robust growth. Conversely, NEM demonstrated a slight downward trend despite overall sector gains.

| Stock | Performance (%) | Performance |

|---|---|---|

| CTVA | 13.73 | |

| FCX | 13.21 | |

| DD | 12.91 | |

| MLM | 9.94 | |

| ECL | 7.28 | |

| SHW | 4.70 | |

| LIN | 2.52 | |

| APD | 1.01 | |

| NEM | -1.36 |

📊 Material Stocks Performance Three Months

Over the last three months, Newmont Corporation (NEM) displayed exceptional growth, suggesting strong market confidence. Conversely, Dupont (DD) faced considerable setbacks, highlighting potential challenges.

| Stock | Performance (%) | Performance |

|---|---|---|

| NEM | 19.49 | |

| CTVA | 8.75 | |

| FCX | 6.45 | |

| MLM | 3.54 | |

| LIN | -0.86 | |

| SHW | -1.53 | |

| ECL | -2.63 | |

| APD | -11.86 | |

| DD | -16.66 |

📈 Summary

Overall, the materials sector presents a diverse landscape, with several stocks achieving robust growth while others face challenges. Leaders such as Corteva, Inc. and Newmont Corporation offer promising opportunities given their positive trajectories over multiple timeframes. However, investors should remain cautious regarding stocks experiencing significant underperformance, like Dupont, suggesting underlying challenges. Diversification within the sector could be a prudent strategy to balance risk and capitalize on emerging opportunities.