August 08, 2025 a 11:44 am

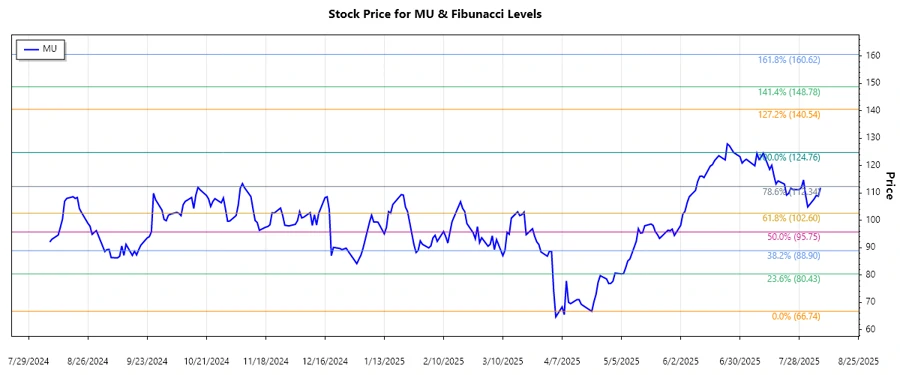

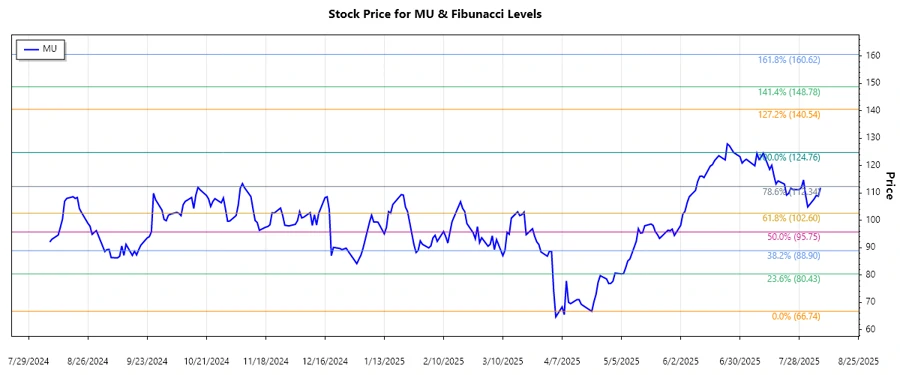

MU: Fibonacci Analysis - Micron Technology, Inc.

Micron Technology, Inc. (MU) has experienced a fluctuating market condition over the past few months with notable periods of high volatility. Recently, the stock has seen a significant upward trend, indicative of investor confidence and rising demand within the semiconductor sector. However, market conditions remain dynamic with potential risks lurking due to global economic conditions and market competition.

Fibonacci Analysis

| Parameter | Value |

|---|---|

| Start Date | 2025-04-21 |

| End Date | 2025-08-07 |

| High Price | $124.76 on 2025-06-27 |

| Low Price | $66.74 on 2025-04-21 |

| Fibonacci Level | Price Level |

|---|---|

| 0.236 | $82.52 |

| 0.382 | $93.09 |

| 0.5 | $95.75 |

| 0.618 | $107.41 |

| 0.786 | $112.84 |

Currently, the price is near $111.87, which is in the 0.786 retracement zone. This suggests potential resistance around this level.

Technically, this level could act as a strong resistance. If the price breaks this point, it might continue the upward trajectory; otherwise, a reversal might occur.

Conclusion

The upward trend observed in Micron Technology's stock suggests positive investor sentiment and market confidence. The price nearing the 0.786 Fibonacci retracement level signals a crucial test for the stock's persistence in this bullish trend. Breaking past this level could propel further gains, though caution is warranted due to potential resistance and global market variables. Investors should weigh the robust sector demand against potential geopolitical and competitive risks influencing the semiconductor industry.