November 04, 2025 a 10:15 am

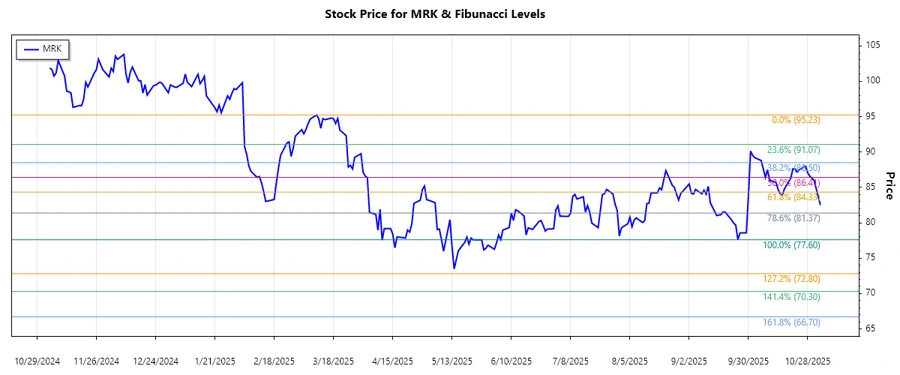

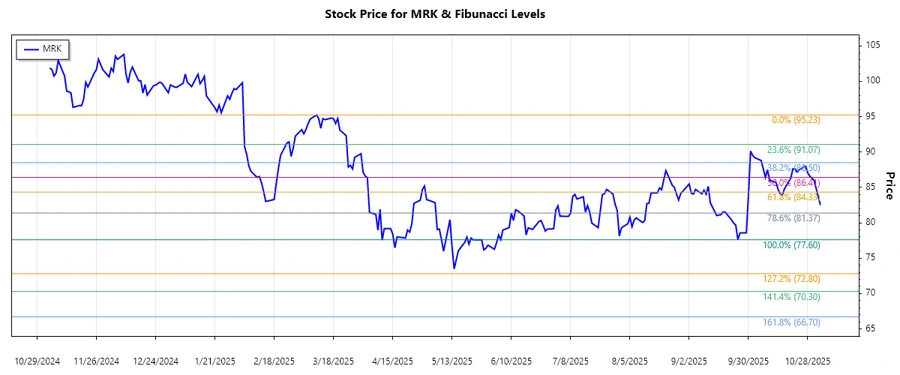

MRK: Fibonacci Analysis - Merck & Co., Inc.

Merck & Co., Inc. has experienced various market conditions over the past few months, demonstrating resilience amid economic fluctuations. Recent trends suggest a shift in momentum, which could provide strategic opportunities for investors focused on healthcare and pharmaceuticals. This analysis will delve into the technical aspects to evaluate potential price movements using Fibonacci Retracements.

Fibonacci Analysis

| Information | Details |

|---|---|

| Trend Duration | March 3, 2025 - September 29, 2025 |

| High Point | $95.23 on March 10, 2025 |

| Low Point | $77.60 on September 25, 2025 |

| Fibonacci Level | Price |

|---|---|

| 0.236 | $82.73 |

| 0.382 | $85.44 |

| 0.5 | $86.42 |

| 0.618 | $87.41 |

| 0.786 | $89.38 |

The current price of $82.49 is below the 0.236 Fibonacci level, indicating that the price is potentially moving towards the retracement zone, but has yet to establish a clear position within it. This situation suggests possible support in the near term.

Conclusion

The Fibonacci analysis identifies key levels where Merck's stock may find support or resistance. While currently trading near the lower retracement levels, the stock demonstrates potential upward momentum if it rebounds. Investors should watch for price action around these Fibonacci levels to gauge market sentiment and measure risk against reward. Overall, this analysis suggests cautious optimism for Merck's stock, pending confirmation of a reversal pattern or continuation.