October 19, 2025 a 12:46 pm

MPC: Dividend Analysis - Marathon Petroleum Corporation

Marathon Petroleum Corporation has shown a consistent dividend payment history over the past 15 years. With a current dividend yield of 2.20%, the company exhibits a solid commitment to returning value to shareholders. However, the growth rate of dividends has been moderate, reflecting a stable but not aggressive growth strategy. The absence of recent cuts or suspensions further indicates resilience in its dividend policy.

📊 Overview

Marathon Petroleum Corporation operates within the energy sector, where dividend yield and stability are significant indicators of financial health and shareholder returns. Analysis shows a sector-average yield with a steady dividend history.

| Metric | Value |

|---|---|

| Sector | Energy |

| Dividend yield | 2.20% |

| Current dividend per share | 3.38 USD |

| Dividend history | 15 years |

| Last cut or suspension | None |

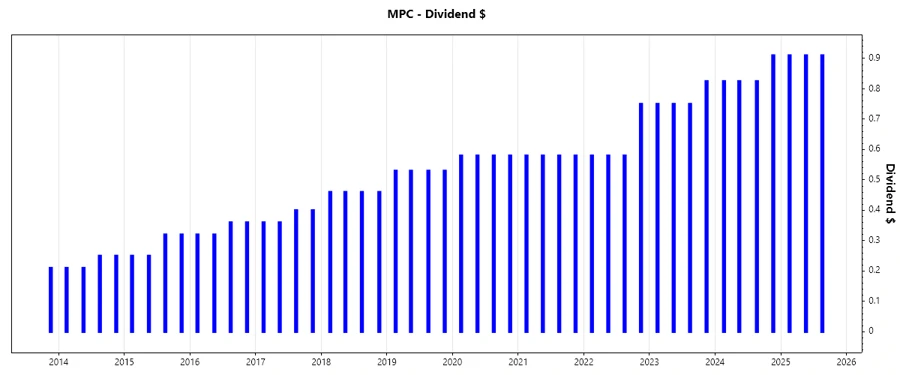

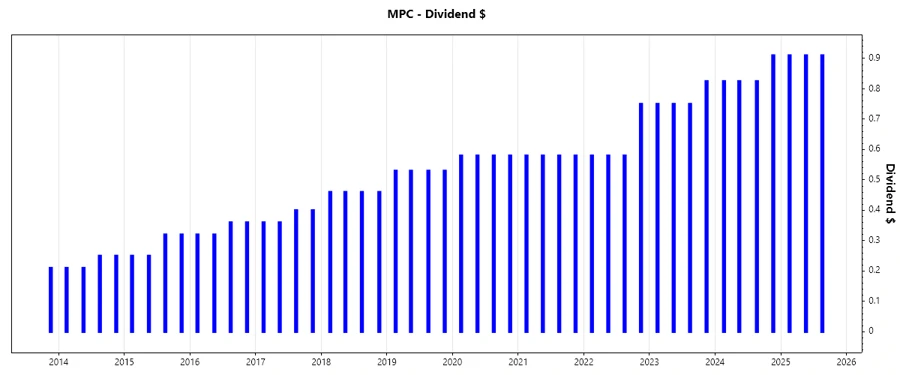

📈 Dividend History

The company's dividend history is critical for predicting future payout stability and shareholder confidence. Marathon has demonstrated reliability in its distributions, reflecting positively on managerial foresight and operational stability.

| Year | Dividend per Share (USD) |

|---|---|

| 2025 | 2.73 |

| 2024 | 3.385 |

| 2023 | 3.075 |

| 2022 | 2.49 |

| 2021 | 2.32 |

📈 Dividend Growth

Dividend growth rates are indicative of a company's confidence in its future earnings and its willingness to share profits. Marathon's growth over the last few years has been moderate but consistent, laying a firm foundation for long-term investors.

| Time | Growth |

|---|---|

| 3 years | 13.42% |

| 5 years | 9.81% |

The average dividend growth is 9.81% over 5 years. This shows moderate but steady dividend growth.

✔️ Payout Ratio

Payout ratios reveal how well earnings cover the dividend payments and are vital for assessing the sustainability of dividends. Marathon's payout ratios suggest a balanced approach, where the current earnings and free cash flow comfortably cover its dividend commitments.

| Key figure | Ratio |

|---|---|

| EPS-based | 49.03% |

| Free cash flow-based | 28.21% |

With a payout ratio of 49.03% (EPS) and 28.21% (FCF), the company's dividends are well-covered, reflecting robust earnings and cash flow support.

💵 Cashflow & Capital Efficiency

Analyzing cash flow and capital efficiency metrics indicates how effectively the company generates and uses capital to sustain its operations and dividends. Marathon shows a solid free cash flow yield and moderation in CAPEX relative to operating cash flow—an efficient use of capital.

| Metric | 2024 | 2023 | 2022 |

|---|---|---|---|

| Free Cash Flow Yield | 12.89% | 20.25% | 23.39% |

| Earnings Yield | 7.24% | 16.02% | 24.35% |

| CAPEX to Operating Cash Flow | 43.60% | 13.39% | 14.79% |

| Stock-based Compensation to Revenue | 0% | 0% | 0% |

| Free Cash Flow / Operating Cash Flow Ratio | 70.77% | 86.61% | 85.21% |

The data suggests that Marathon has stable cash flow and commendable capital efficiency, contributing to a secure financial footing for dividend payments.

📉 Balance Sheet & Leverage Analysis

A company's balance sheet strength indicates its ability to manage financial obligations while supporting dividend payouts. Marathon displays manageable debt levels in relation to its equity and assets.

| Metric | 2024 | 2023 | 2022 |

|---|---|---|---|

| Debt-to-Equity | 1.62 | 1.17 | 1.01 |

| Debt-to-Assets | 36.47% | 33.15% | 31.04% |

| Debt-to-Capital | 61.84% | 53.87% | 50.17% |

| Net Debt to EBITDA | 2.39 | 1.24 | 0.77 |

| Current Ratio | 1.23 | 1.59 | 1.76 |

| Quick Ratio | 0.71 | 1.13 | 1.32 |

| Financial Leverage | 4.44 | 3.52 | 3.24 |

Marathon's leverage ratios reflect skillful financial management, sustaining stability and providing a solid ground for further growth.

📈 Fundamental Strength & Profitability

Strong fundamentals and profitability are key for ensuring dividend safety and growth. Marathon's returns and profit margins are reflective of an efficient and profitable operation.

| Metric | 2024 | 2023 | 2022 |

|---|---|---|---|

| Return on Equity | 19.40% | 39.64% | 52.35% |

| Return on Assets | 4.36% | 11.25% | 16.14% |

| Margins: Net | 2.48% | 6.52% | 8.18% |

| Margins: EBIT | 5.27% | 10.28% | 12.22% |

| Margins: EBITDA | 7.74% | 12.56% | 14.04% |

| Margins: Gross | 6.52% | 11.18% | 12.71% |

| Research & Development to Revenue | 0% | 0% | 0% |

This profitability is aligned with shareholder interests, securing long-term value and dividend reliability.

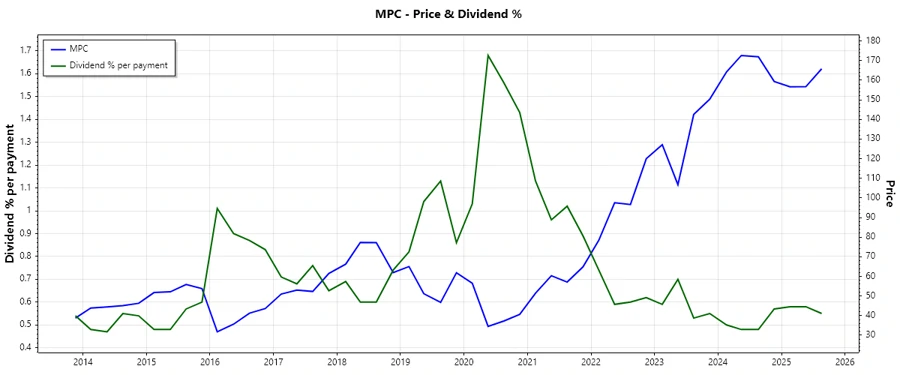

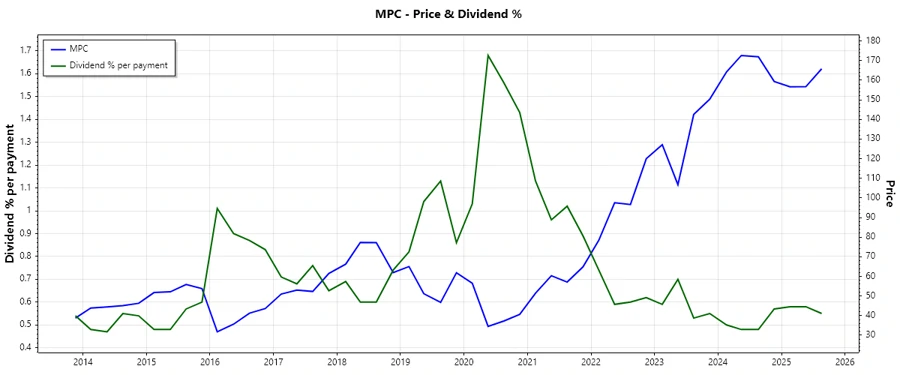

📈 Price Development

🔍 Dividend Scoring System

| Category | Score | Bar |

|---|---|---|

| Dividend yield | 3 | |

| Dividend Stability | 5 | |

| Dividend growth | 3 | |

| Payout ratio | 4 | |

| Financial stability | 4 | |

| Dividend continuity | 5 | |

| Cashflow Coverage | 4 | |

| Balance Sheet Quality | 4 |

Total Score: 32/40

⭐ Rating

In conclusion, Marathon Petroleum Corporation presents a well-balanced dividend profile with stable payouts and dependable growth potential. While the dividend yield is moderate, its consistency and financial strategies commend a 'Buy' recommendation for income-focused investors.