August 12, 2025 a 06:44 am

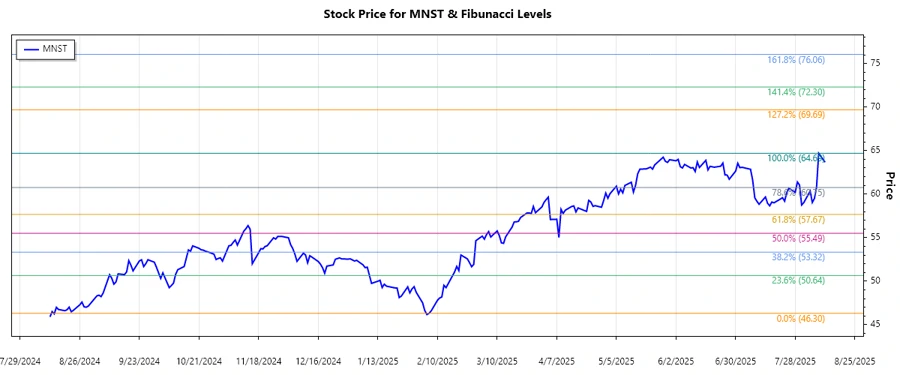

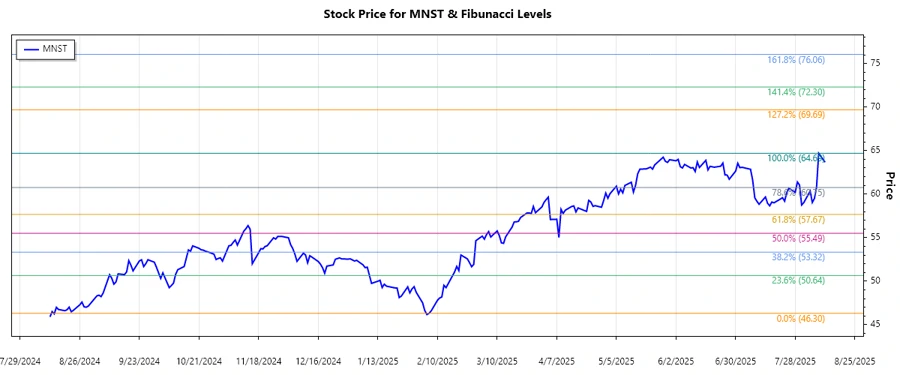

MNST: Fibonacci Analysis - Monster Beverage Corporation

The Monster Beverage Corporation's stock, denoted by MNST, has demonstrated significant momentum upward from earlier this year, reflecting strong market trends and favorable sentiment. Despite some recent fluctuations, the overall trend shows resilience, with energy drinks' growing market and Monster's strategic branding playing key roles. The current technical outlook suggests a pivotal moment as the stock approaches critical retracement levels. Investors should cautiously analyze these levels for potential support or resistance in line with the prevailing market dynamics.

Fibonacci Analysis

Over the past months, MNST has primarily exhibited an upward trend beginning from its lows in early February, culminating in a recent high in August.

| Details | Information |

|---|---|

| Trend Start Date | 2025-02-12 |

| Trend End Date | 2025-08-11 |

| High Price and Date | $64.69 on 2025-08-08 |

| Low Price and Date | $46.30 on 2025-02-06 |

| Fibonacci Levels |

|

| Current Retracement Zone | 0.236 |

| Technical Interpretation | The current price suggests interaction with the 0.236 retracement level, potentially indicating a testing of support or a possible reversal if upheld. |

Conclusion

The Monster Beverage Corporation's stock shows both potential and cautionary signs. While the upward trend is supported by robust market dynamics and strategic innovation, the recent price action near the 0.236 Fibonacci level could signify critical support. Analysts should monitor this closely for signs of resilience or potential downside risks. The ability to maintain or breakout from this retracement level will be pivotal for the stock's short- to mid-term trajectory. Continued growth in the global energy drinks market and successful branding campaigns buoy long-term prospects, but investors must remain vigilant about potential volatility.