May 01, 2025 a 03:31 pm

MDLZ: Dividend Analysis - Mondelez International, Inc.

Mondelez International, Inc. exhibits a notable history of consistent dividend payments alongside a stable financial framework. As a prominent player in the consumer goods sector, its current dividend yield presents a moderately attractive return for income-focused investors. The company's strong track record of dividend growth and financial resilience underscores its commitment to returning value to shareholders.

Overview 📊

The overview offers a glimpse into Mondelez's financial health and dividend performance. The following metrics are critical for assessing the company's ability to sustain its dividend payments:

| Metric | Value |

|---|---|

| Sector | Consumer Goods |

| Dividend Yield | 2.70 % |

| Current Dividend per Share | 1.75 USD |

| Dividend History | 25 years |

| Last Cut or Suspension | None |

Dividend History 🗣️

Mondelez's dividend history reflects its consistency in providing dividends over the past years, showcasing its commitment to shareholders. This component is crucial for assessing reliability.

| Year | Dividend per Share (USD) |

|---|---|

| 2025 | 0.47 |

| 2024 | 1.79 |

| 2023 | 1.62 |

| 2022 | 1.47 |

| 2021 | 1.33 |

Dividend Growth 📈

The growth rate of dividends is a strong indication of a company's financial health and ability to increase shareholder value. Here’s how Mondelez has performed in this area over recent years:

| Time | Growth |

|---|---|

| 3 years | 10.41 % |

| 5 years | 10.43 % |

The average dividend growth is 10.43 % over 5 years, indicating moderate but steady dividend growth.

Payout Ratio 📉

Payout ratios are critical to assess the sustainability of a company's dividends. A high payout ratio may suggest a limited ability to maintain or grow dividends if earnings drop.

| Key Figure | Ratio |

|---|---|

| EPS-based | 65.11 % |

| Free Cash Flow-based | 68.50 % |

The EPS payout ratio of 65.11 % and the FCF payout ratio of 68.50 % suggest a relatively high payout, yet within a sustainable range due to consistent cash flow generation.

Cashflow & Capital Efficiency ✅

Evaluating cash flow and capital efficiency gives insight into how well a company converts its revenue into free cash flow, indicating potential for dividend stability and growth.

| Metric | 2024 | 2023 | 2022 |

|---|---|---|---|

| Free Cash Flow Yield | 4.40% | 3.65% | 3.27% |

| Earnings Yield | 5.76% | 5.02% | 2.96% |

| CAPEX to Operating Cash Flow | 28.25% | 23.59% | 23.18% |

| Stock-based Compensation to Revenue | 0.40% | 0.41% | 0.38% |

| Free Cash Flow / Operating Cash Flow Ratio | 71.75% | 76.41% | 76.82% |

The metrics suggest consistent generation of free cash flow, supporting dividend payouts and potential growth. The capital efficiency ratios reinforce Mondelez's ability to effectively manage its investment and operational strategies.

Balance Sheet & Leverage Analysis 🚨

Balance sheet analysis offers a window into the company's financial stability and leverage, crucial for assessing the risk of financial deterioration.

| Metric | 2024 | 2023 | 2022 |

|---|---|---|---|

| Debt-to-Equity | 0.68 | 0.70 | 0.88 |

| Debt-to-Assets | 0.27 | 0.28 | 0.33 |

| Debt-to-Capital | 0.41 | 0.41 | 0.47 |

| Net Debt to EBITDA | 2.11 | 2.37 | 4.54 |

| Current Ratio | 0.68 | 0.62 | 0.60 |

| Quick Ratio | 0.48 | 0.43 | 0.40 |

The solid financial leverage ratios and improving debt metrics signal a sound financial standing. The company's leverage seems manageable, yet liquidity ratios highlight a need for cautious short-term financial planning.

Fundamental Strength & Profitability 💪

An analysis of the fundamental strength and profitability illustrates Mondelez's efficiency in utilizing its resources and its ability to maintain healthy profit margins, essential for long-term competitiveness.

| Metric | 2024 | 2023 | 2022 |

|---|---|---|---|

| Return on Equity | 17.12% | 17.50% | 10.11% |

| Return on Assets | 6.73% | 6.95% | 3.82% |

| Margins: Net | 12.65% | 13.77% | 8.63% |

| EBITDA | 22.15% | 21.23% | 15.12% |

| Gross | 39.12% | 38.22% | 35.92% |

Mondelez demonstrates robust profitability metrics with strong returns on equity and assets. These figures affirm operational efficiency and competitive edge in the consumer goods market.

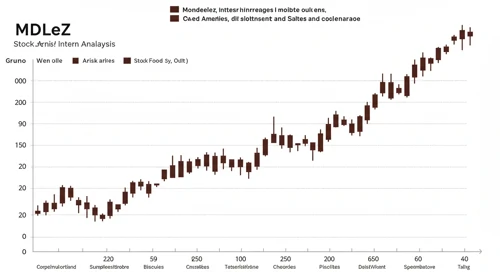

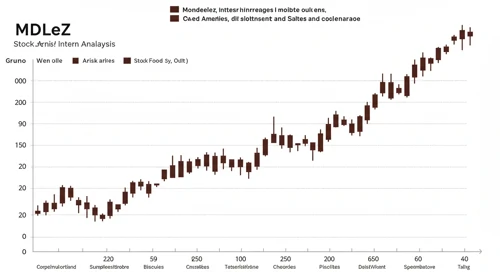

Price Development 📈

Dividend Scoring System ✅

| Criteria | Description | Score |

|---|---|---|

| Dividend Yield | Current yield relative to market | 3.5 |

| Dividend Stability | Consistency and growth history | 4.5 |

| Dividend Growth | Historical growth rate | 4.0 |

| Payout Ratio | Sustainability of payout | 3.75 |

| Financial Stability | Balance sheet strength | 4.25 |

| Dividend Continuity | Payout consistency | 4.75 |

| Cashflow Coverage | Ability to cover dividends with FCF | 3.5 |

| Balance Sheet Quality | Debt levels and asset coverage | 4.0 |

Total Score: 32.25 / 40

Rating ⚖️

Mondelez International, Inc. showcases a solid dividend profile enriched by stable growth and robust financial fundamentals. With a combination of consistent dividend payments, strong payout ratios, and commendable profitability, Mondelez stands as a reliable investment for income-focused portfolios. Given the current metrics, Mondelez merits a 'Buy' recommendation, with caution advised towards market conditions affecting short-term liquidity.