February 02, 2026 a 12:46 pm

MAS: Dividend Analysis - Masco Corporation

Masco Corporation's dividend profile highlights its steady dividend history with a current yield slightly above the industry average. Despite historical volatility, its commitment to consistent payouts and substantial growth over the past five years shows a positive trajectory for income-focused investors. However, financial stability metrics must be closely monitored given recent leverage indications.

📊 Overview

The following table offers a snapshot of Masco Corporation's key dividend metrics, providing insights into its sector performance and dividend credibility.

| Metric | Detail |

|---|---|

| Sector | Building Products |

| Dividend yield | 2.00 % |

| Current dividend per share | 1.17 USD |

| Dividend history | 43 years |

| Last cut or suspension | 2010 |

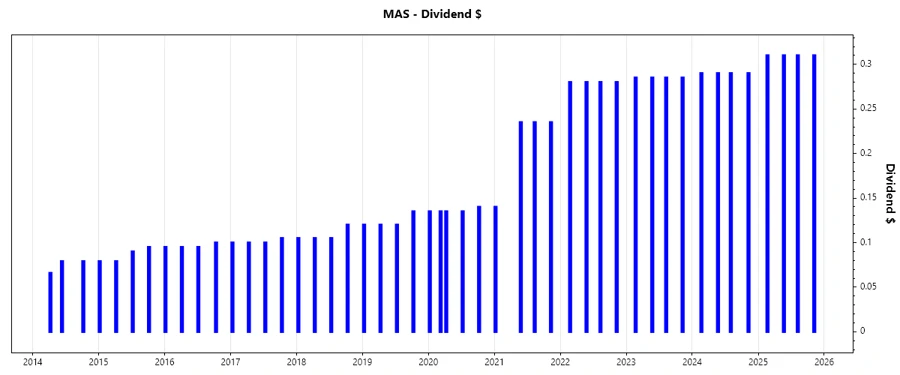

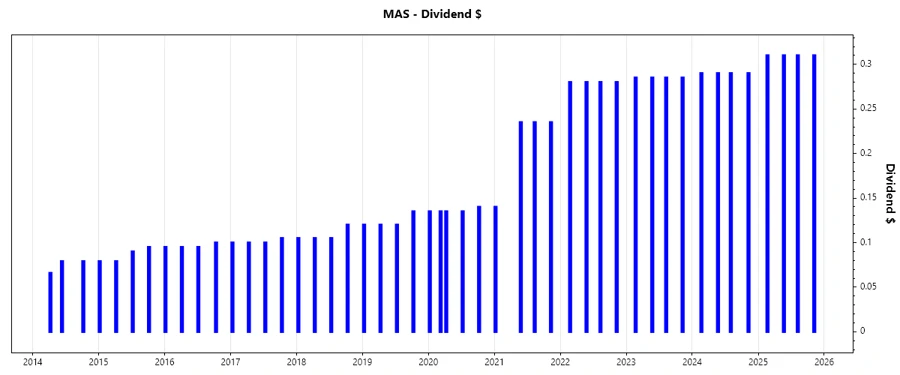

🏆 Dividend History

Masco Corporation boasts a robust dividend history, reflecting its resilience and commitment to shareholder returns over time. The significance of a sustained dividend record cannot be understated, as it often correlates with prudent fiscal management and shareholder-friendly practices.

| Year | Dividend Per Share (USD) |

|---|---|

| 2025 | 1.24 |

| 2024 | 1.16 |

| 2023 | 1.14 |

| 2022 | 1.12 |

| 2021 | 0.85 |

📈 Dividend Growth

Dividend growth is a critical factor as it shows the company's ability to enhance shareholder wealth over time. Masco Corporation has demonstrated a moderate yet steady growth in dividends, reflecting a stable cash flow and a disciplined reinvestment strategy.

| Time | Growth |

|---|---|

| 3 years | 3.45 % |

| 5 years | 12.77 % |

The average dividend growth is 12.77% over 5 years. This shows moderate but steady dividend growth.

💼 Payout Ratio

The payout ratio gauges the portion of earnings distributed as dividends, providing insight into financial discipline and dividend sustainability. A lower ratio suggests potential for dividend increases, while a higher one may imply sustainability risks.

| Key Figure | Ratio |

|---|---|

| EPS-based | 29.59 % |

| Free cash flow-based | 28.57 % |

The EPS payout of 29.59% and FCF payout of 28.57% indicate a conservative payout strategy, supporting dividend reliability and future potential increases.

🔍 Cashflow & Capital Efficiency

Evaluating cash flow and capital efficiency determines the robustness of the company’s financial operations and its ability to cover dividends with operations-generated cash.

| Metric | 2024 | 2023 | 2022 |

|---|---|---|---|

| Free Cash Flow Yield | 5.73 % | 7.76 % | 5.71 % |

| Earnings Yield | 5.20 % | 6.03 % | 7.85 % |

| CAPEX to Operating Cash Flow | 16.30 % | 17.20 % | 26.67 % |

| Stock-based Compensation to Revenue | 0 % | 0.39 % | 0 % |

| Free Cash Flow / Operating Cash Flow Ratio | 84.37 % | 82.83 % | 73.33 % |

Masco Corporation's cash flow metrics reflect a healthy generation of cash relative to operating needs, crucial for sustained dividend payments and reinvestment capabilities.

🔍 Balance Sheet & Leverage Analysis

An analysis of leveraging metrics reveals insights into the company's financial health, particularly its debt management and liquidity position.

| Metric | 2024 | 2023 | 2022 |

|---|---|---|---|

| Debt-to-Equity | -11.48 | -25.80 | -7.18 |

| Debt-to-Assets | 64.07 % | 60.62 % | 66.42 % |

| Debt-to-Capital | 109.54 % | 104.03 % | 116.19 % |

| Net Debt to EBITDA | 1.83 | 1.75 | 2.07 |

| Current Ratio | 1.75 | 1.68 | 1.56 |

| Quick Ratio | 1.15 | 1.08 | 0.91 |

Despite high debt ratios, Masco Corporation maintains adequate liquidity, reflected in its current and quick ratios, indicating its ability to meet short-term obligations.

📊 Fundamental Strength & Profitability

Fundamental ratios give an edge to understanding overall business performance, revealing profitability, efficiency, and the company’s capability to add shareholder value.

| Metric | 2024 | 2023 | 2022 |

|---|---|---|---|

| Return on Equity | -2.94 % | -7.21 % | -1.76 % |

| Return on Assets | 16.39 % | 16.93 % | 16.31 % |

| Net Margin | 10.50 % | 11.40 % | 9.75 % |

| Gross Margin | 36.17 % | 35.60 % | 31.26 % |

Masco Corporation exhibits resilient profitability with strong returns on assets and maintained gross margins, affirming its competitiveness and operational efficiency.

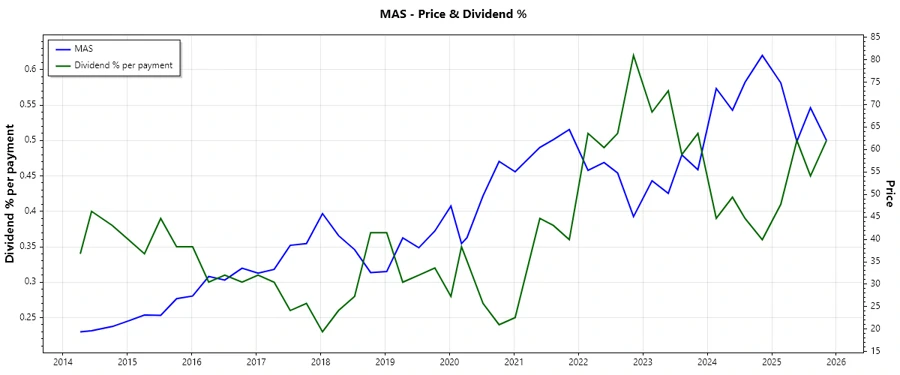

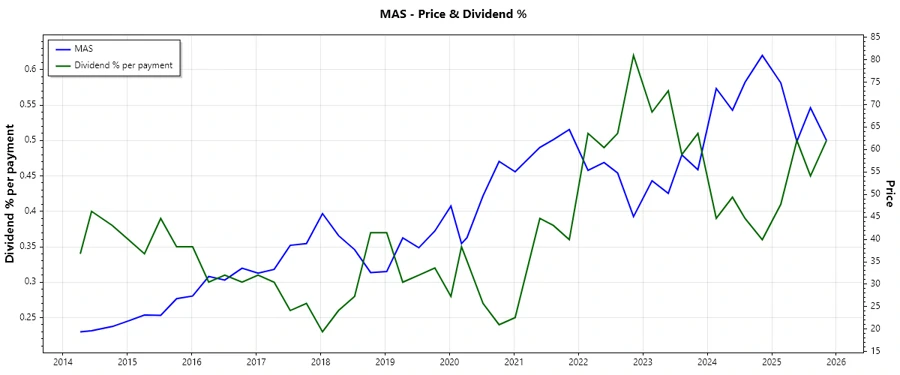

📊 Price Development

🗳️ Dividend Scoring System

This scoring system evaluates Masco Corporation's dividend quality based on multiple financial parameters critical for investors.

| Category | Score | Score Bar |

|---|---|---|

| Dividend yield | 4 | |

| Dividend Stability | 5 | |

| Dividend growth | 3 | |

| Payout ratio | 4 | |

| Financial stability | 3 | |

| Dividend continuity | 5 | |

| Cashflow Coverage | 4 | |

| Balance Sheet Quality | 3 |

Overall Score: 31/40

✅ Rating

Masco Corporation maintains a robust dividend structure, underlining a strong commitment to returning value to its shareholders. While its leverage requires monitoring, the company's consistent dividend payout, historical growth, and reasonable payout ratios make it a viable option for income-focused investors seeking stability with moderate growth expectations.