October 10, 2025 a 02:03 pm

L: Trend and Support & Resistance Analysis - Loews Corporation

Loews Corporation, a diverse company providing insurance, has shown a generally stabilizing trend over recent months. With interests also spanning transportation and storage of natural resources, alongside their ventures in hotels and plastic manufacturing, the company's stock has experienced moderate fluctuations. Most recently, the stock has exhibited signs of upward momentum, potentially indicating positive future performance.

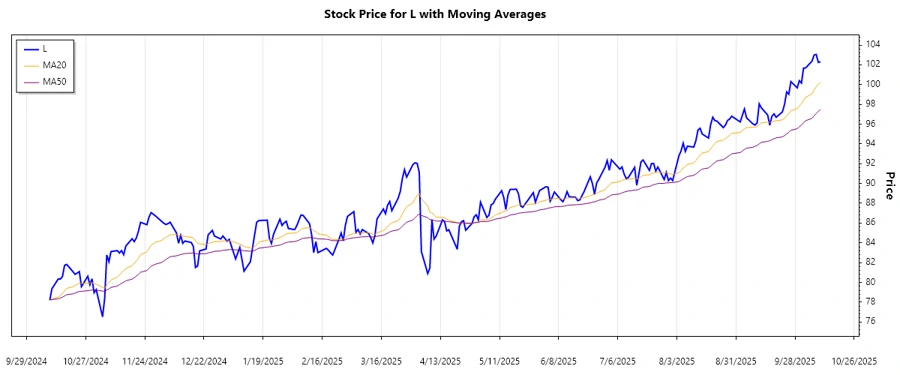

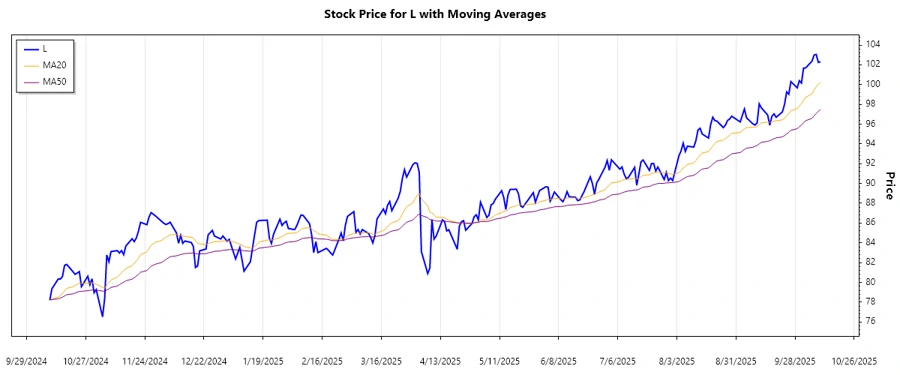

Trend Analysis

The analysis of Loews Corporation shows an indicative shift in trend direction over the recent period. Calculation of EMA20 and EMA50 reveals:

| Date | Close Price | Trend |

|---|---|---|

| 2025-10-10 | 102.31 | ▲ Uptrend |

| 2025-10-09 | 102.24 | ▲ Uptrend |

| 2025-10-08 | 103.05 | ▲ Uptrend |

| 2025-10-07 | 102.99 | ▲ Uptrend |

| 2025-10-06 | 102.37 | ▲ Uptrend |

| 2025-10-03 | 101.68 | ▲ Uptrend |

| 2025-10-02 | 101.67 | ▲ Uptrend |

The EMA analysis shows a dominant upward trend as the EMA20 holds above the EMA50. This often suggests positive momentum, which may lead to further gains if sustained.

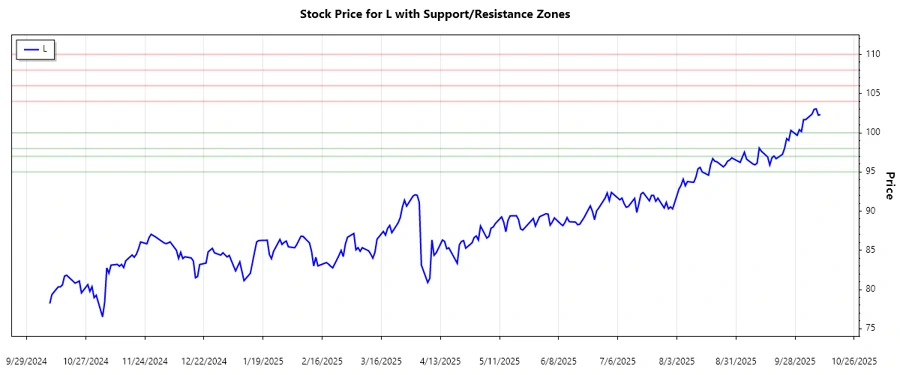

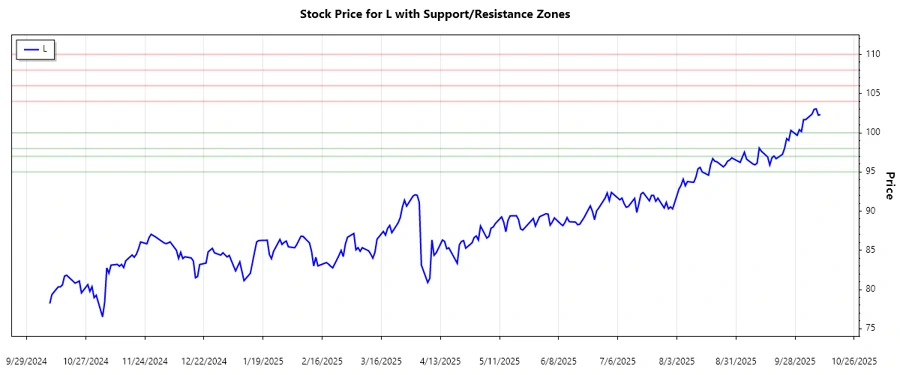

Support- and Resistance

Upon analyzing the recent price data, the following support and resistance zones have been identified:

| Zone | From | To | Status |

|---|---|---|---|

| Support 1 | 98.00 | 100.00 | ▼ Waiting |

| Support 2 | 95.00 | 97.00 | ▼ Waiting |

| Resistance 1 | 104.00 | 106.00 | ▲ Approaching |

| Resistance 2 | 108.00 | 110.00 | ▲ Above |

The current price hovers near the Resistance 1 zone, potentially facing future selling pressure. If breached, it could move towards the next resistance level.

Conclusion

Loews Corporation's current stock trajectory suggests a sound possibility for continued growth, indicated by the prevailing uptrend and approach toward key resistance zones. However, investors should remain cautious of possible retracement upon nearing resistance levels. The company's broad business operations mitigate some sector-specific risks, adding a buffer against rapid downturns. Overall, the stock remains an attractive option for investors eyeing long-term growth potential in a diversified industry context.