October 06, 2025 a 04:45 pm

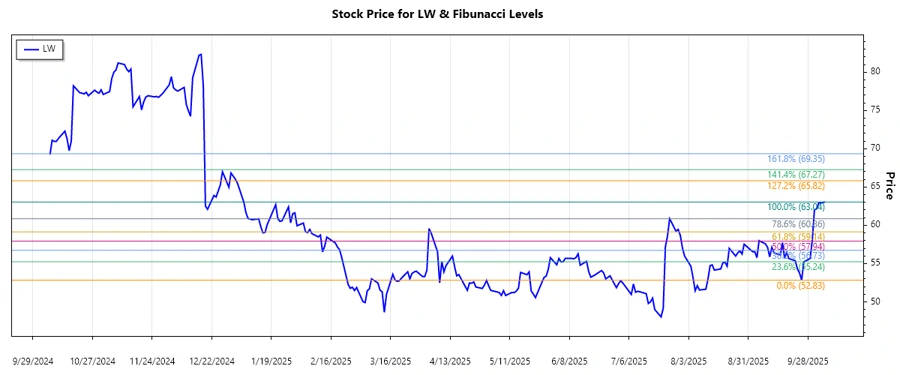

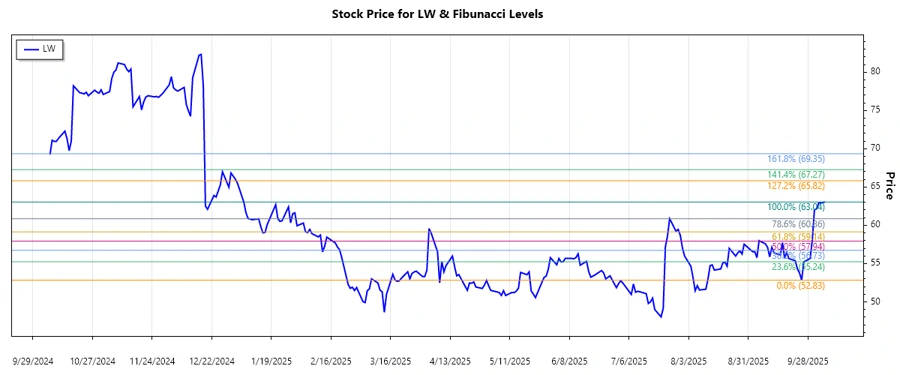

LW: Fibonacci Analysis - Lamb Weston Holdings, Inc.

Lamb Weston Holdings, Inc. has shown a noteworthy recovery in recent months. The stock saw a significant trend change from a prior downtrend and is currently in an uptrend. This is indicative of strong investor confidence and a solid business performance. With its well-established market presence and growth in various segments, the company seems to be in a favorable position. However, it is essential to consider the broader market conditions which could impact future performance.

Fibonacci Analysis

| Detail | Information |

|---|---|

| Start Date | 2025-09-25 |

| End Date | 2025-10-06 |

| High Point (Price & Date) | $63.04 (2025-10-06) |

| Low Point (Price & Date) | $52.83 (2025-09-25) |

| Fibonacci Level | Price Level ($) |

|---|---|

| 0.236 | 57.99 |

| 0.382 | 60.50 |

| 0.5 | 62.59 |

| 0.618 | 64.68 |

| 0.786 | 67.48 |

The current price is within the 0.618 Fibonacci retracement zone, suggesting a potential reversal point onto higher levels. Technically, this could indicate a strong support level where buyers may step in, reinforcing the ongoing uptrend.

Conclusion

Lamb Weston Holdings, Inc. shows substantial recovery with a strong uptrend, suggesting continued investor interest and potential upside. The stock currently lies at a critical Fibonacci level, which can act as a support zone, encouraging further upward movement. This could be a solid entry point for long-term investors. However, external economic pressures and market volatility should be closely monitored. Risk-averse investors might consider waiting for confirmation of the trend's strength before committing to any position. Overall, the company's robust fundamentals and improved stock performance make for a cautiously optimistic outlook.