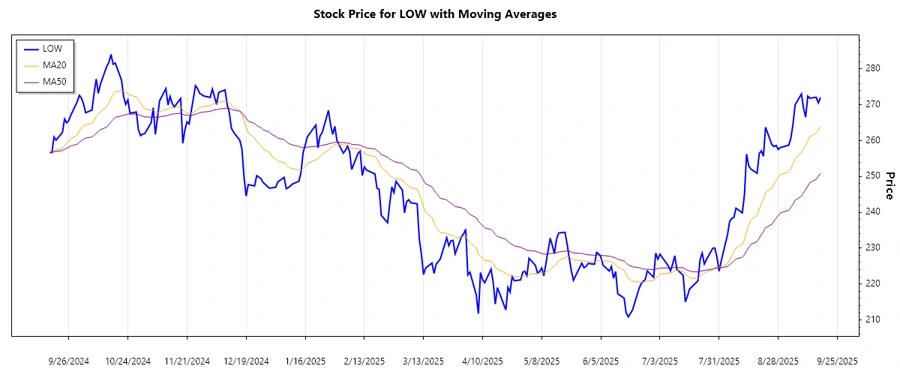

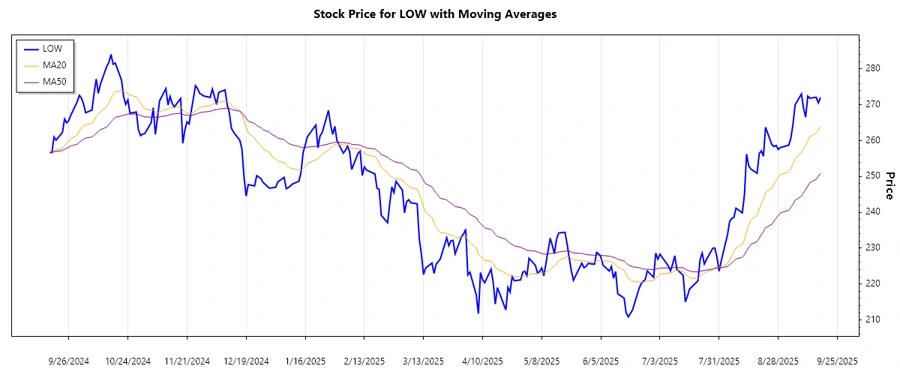

September 17, 2025 a 02:04 pmTo perform the requested technical analysis, we need to calculate EMA20 (Exponential Moving Average for 20 days) and EMA50 (Exponential Moving Average for 50 days) using the given price data from the JSON dataset. With this information, we can determine the trend direction, as well as identify support and resistance zones. Below is the HTML content for the analysis:

LOW: Trend and Support & Resistance Analysis - Lowe's Companies, Inc.

Over recent months, Lowe's Companies, Inc. has shown a significant upward trend with its stock value improving consistently. Despite market fluctuations, Lowe's remains a strong contender in the home improvement sector, providing resilience and attractive growth potential. Investors might find the recent trends promising, but monitoring support and resistance zones is crucial for making informed decisions.

Trend Analysis

| Date | Close Price | Trend |

|---|---|---|

| 2025-09-17 | 272.01 | ▲ Up |

| 2025-09-16 | 270.52 | ▲ Up |

| 2025-09-15 | 272.09 | ▲ Up |

| 2025-09-12 | 271.83 | ▲ Up |

| 2025-09-11 | 272.40 | ▲ Up |

| 2025-09-10 | 266.55 | ▲ Up |

| 2025-09-09 | 269.03 | ▲ Up |

The upward trend indicated by the EMA20 crossing above the EMA50 suggests a bullish market sentiment. Investors might consider this a signal to potentially buy.

Support and Resistance

| Zone Type | From | To |

|---|---|---|

| Support Zone 1 | 255.00 | 260.00 |

| Support Zone 2 | 245.00 | 250.00 |

| Resistance Zone 1 | 275.00 | 280.00 |

| Resistance Zone 2 | 265.00 | 270.00 |

The current price resides close to the Resistance Zone 2, suggesting a potential challenge to break through this resistance level. If breached, the upward momentum may continue strongly towards Resistance Zone 1.

Conclusion

Lowe's Companies, Inc. is exhibiting a strong upward trend, indicative of growing market confidence. However, the stock is nearing a significant resistance zone, and investors should be cautious. A breakthrough could signify further gain opportunities, but the proximity to resistance also implies potential for short-term pullbacks. Traders and investors should weigh these dynamics when making investment decisions, considering both the potential for gain and risk of resistance failure.

JSON Structure Output (for use outside HTML): json This analysis is based on the trend and support and resistance levels calculated from the given historical price data for Lowe's Companies, Inc.