February 12, 2026 a 12:46 pm

LLY: Dividend Analysis - Eli Lilly and Company

Eli Lilly and Company presents a robust dividend profile with a legacy of consistent payments, boasting 55 years of dividend history underlining its reliability. The dividend growth over the past 5 years signifies steady progress, yet the relatively modest current dividend yield may not appeal to income-focused investors. Analysts should also note the robust payout ratios, which highlight a well-supported dividend policy. Lilly's strategic financial management balances growth and shareholder returns.

📊 Overview

The following provides an extensive overview of Eli Lilly's dividend metrics:

| Metric | Detail |

|---|---|

| Sector | Pharmaceuticals |

| Dividend yield | 0.61% |

| Current dividend per share | 6 USD |

| Dividend history | 55 years |

| Last cut or suspension | None |

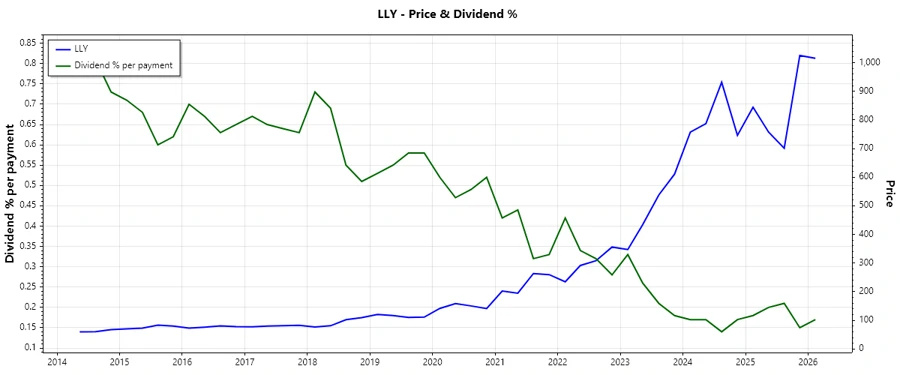

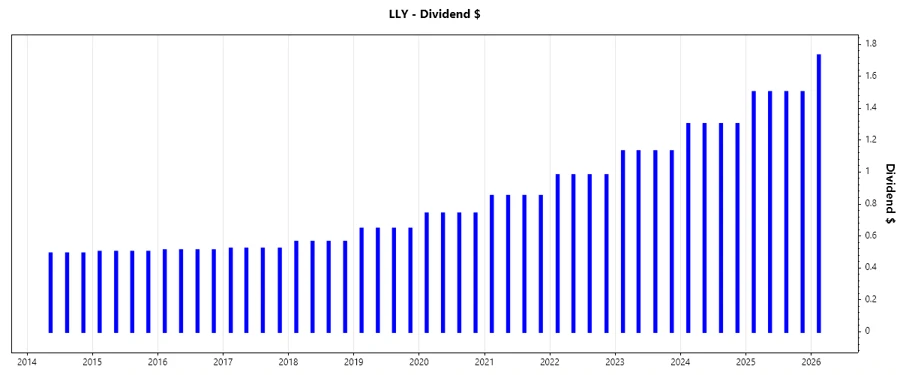

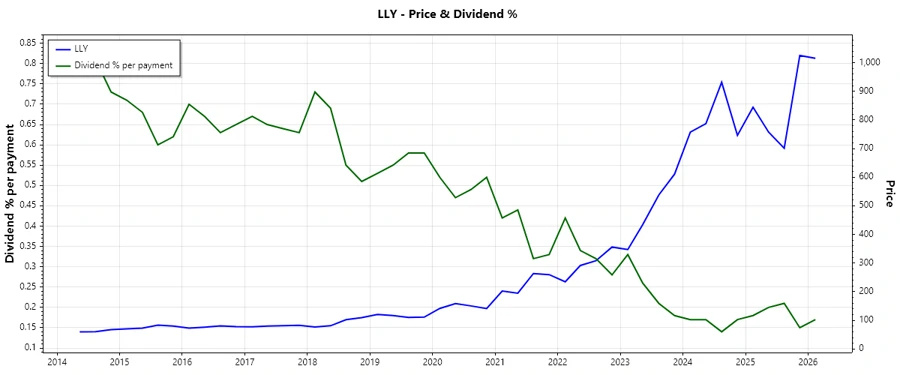

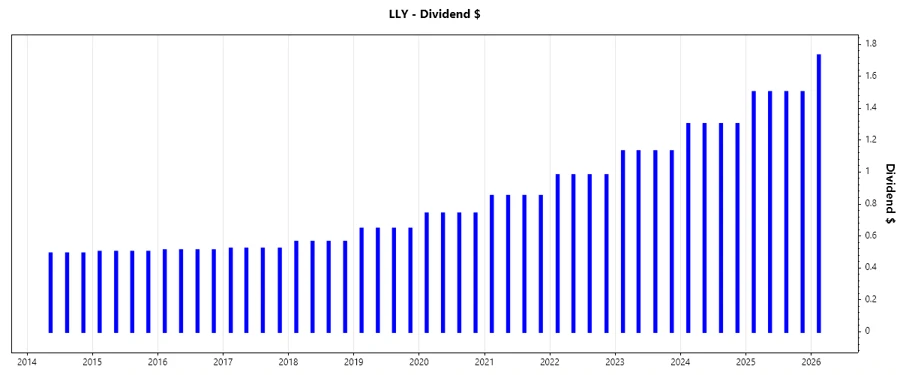

📈 Dividend History

Eli Lilly's dividend payments highlight the company's strong commitment to its shareholders, which is crucial for evaluating its long-term financial health and planning a tentative future investment strategy.

| Year | Dividend per Share (USD) |

|---|---|

| 2026 | 1.73 |

| 2025 | 6.0 |

| 2024 | 5.2 |

| 2023 | 4.52 |

| 2022 | 3.92 |

📊 Dividend Growth

An evaluation of dividend growth rate indicates the company's potential for future increases in dividend payouts. Growth metrics are essential in assessing the potential inflation-adjusted returns.

| Time | Growth |

|---|---|

| 3 years | 15.24% |

| 5 years | 15.18% |

The average dividend growth is 15.18% over 5 years. This shows moderate but steady dividend growth.

⚖️ Payout Ratio

Payout ratios indicate Eli Lilly's ability to maintain dividend payments through its earnings, thus reflecting confidence in future cash flows.

| Key figure | Ratio |

|---|---|

| EPS-based | 26.11% |

| Free cash flow-based | 59.63% |

The EPS payout ratio at 26.11% shows a conservative approach, ensuring the alignment of earnings and dividends. The 59.63% FCF payout ratio, while higher, remains within an acceptable threshold, reflecting solid cash flow generation to support dividend payments.

💰 Cashflow & Capital Efficiency

Cash flow metrics are pivotal for maintaining operations and supporting financial obligations, directly impacting dividend stability.

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Free Cash Flow Yield | -0.60% | 0.06% | 0% |

| Earnings Yield | 1.00% | 1.52% | 2.14% |

| CAPEX to Operating Cash Flow | 174.34% | 95.30% | 43.84% |

| Stock-based Compensation to Revenue | 1.84% | 1.43% | 0% |

| Free Cash Flow / Operating Cash Flow Ratio | -74.34% | 4.70% | 0% |

The evaluation of cash flow stability and capital efficiency is satisfactory. Although the negative free cash flow yield in 2023 is a point of concern, the subsequent improvement and efficient CAPEX management bolster future prospects.

📉 Balance Sheet & Leverage Analysis

Analyzing the balance sheet provides insights into the company's debt levels, highlighting leverage and liquidity metrics pertinent to financial robustness.

| 2023 | 2024 | |

|---|---|---|

| Debt-to-Equity | 234.18% | 237.06% |

| Debt-to-Assets | 39.41% | 42.74% |

| Debt-to-Capital | 70.08% | 70.33% |

| Net Debt to EBITDA | 2.62 | 1.99 |

| Current Ratio | 0.94 | 1.15 |

| Quick Ratio | 0.73 | 0.89 |

While the debt-to-equity ratio is elevated, indicating high leverage, a robust interest coverage ratio maintains adequate debt servicing capacity. Improvement in current ratio signals an upward trend in liquidity.

🏛️ Fundamental Strength & Profitability

Examining fundamental strength and profitability sheds light on the firm's operational efficiency and capacity for sustaining dividends.

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Return on Equity | 48.65% | 74.62% | 0% |

| Return on Assets | 8.19% | 13.45% | 0% |

| Margins: Net | 15.36% | 23.51% | 31.66% |

| Margins: EBIT | 20.63% | 29.88% | 40.46% |

| Margins: EBITDA | 25.11% | 33.81% | 42.86% |

| Margins: Gross | 79.25% | 81.31% | 83.79% |

| Research & Development to Revenue | 27.29% | 24.40% | 20.46% |

High ROE and ROA metrics are indicative of robust financial health, augmented by strong profit margins across the board. These fundamentals underpin confident projections for sustainable dividends.

📉 Price Development

🗣️ Dividend Scoring System

| Category | Score | Score Bar |

|---|---|---|

| Dividend yield | 3 | |

| Dividend Stability | 5 | |

| Dividend growth | 5 | |

| Payout ratio | 4 | |

| Financial stability | 4 | |

| Dividend continuity | 5 | |

| Cashflow Coverage | 3 | |

| Balance Sheet Quality | 4 |

Total Score: 33/40

🗣️ Rating

Eli Lilly & Company presents a compelling investment case anchored in a robust historical dividend record and consistent growth metrics. While its current yield may not be the highest, its stability and growth prospects offer significant long-term value, offering potential for capital appreciation and a secure income stream for conservative investors seeking steady returns. Maintain a 'Buy' rating fueled by confidence in the company’s financial strategy and its ability to balance growth with shareholder returns.