October 07, 2025 a 03:15 am

LKQ: Trend and Support & Resistance Analysis - LKQ Corporation

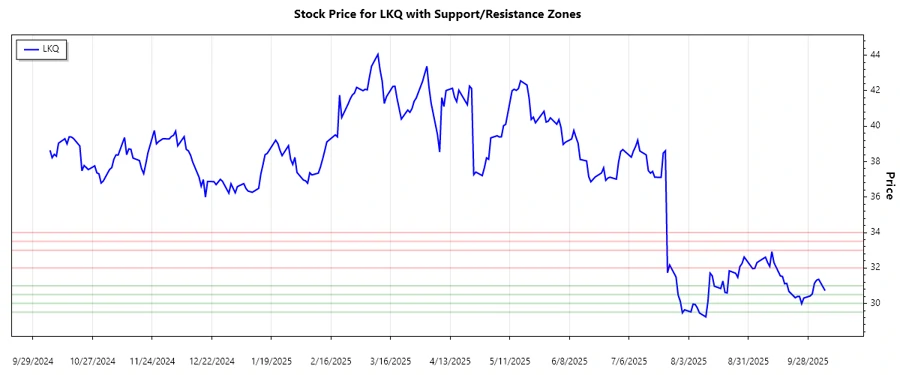

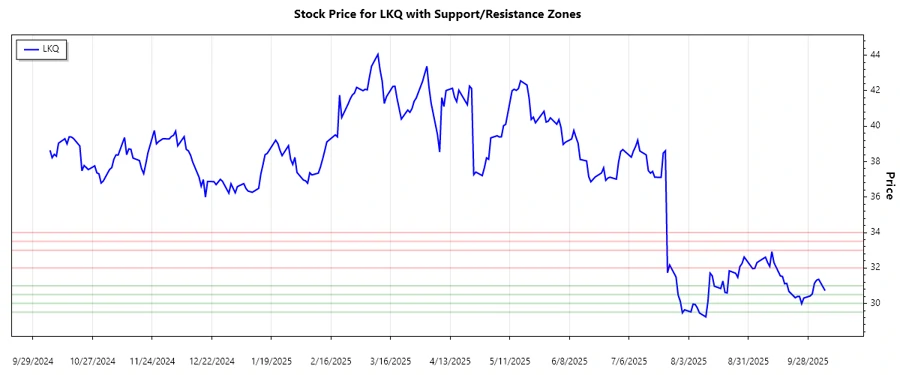

The LKQ Corporation stock has shown notable fluctuation over recent months. Recent trends suggest a downward movement as indicated by long-term moving averages. Investors should consider the company's operational segments and global presence, which could impact future growth. It's essential to watch for changes in automotive demand, especially in the regions LKQ operates. As always, diversification remains key.

Trend Analysis

The analysis of LKQ stock shows that the current moving averages indicate a predominant downward trend. The EMA20 is consistently below the EMA50 for the last few data points, reinforcing a bearish sentiment. This suggests that market sentiment might be inclined towards selling.

| Date | Closing Price | Trend |

|---|---|---|

| 2025-10-06 | $30.72 | ▼ |

| 2025-10-03 | $31.36 | ▼ |

| 2025-10-02 | $31.31 | ▼ |

| 2025-10-01 | $31.13 | ▼ |

| 2025-09-30 | $30.54 | ▼ |

| 2025-09-29 | $30.42 | ▼ |

| 2025-09-26 | $30.30 | ▼ |

The technical interpretation based on the EMA indicates potential further declines unless fundamental changes occur or external catalysts trigger upward momentum.

Support and Resistance

Evaluation of the stock's support and resistance identifies two critical support zones between $29.50—$30.00 and $30.50—$31.00, and two resistance zones between $32.00—$33.00 and $33.50—$34.00. The current price movement remains at a lower range, indicating bearish control unless surpassing resistance levels.

| Zone Type | Range | Status |

|---|---|---|

| Support | $29.50 — $30.00 | Active ▼ |

| Support | $30.50 — $31.00 | Active ▼ |

| Resistance | $32.00 — $33.00 | Potential ▲ |

| Resistance | $33.50 — $34.00 | Potential ▲ |

The current price is operating within the defined support zone, suggesting a potential for further downside unless crucial resistance levels are tested and breached.

Conclusion

The overall analysis for LKQ Corporation indicates a bearish trend with active support levels. The stock faces considerable resistance at higher levels, suggesting limited upside potential without significant catalysts. Investors may want to exercise caution in the short term, awaiting either a breakdown below current support or a confirmed breakout above resistance levels. Observing global trends in automotive parts and regional economic conditions will be crucial. Long-term prospects depend significantly on operational efficiencies across their international markets.