October 29, 2025 a 03:15 pm

K: Fibonacci Analysis - Kellanova

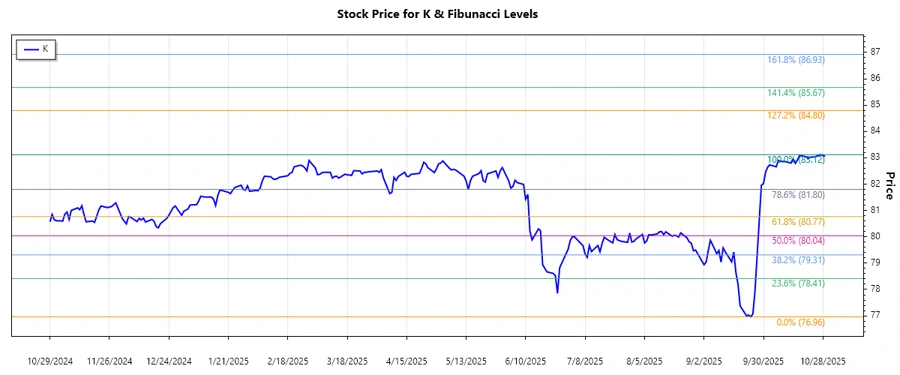

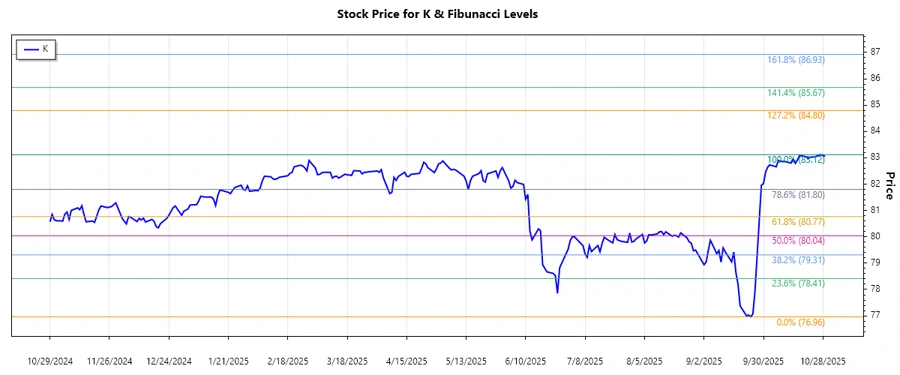

Kellanova, previously known as Kellogg Company, operates in the snacks and convenience foods sector. With a broad array of popular brands under its umbrella, the company has a sturdy foothold in the global market. The recent name change reflects a strategic branding decision as it continues to adapt to evolving consumer preferences. Despite the competitive landscape, Kellanova's diverse product offerings position it well for sustained growth. Technical analysis suggests examining potential retracement levels for strategic entry points.

Fibonacci Analysis

| Detail | Value |

|---|---|

| Start Date | 2025-09-24 |

| End Date | 2025-10-29 |

| High (Price/Date) | $83.12 on 2025-10-27 |

| Low (Price/Date) | $76.96 on 2025-09-24 |

Fibonacci Levels

| Level | Price |

|---|---|

| 0.236 | $78.47 |

| 0.382 | $79.56 |

| 0.5 | $80.04 |

| 0.618 | $82.52 |

| 0.786 | $81.43 |

The current price of $83.0602 lies above the Fibonacci retracement levels, indicating that prices have moved beyond the retracement zone and suggesting potential upward momentum.

This suggests that the previous resistance could now act as support, a common technical pattern observed in retracement analysis.

Conclusion

Kellanova's recent upward trend indicates robust momentum following its recent rebranding. The current price has surpassed several key Fibonacci retracement levels, implying potential support and a positive outlook. However, any reversal could retest previous resistance levels, so investors should remain vigilant. Analysts find merit in this setup given the company’s strategic market positioning and brand strength. The technical picture, combined with strong fundamentals, suggests a potentially rewarding investment scene.