November 10, 2025 a 09:03 amUm die gewünschte Analyse zu erstellen, müssen wir einige Berechnungen durchführen und die Daten entsprechend formatieren. Hier ist die HTML-Ausgabe und JSON-Struktur auf Grundlage der bereitgestellten Kursdaten von Kenvue Inc. (Ticker: KVUE):

KVUE: Trend and Support & Resistance Analysis - Kenvue Inc.

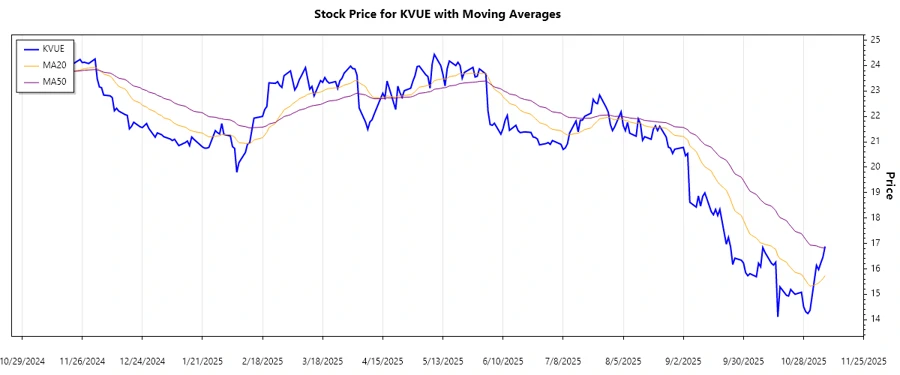

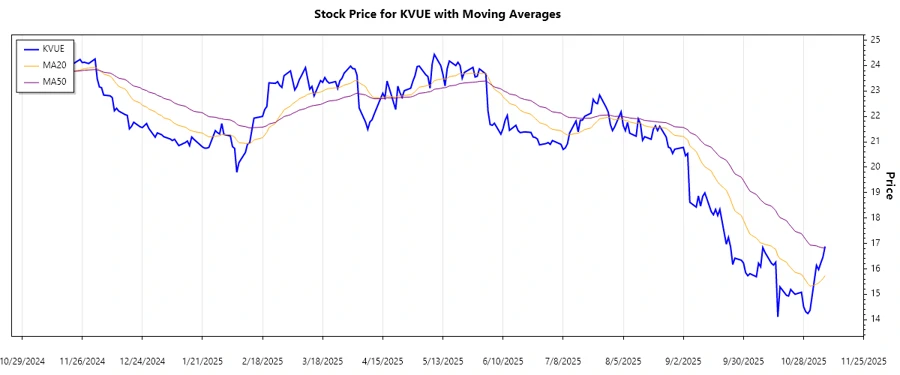

Kenvue Inc., as a subsidiary of Johnson & Johnson, operates in the consumer health sector, offering products across self-care, skin health, beauty, and essential health. Despite market volatility, KVUE shows potential for recovery influenced by healthcare trends. The recent trend indicates a downward movement with potential support zones that could attract buyers.

Trend Analysis

The recent trajectory of KVUE's stock has shown an overall downtrend due to EMA indicators. The following table outlines the trend over the past week.

| Date | Closing Price | Trend |

|---|---|---|

| 2025-11-07 | 16.88 | ▼ |

| 2025-11-06 | 16.46 | ▼ |

| 2025-11-05 | 16.23 | ▼ |

| 2025-11-04 | 15.97 | ▼ |

| 2025-11-03 | 16.14 | ▼ |

| 2025-10-31 | 14.37 | ▼ |

| 2025-10-30 | 14.24 | ▼ |

These indicators suggest a clear downtrend in recent days with EMA20 below EMA50. This signals a bearish market sentiment.

Support- and Resistance

Based on historical price levels, here are the key support and resistance zones for KVUE:

| Zone Type | Level From | Level To |

|---|---|---|

| Support 1 | 16.00 | ▲ 16.30 |

| Support 2 | 15.00 | ▲ 15.50 |

| Resistance 1 | 17.50 | ▼ 18.00 |

| Resistance 2 | 18.50 | ▼ 19.00 |

The current price is nearing the upper boundaries of the lowest support zone, indicating that it might become a buying interest area.

Conclusion

KVUE is currently exhibiting a bearish trend with potential support levels identified at key points. This scenario poses a risk for further downward movement, yet offers an opportunity for buyers at strategic support zones. Investors should closely monitor EMA indicators and market response to support levels for possible bullish reversals. The resistance zones are considerably distant, suggesting that any positive breakout could face challenges. Given market volatility, investors should remain cautious and consider implementing risk management strategies.

And the JSON structure: json Diese Analyse verwendet die historischen Kursdaten von Kenvue Inc., um aktuelle Trends und bedeutende Unterstützung- und Widerstandspunkte zu identifizieren. Die technischen Indikatoren weisen auf einen Abwärtstrend hin, obwohl die Nähe zu Unterstützungszonen potenzielle Gelegenheiten für Käufer eröffnen kann.