December 07, 2025 a 03:43 pm

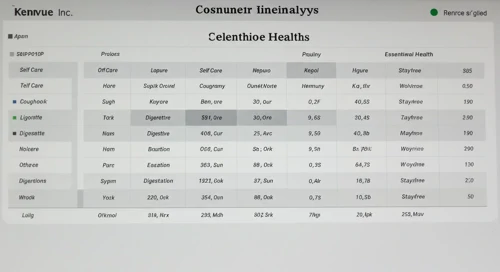

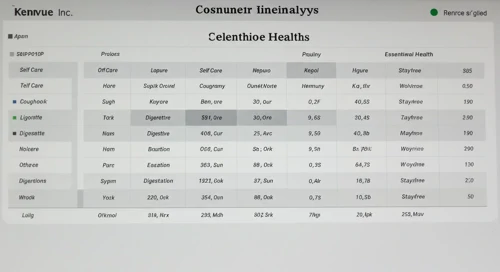

KVUE: Fundamental Ratio Analysis - Kenvue Inc.

Kenvue Inc., with its diverse portfolio across self-care, skin health, and essential health segments, offers products that are staples in consumer health. Despite being a relatively new company, Kenvue's established brand names like Tylenol, Neutrogena, and Listerine provide a solid foundation for growth. The stock reflects a promising yet cautious outlook given the current economic climate.

Fundamental Rating

The overall fundamental score of Kenvue Inc. is moderate, indicating a stable but cautious position in the market. The company's balanced scores in discounted cash flow, return on equity, and return on assets are offset by weaker scores in debt to equity and price ratios.

| Category | Score | Visualization |

|---|---|---|

| Discounted Cash Flow | 4 | |

| Return on Equity | 4 | |

| Return on Assets | 4 | |

| Debt to Equity | 1 | |

| Price to Earnings | 2 | |

| Price to Book | 2 |

Historical Rating

Looking at historical data, the scores have remained consistent, reflecting a stable but modest growth trajectory.

| Date | Overall | DCF | ROE | ROA | Debt/Equity | P/E | P/B |

|---|---|---|---|---|---|---|---|

| 2025-12-05 | 3 | 4 | 4 | 4 | 1 | 2 | 2 |

| Earlier | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Analyst Price Targets

The consensus among analysts suggests a median price target of $18, indicating modest upside potential from the stock's current price.

| High | Low | Median | Consensus |

|---|---|---|---|

| $23 | $15 | $18 | $18.57 |

Analyst Sentiment

The current sentiment among analysts is predominantly 'Hold', reflecting a conservative stance on the stock's performance at this time.

| Recommendation | Count | Visualization |

|---|---|---|

| Strong Buy | 0 | |

| Buy | 5 | |

| Hold | 9 | |

| Sell | 0 | |

| Strong Sell | 0 |

Conclusion

Kenvue Inc. demonstrates a stable performance backed by its strong brand portfolio, which helps mitigate risks associated with market volatility. While the fundamental analysis shows moderate scores, indicating potential areas for improvement, the consistent historical data reflects reliability. Analyst sentiments lean towards caution with a consensus 'Hold' recommendation, underscoring the need for careful monitoring of market trends and company developments. Overall, Kenvue provides growth opportunities within a strategic and diversified segment of consumer health.