October 10, 2025 a 05:15 am

KMX: Fibonacci Analysis - CarMax, Inc.

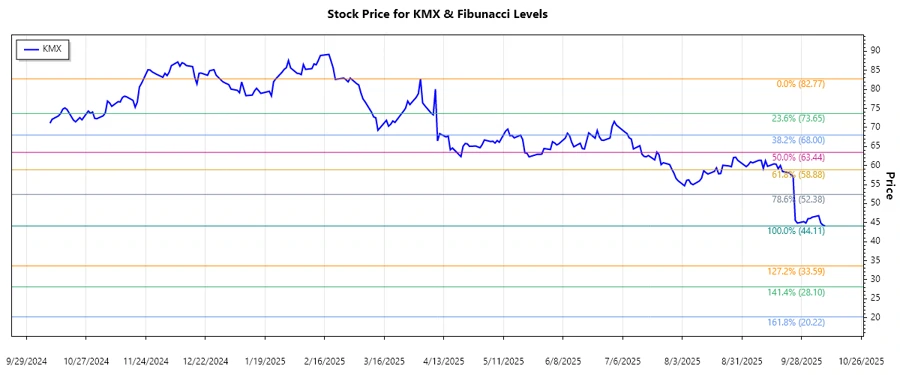

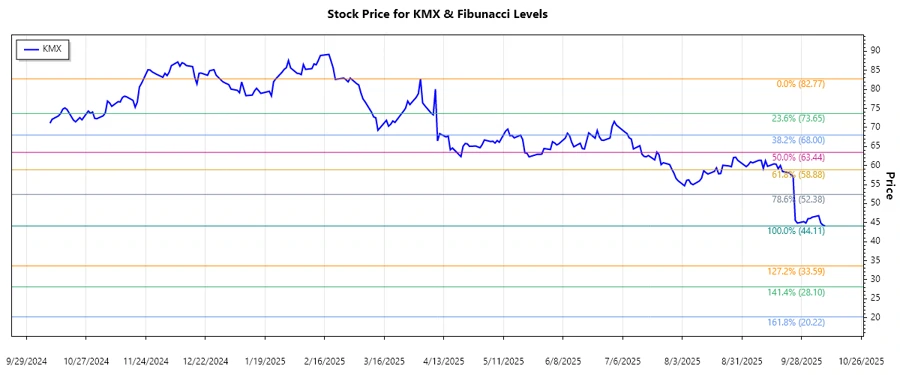

CarMax, Inc., a prominent used vehicle retailer in the U.S., shows dynamic market activity. Recently, it has navigated a volatile path with significant price fluctuations. Analysts are focusing on identifying potential support and resistance levels using Fibonacci retracement, amidst broader trends in consumer demand for used vehicles. The stock's behavior is intricately linked to economic factors and consumer credit conditions, providing both challenges and opportunities for investors.

Fibonacci Analysis

| Parameter | Details |

|---|---|

| Trend Type | Downward |

| Start Date (High Point) | 2025-04-02 |

| End Date (Low Point) | 2025-10-09 |

| High Price | 82.77 |

| Low Price | 44.11 |

| Retracement Level | Price Level |

|---|---|

| 0.236 | 57.55 |

| 0.382 | 62.11 |

| 0.5 | 63.44 |

| 0.618 | 64.76 |

| 0.786 | 66.71 |

The current price of 44.11 suggests it is below the Fibonacci retracement levels, indicating strong downward momentum. This could serve as a potential support breach, aiding further bearish continuity.

Conclusion

The CarMax, Inc. stock has experienced a clear downtrend from its peak in early April. The retracement analysis indicates potential support around the 57.55 level; however, the current price remains beneath all significant retracement markers, highlighting a prevalent bearish sentiment. Investors should exercise caution amidst any signs of reversal and consider risk mitigation strategies when engaging in the stock. The extended retracement below foundational support underscores potential for further declines unless new bullish catalysts emerge. Analysts should continue monitoring macroeconomic influences and consumer trends closely.