October 21, 2025 a 07:47 am

KIM: Dividend Analysis - Kimco Realty Corporation

Kimco Realty Corporation demonstrates a robust dividend profile with an impressive dividend history of 34 years. Despite the challenges, the company maintains a competitive dividend yield of 4.39%, reflecting its dedication to rewarding shareholders. The current dividend per share stands at $1.02, showcasing the company's commitment to maintaining consistent payouts. Investors should note the last dividend cut occurred less than ideally prepared but has since shown resilience.

📊 Overview

Kimco Realty Corporation operates in the Real Estate Investment Trusts (REITs) sector. The company's current dividend yield is a notable 4.39%, positioning it favorably in terms of income generation. With a solid dividend history spanning 34 years, the company demonstrates reliability in payout continuity, with no recent cuts in 2023.

| Metric | Value |

|---|---|

| Sector | Real Estate Investment Trusts (REITs) |

| Dividend Yield | 4.39% |

| Current Dividend per Share | $1.02 |

| Dividend History | 34 years |

| Last Cut or Suspension | None |

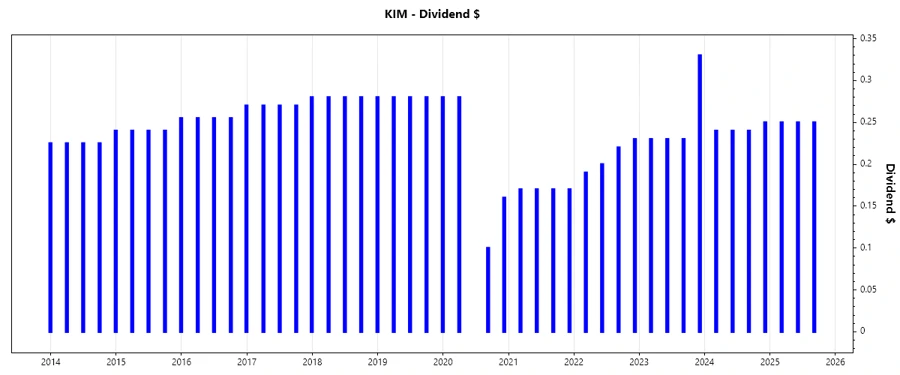

🗣️ Dividend History

The historical dividend payments reflect Kimco's stability and commitment towards returning value to shareholders. Regular dividends contribute to income predictability and investor confidence.

| Year | Dividend per Share (USD) |

|---|---|

| 2025 | 0.75 |

| 2024 | 0.97 |

| 2023 | 1.02 |

| 2022 | 0.84 |

| 2021 | 0.68 |

📈 Dividend Growth

Understanding dividend growth is crucial as it indicates potential for future income enhancement and reflects the company’s earnings strength. Although the 5-year growth rate is slightly negative, recent trends display a rise in payouts.

| Time | Growth |

|---|---|

| 3 years | 12.57% |

| 5 years | -2.83% |

The average dividend growth is -2.83% over 5 years. This shows moderate but steady dividend growth despite economic pressures.

✅ Payout Ratio

The payout ratio is a crucial indicator of the sustainability of dividend payments. A high payout ratio could signal potential risks if earnings decline.

| Key Figure | Ratio |

|---|---|

| EPS-based | 115.67% |

| Free cash flow-based | 70.68% |

While an EPS-based payout ratio of 115.67% might seem unsustainable, the free cash flow-based ratio of 70.68% is a more reassuring indicator of the company's ability to support its dividends.

⚠️ Cashflow & Capital Efficiency

Robust cash flow generation and efficient capital allocation are pivotal for ensuring ongoing dividend payments. Here is a detailed breakdown of these metrics over recent years:

| Year | 2022 | 2023 | 2024 |

|---|---|---|---|

| Free Cash Flow Yield | 6.61% | 8.15% | 6.39% |

| Earnings Yield | 0.97% | 4.98% | 2.61% |

| CAPEX to Operating Cash Flow | 8.09% | 0.00% | 0.00% |

| Stock-based Compensation to Revenue | 1.54% | 1.85% | 1.71% |

| Free Cash Flow / Operating Cash Flow Ratio | 1.00 | 1.00 | 1.00 |

The data signifies a strong cash flow position with consistent free cash flow compared to operating cash flow, providing a solid foundation for sustained dividend payments and growth investments.

📉 Balance Sheet & Leverage Analysis

Assessing leverage is vital for understanding financial health and the company’s ability to withstand economic downturns. Here is a breakdown of leverage and balance sheet quality:

| Year | 2022 | 2023 | 2024 |

|---|---|---|---|

| Debt-to-Equity | 76.42% | 81.12% | 80.53% |

| Debt-to-Assets | 42.28% | 42.28% | 42.23% |

| Debt-to-Capital | 44.32% | 44.79% | 44.61% |

| Net Debt to EBITDA | 9.18 | 4.96 | 6.25 |

| Current Ratio | 4.93 | 6.42 | 3.58 |

| Quick Ratio | 4.93 | 6.42 | 3.58 |

| Financial Leverage | 1.87 | 1.91 | 1.91 |

Kimco Realty Corporation maintains a manageable level of leverage, supporting its capacity for steady dividend payments. The current and quick ratios suggest strong liquidity, vital for operational flexibility.

📊 Fundamental Strength & Profitability

Profitability ratios and fundamental analysis provide insights into operational efficiency and financial robustness:

| Year | 2022 | 2023 | 2024 |

|---|---|---|---|

| Return on Equity | 1.32% | 6.87% | 3.86% |

| Return on Assets | 0.71% | 3.58% | 2.02% |

| Gross Margin | 69.27% | 68.78% | 68.70% |

| EBIT Margin | 15.69% | 50.14% | 32.35% |

| EBITDA Margin | 44.92% | 78.58% | 61.99% |

| Research & Development to Revenue | 0% | 0% | 0% |

The moderate return on equity and assets signify an efficient use of capital. The consistent gross and EBITDA margins are indicators of strong pricing power and cost control.

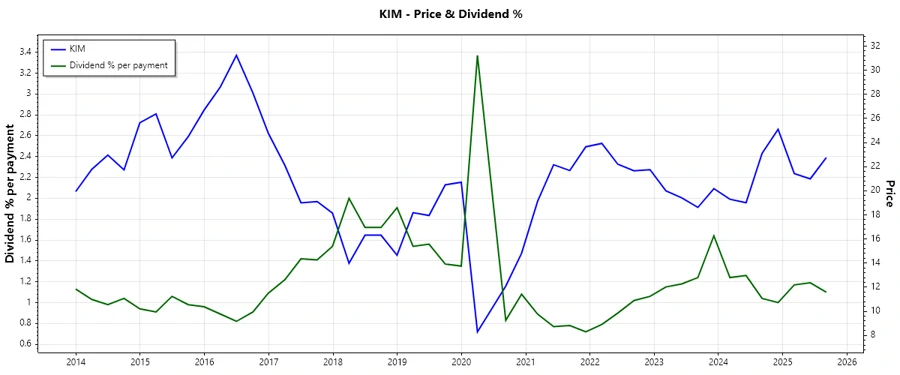

📈 Price Development

🔍 Dividend Scoring System

| Criteria | Score | Score Bar |

|---|---|---|

| Dividend Yield | 4 | |

| Dividend Stability | 5 | |

| Dividend Growth | 3 | |

| Payout Ratio | 3 | |

| Financial Stability | 4 | |

| Dividend Continuity | 5 | |

| Cashflow Coverage | 5 | |

| Balance Sheet Quality | 4 |

Total Score: 33/40

🌟 Rating

Kimco Realty Corporation reflects a firm dividend profile with promising stability and a robust balance sheet. Although dividend growth remains a challenge, strong cash flows support the current payouts. Therefore, the stock is recommended for income-focused investors seeking stable returns in the REIT domain.