February 14, 2026 a 05:01 pm

JPM: Analysts Ratings - JPMorgan Chase & Co.

JPMorgan Chase & Co. has consistently been a focal point in the market due to its vast service coverage in the financial sector. Over recent months, notable shifts in analysts' recommendations reflect evolving sentiment regarding its valuation and prospects. This complex financial institution's diversified strategies and solid market presence continue to attract varied analyst opinions.

Historical Stock Grades

The latest analyst ratings for JPMorgan Chase & Co. show a balanced outlook with a significant portion of analysts advocating a 'Hold' position, indicative of cautious market sentiment amidst macroeconomic uncertainties.

| Number of Recommendations | Count | Score |

|---|---|---|

| Strong Buy | 5 | |

| Buy | 9 | |

| Hold | 12 | |

| Sell | 2 | |

| Strong Sell | 0 |

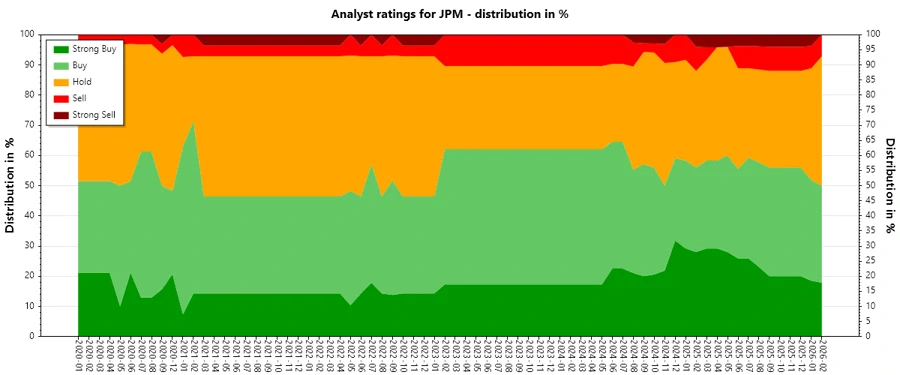

Sentiment Development

Over the past months, the number of 'Hold' recommendations has seen a steady increase, reflecting a shift towards neutral stances amongst analysts. In contrast, 'Strong Buy' ratings have remained stable, suggesting cautious optimism in the market. Analyst sentiment has been relatively stable, with most changes occurring in 'Hold' categorizations.

- Consistent level of 'Strong Buy' ratings suggests some confidence in the stock.

- 'Hold' ratings show a notable rise from 8 in late 2024 to 12 by February 2026.

- Overall sentiment shows increasing caution, with minimal activity in 'Sell' and 'Strong Sell'.

Percentage Trends

The data highlights a noticeable trend within analyst recommendations for JPMorgan. Over recent months, 'Hold' ratings have expanded, influencing the overall recommendation landscape. Investors are observing greater circumspection from analysts as reflected in a contraction of aggressive 'Buy' recommendations.

- 'Strong Buy' ratings holding steady at just below 20% from mid-2025 to early 2026.

- 'Buy' ratings sustaining a moderate level, suggesting tempered bullishness.

- Increasing 'Hold' ratings, now capturing nearly 50% of the recommendations.

- Decline in 'Strong Sell' recommendations to negligible numbers.

Latest Analyst Recommendations

Recent analyst activities for JPMorgan show a trend of consistency, with major institutions maintaining their current assessments. There have been no significant upgrades or downgrades, indicating a period of stabilization in analyst sentiment towards the stock.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2026-01-06 | Hold | Hold | Truist Securities |

| 2026-01-05 | Overweight | Overweight | Barclays |

| 2025-12-18 | Hold | Hold | Truist Securities |

| 2025-12-17 | Outperform | Outperform | Keefe, Bruyette & Woods |

| 2025-11-03 | Overweight | Overweight | Wells Fargo |

Analyst Recommendations with Change of Opinion

The available data shows evidence of some shifting analyst perspectives on JPMorgan, with a mix of downgrades and upgrades in various periods. These alterations indicate renewed evaluations of JPM's potential amidst ongoing market dynamics.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2024-11-20 | Perform | Outperform | Oppenheimer |

| 2024-09-03 | Hold | Buy | Deutsche Bank |

| 2024-01-09 | Buy | Hold | Deutsche Bank |

| 2023-07-12 | Neutral | Buy | Citigroup |

| 2023-07-11 | Buy | Hold | Jefferies |

Interpretation

Analysts' evaluations of JPMorgan Chase & Co. reveal a mixed yet stable sentiment. While there is a noticeable increase in 'Hold' recommendations, suggesting cautious optimism, the number of 'Buy' and 'Strong Buy' ratings points to underlying confidence in the company’s long-term strategy. The data does not reflect a significant leaning towards bearishness, but the increased 'Hold' ratings indicate market prudence. Thus, analysts maintain a collective cautious stance with nuanced positions regarding JPMorgan's future prospects.

Conclusion

The overarching theme in recent analyst recommendations for JPMorgan Chase & Co. is cautious optimism with a strong propensity towards 'Hold' recommendations. This indicates analysts are waiting for clearer signals amid unpredictable market conditions. Despite the stable number of 'Strong Buy' and 'Buy' recommendations, the shift to more 'Hold' ratings embodies a strategic pause. Moving forward, stability in earnings and foreseeable positive catalyzers could sway opinions positively, but simultaneous macroeconomic challenges present tangible risks. Investors should therefore remain vigilant and assess developments surrounding JPMorgan's strategic endeavors and the broader financial markets.