November 28, 2025 a 08:38 am

JPM: Analysts Ratings - JPMorgan Chase & Co.

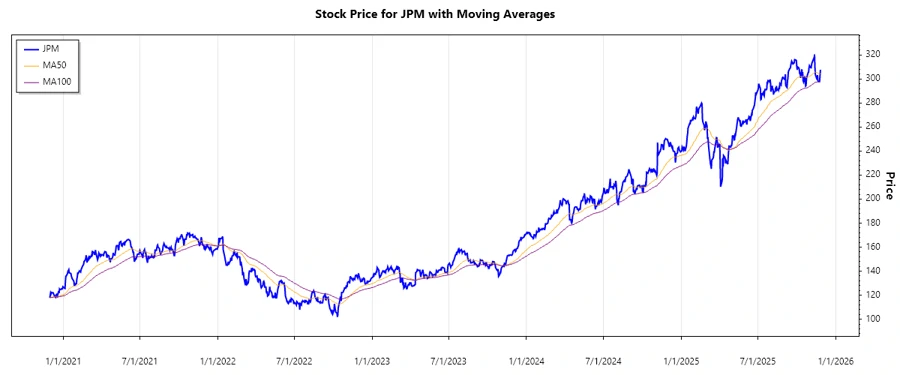

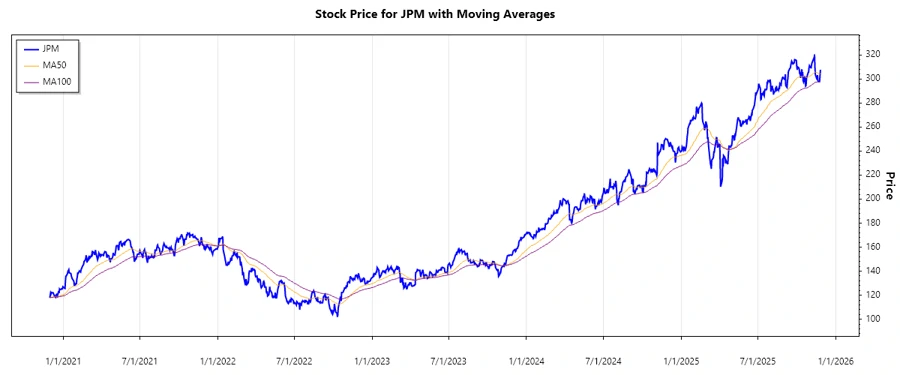

JPMorgan Chase & Co. remains a pivotal player in the financial services sector with a diverse set of operations spanning various financial activities. Analysts' recommendations have showcased nuanced shifts over the past year, reflecting changes in market dynamics and investor sentiment. While maintaining a generally positive outlook, there is a noticeable trend towards moderation, likely catalyzed by broader economic factors impacting the banking industry.

Historical Stock Grades

The latest analysis reveals stability in analyst ratings, with a consistent pattern observed over several months. Despite minor fluctuations, the sentiment remains cautiously optimistic.

| Rating | Count | Score |

|---|---|---|

| Strong Buy | 5 | |

| Buy | 9 | |

| Hold | 8 | |

| Sell | 2 | |

| Strong Sell | 1 |

Sentiment Development

Over the past few months, there has been a gradual shift in sentiment among analysts. The data shows an increase in 'Hold' ratings at the expense of a small decline in 'Strong Buy' recommendations. Analysts appear to be taking a more conservative stance amidst uncertain economic conditions.

- Increase in 'Hold' ratings over the last six months.

- Consistent number of 'Buy' ratings suggest underlying confidence in the stock.

- 'Strong Sell' ratings remain minimal, indicating a lack of bearish sentiment.

Percentage Trends

An examination of percentage trends reveals a subtle rebalancing of opinions. The slight drop in 'Strong Buy' ratings suggests a cautious approach, whereas an increase in 'Hold' signals prudence. The market seems to be adjusting expectations in line with macroeconomic factors.

- Strong Buy ratings decreased from 41% in July 2025 to 33% in November 2025.

- Hold ratings increased from 28% in October 2024 to 38% in November 2025.

- Buy ratings remained relatively stable, demonstrating resilient confidence.

Latest Analyst Recommendations

Recent recommendations show a trend of maintained positions, with all the latest changes reflecting a status quo across various firms. This indicates a stable market view without significant changes in the outlook for JPM's prospects.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-11-03 | Overweight | Overweight | Wells Fargo |

| 2025-10-15 | Overweight | Overweight | Barclays |

| 2025-10-15 | Equal Weight | Equal Weight | Morgan Stanley |

| 2025-10-07 | Buy | Buy | UBS |

| 2025-09-30 | Outperform | Outperform | Evercore ISI Group |

Analyst Recommendations with Change of Opinion

While the latest recommendations show maintenance of positions, notable earlier shifts include downgrades, suggesting some moderate caution introduced by economic variables over the past year.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2024-11-20 | Perform | Outperform | Oppenheimer |

| 2024-09-03 | Hold | Buy | Deutsche Bank |

| 2024-01-09 | Buy | Hold | Deutsche Bank |

| 2023-07-12 | Neutral | Buy | Citigroup |

| 2023-07-11 | Neutral | Buy | Citigroup |

Interpretation

The prevailing sentiment among analysts regarding JPMorgan Chase & Co. indicates a cautious but generally positive outlook. The absence of a significant increase in 'Strong Sell' ratings demonstrates minimal bearish sentiment, while an increase in 'Hold' recommendations signifies a protective approach in volatile markets. Analysts seem hesitant to make aggressive calls, indicating some market uncertainty. However, consistent 'Buy' ratings reaffirm confidence in the company's stability and growth potential.

Conclusion

In conclusion, while JPMorgan Chase & Co. faces a dynamic financial landscape, the firm's diverse operations provide resilience. Analysts show cautious optimism, balancing positive long-term prospects with near-term macroeconomic uncertainties. The stable "Buy" and reducing "Strong Buy" recommendations suggest confidence tempered by caution. Despite potential risks, JPM's vast portfolio positions it well to navigate challenges and leverage opportunities. Analysts should continue monitoring economic developments to adjust their positions accordingly.