April 19, 2025 a 09:31 am

Industrial Stocks - Performance Analysis

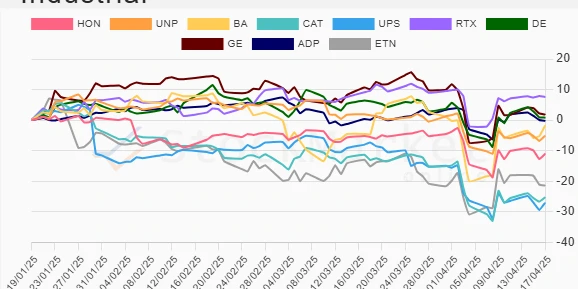

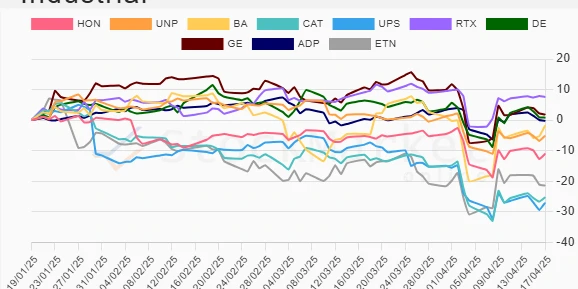

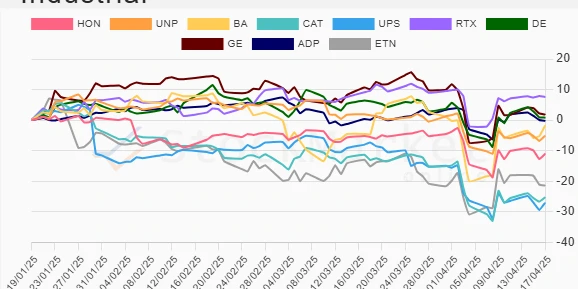

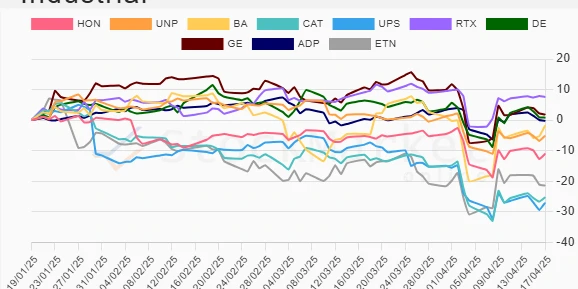

In the last quarter, industrial stocks have faced significant volatility, with notable fluctuations across different timeframes. The week-long performance showed divergence, monthly data highlighted widespread declines, and the quarterly results continued to expose selective resilience amidst broader downturns. This analysis will assess these variations, recognizing top performers and laggards while offering strategic insights.

Industrial Stocks Performance One Week

📊 Over the past week, Boeing (BA) emerged as the leading performer with a substantial gain of 3.28%, reflective of strong market confidence. On the contrary, Eaton (ETN) demonstrated the weakest performance, depreciating by -3.33%, indicating sector-specific challenges. The mixed results suggest a selective improvement in market sentiment, though macroeconomic concerns persist.

| Stock | Performance (%) | Performance |

|---|---|---|

| BA | 3.28% | |

| UNP | 0.80% | |

| RTX | 0.49% | |

| GE | 0.11% | |

| CAT | 0.32% | |

| UPS | -0.57% | |

| HON | -0.92% | |

| DE | -1.51% | |

| ADP | -2.10% | |

| ETN | -3.33% |

Industrial Stocks Performance One Month

📈 The past month saw uniform declines across most stocks, led by UPS with a steep fall of -18.10%. This suggests potential systemic concerns or sector-level pressures affecting industrial stocks. ADP remained the relative outperformer, merely slipping by -0.92%. Overall, the monthly overview indicates a defensive posture may continue to be prudent.

| Stock | Performance (%) | Performance |

|---|---|---|

| ADP | -0.92% | |

| RTX | -3.38% | |

| BA | -4.06% | |

| DE | -4.47% | |

| UNP | -5.72% | |

| HON | -6.03% | |

| ETN | -7.94% | |

| GE | -9.85% | |

| CAT | -12.06% | |

| UPS | -18.10% |

Industrial Stocks Performance Three Months

📉 Quarterly performance showed a mixed picture. Raytheon (RTX) recorded a robust gain of 7.58%, contrasting with UPS's contraction of -27.03%. The polarization within the sector suggests potential opportunities for stock-specific strategies amid broader market challenges.

| Stock | Performance (%) | Performance |

|---|---|---|

| RTX | 7.58% | |

| GE | 1.82% | |

| DE | 0.82% | |

| ADP | -0.24% | |

| BA | -1.78% | |

| UNP | -5.10% | |

| HON | -11.01% | |

| ETN | -21.41% | |

| CAT | -25.22% | |

| UPS | -27.03% |

Summary

💡 The recent performance of the industrial sector reflects significant challenges, yet pockets of opportunity. Raytheon's gains amidst general declines highlight the potential for targeted investments. However, the prevalent downward trend calls for cautious consideration, as market volatility remains a defining factor in the near term. Investors may benefit from identifying resilient performers while maintaining an adaptive strategy to navigate ongoing uncertainties in the sector.