August 02, 2025 a 09:31 am

Industrial Stocks - Performance Analysis

In the industrial sector, market dynamics have shown varied performances across different timeframes from one week to three months. While some stocks demonstrated resilience and growth, others faced declines due to sector volatility, global supply chains, and macroeconomic factors. This analysis delves into the performance of major industrial stocks over three distinct periods, highlighting top performers and underperformers.

📊 Industrial Stocks Performance One Week

During the past week, the industrial sector evidenced both strengths and challenges. UPS was notably the poorest performer, witnessing a substantial decline. On the other side, stocks like Raytheon Technologies remained relatively stable, resisting the downward tide others could not avoid.

| Stock | Performance (%) | Performance |

|---|---|---|

| UPS | -19.61 | |

| BA | -4.78 | |

| DE | -3.05 | |

| ETN | -2.80 | |

| ADP | -2.63 | |

| HON | -2.92 | |

| UNP | -2.35 | |

| GE | -0.80 | |

| CAT | -1.14 | |

| RTX | -0.04 |

📊 Industrial Stocks Performance One Month

In the one-month view, General Electric and Caterpillar have demonstrated robust performance, leading with positive gains. Conversely, UPS has struggled, continuing its downward trend, leading to a concern for investors focusing on logistics.

| Stock | Performance (%) | Performance |

|---|---|---|

| GE | 8.89 | |

| CAT | 7.63 | |

| RTX | 7.50 | |

| ETN | 5.35 | |

| BA | 2.98 | |

| UNP | -7.17 | |

| HON | -9.65 | |

| ADP | -2.79 | |

| DE | -3.64 | |

| UPS | -20.02 |

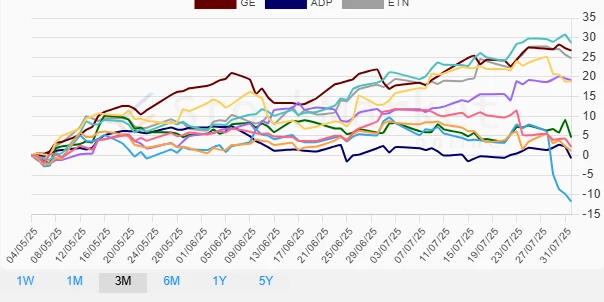

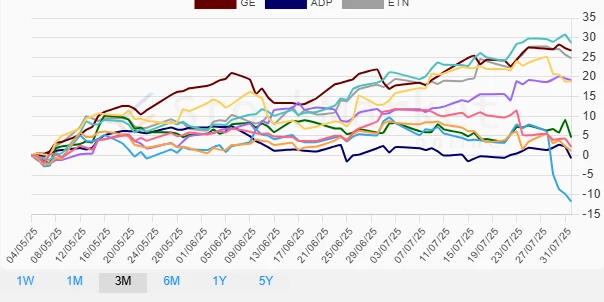

📊 Industrial Stocks Performance Three Months

Over the past three months, the industrial sector shows a positive trend. Caterpillar outperformed with a strong upward movement, followed closely by Raytheon and General Electric. Boeing also displayed significant gains, indicating a recovery or growth phase.

| Stock | Performance (%) | Performance |

|---|---|---|

| CAT | 28.66 | |

| RTX | 19.16 | |

| GE | 26.71 | |

| ETN | 24.80 | |

| BA | 18.87 | |

| DE | 4.61 | |

| HON | 2.21 | |

| UNP | 1.17 | |

| ADP | -0.67 | |

| UPS | -11.70 |

✅ Summary

In summary, the industrial sector exhibits a mixed performance landscape over varying timeframes. Major players like Caterpillar and Boeing provided substantial returns, highlighting growth opportunities within specific industries. Meanwhile, UPS struggled, indicating sector-specific challenges perhaps in logistics and delivery operations. Investors should be cautious of broader economic influences and sector trends, adjusting portfolios as necessary to balance risk and opportunity within this dynamic sector.