August 05, 2025 a 04:38 pm

IR: Analysts Ratings - Ingersoll Rand Inc.

Ingersoll Rand Inc., with its robust offerings across Industrial Technologies and Precision and Science Technologies, has established a strong market presence globally. Recent analyst ratings reflect a steady position for the company, with a significant number of analysts expressing a "Buy" or "Hold" stance. As the market continually evolves, monitoring these sentiment trends provides valuable insights into the company's perceived market potential.

Historical Stock Grades

| Rating Type | Number of Recommendations | Score Bar |

|---|---|---|

| Strong Buy | 1 | |

| Buy | 8 | |

| Hold | 7 | |

| Sell | 0 | |

| Strong Sell | 0 |

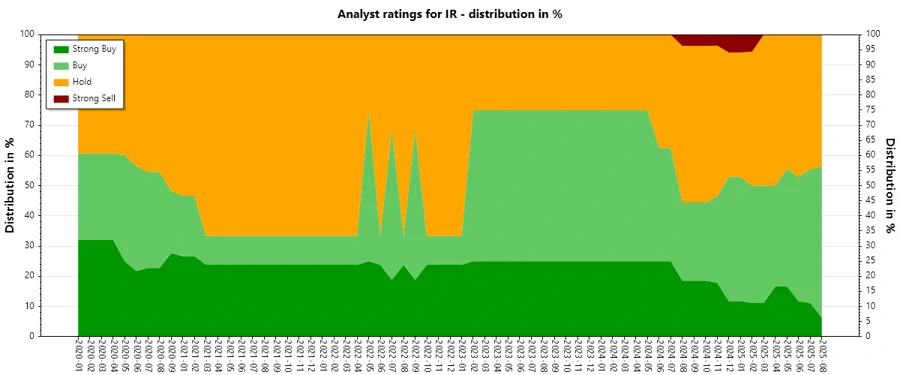

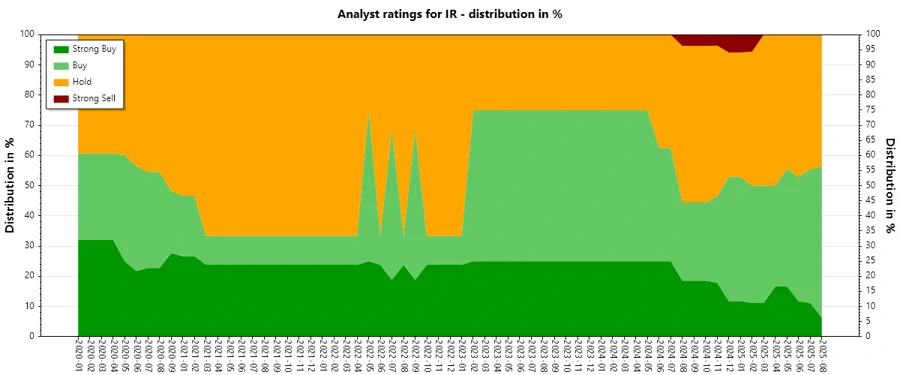

Sentiment Development

The sentiment for Ingersoll Rand has showcased a relatively stable trend over recent months. Notable indicators include varying degrees of analyst confidence, with "Buy" and "Hold" recommendations dominating. - There has been a slight decrease in "Strong Buy" recommendations from 3 to 1 within this year. - "Buy" recommendations have remained relatively stable, hinting at persistent positive sentiment among analysts. - "Hold" assessments have slightly increased, indicating some cautious optimism or market hedging.

Percentage Trends

Examining percentage shifts in analyst recommendations highlight strategic market observations: - A transition from "Strong Buy" to "Buy" and "Hold" suggests increased analysis scrutiny from certain analysts. - Over the last twelve months, the distribution of recommendations evolved with a visible decline in "Strong Buys," paired with an uptick in "Hold" ratings. - The percentage of "Buy" ratings has seen minor fluctuations, reinforcing analyst commitment to the company's potential.

Latest Analyst Recommendations

Recent analyst recommendations imply sustained confidence in Ingersoll Rand's performance. The persistent "Overweight" and "Outperform" ratings indicate a positive growth outlook:

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-08-04 | Overweight | Overweight | Barclays |

| 2025-08-04 | Outperform | Outperform | Baird |

| 2025-08-04 | Hold | Hold | Stifel |

| 2025-07-21 | Hold | Hold | Stifel |

| 2025-07-14 | Buy | Buy | Citigroup |

Analyst Recommendations with Change of Opinion

Changes in analyst opinions for Ingersoll Rand signal nuanced adjustments, possibly reflecting evolving market conditions or strategic shifts:

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2024-11-18 | Hold | Buy | Stifel |

| 2024-02-20 | In Line | Outperform | Evercore ISI Group |

| 2023-10-24 | Buy | Hold | Stifel |

| 2023-05-09 | Outperform | In Line | Evercore ISI Group |

| 2023-05-08 | Outperform | In Line | Evercore ISI Group |

Interpretation

The current analysis highlights a largely positive sentiment towards Ingersoll Rand, with predominant "Buy" recommendations pointing to confidence in the company's operational prowess. Any fluctuations in ratings mainly reflect macroeconomic conditions, and shifts usually indicate tactical adaptations rather than fundamental company performance criticisms. Overall market sentiment appears stable, yet cautious, indicating maintained but watchful trust in the firm's future prospects.

Conclusion

In conclusion, Ingersoll Rand Inc. continues to capture a significant share of positive analyst attention. Sustained "Buy" and "Hold" evaluations, in tandem with strategic downgrades, present a mature market stance that balances potential opportunities against risk factors. As the industrial landscape adapts to new challenges, Ingersoll Rand's historical resilience and strategic innovation could position it well to leverage market developments effectively, yet this will require consistent operational foresight and agile strategic adjustments.