September 24, 2025 a 06:45 am

INTU: Fibonacci Analysis - Intuit Inc.

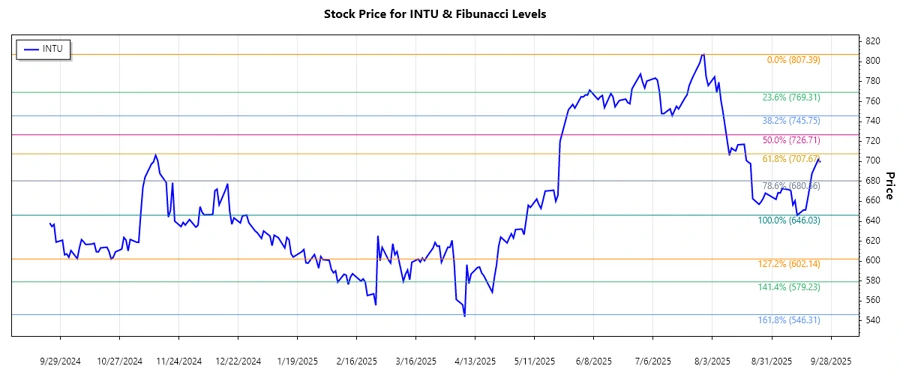

Intuit Inc. has been a leading figure in providing financial management and compliance solutions. Recently, its stock has shown a downward trend, which may present a potential buying opportunity if it rebounds. Analysts are keenly observing the stock to determine if current levels may serve as key support.

Fibonacci Analysis

| Parameter | Details |

|---|---|

| Trend Start Date | 2025-07-30 |

| Trend End Date | 2025-09-23 |

| High Price and Date | $807.39 on 2025-07-30 |

| Low Price and Date | $646.03 on 2025-09-12 |

| Fibonacci Level | Price Level |

|---|---|

| 0.236 | $678.05 |

| 0.382 | $717.47 |

| 0.5 | $726.71 |

| 0.618 | $730.93 |

| 0.786 | $738.79 |

The current price of $699.18 is in the 0.236 to 0.382 retracement zone. This suggests the price might face resistance near the upper retracement levels.

If the stock holds above the 0.236 level, it could potentially signal a reversal. However, breaching this level might confirm the continuation of the downtrend.

Conclusion

Intuit Inc. is currently navigating a technically challenging period with a dominant downward trend. The stock is in a critical zone that could determine its next move. While the current price suggests potential resistance, a breakthrough above this zone could indicate bullish reversal. Investors should weigh the potential for recovery against the risk of continued decline. The company's strong market position could fuel optimism, but caution is advised until clear supportive levels are established.