November 05, 2025 a 09:03 am

IEX: Trend and Support & Resistance Analysis - IDEX Corporation

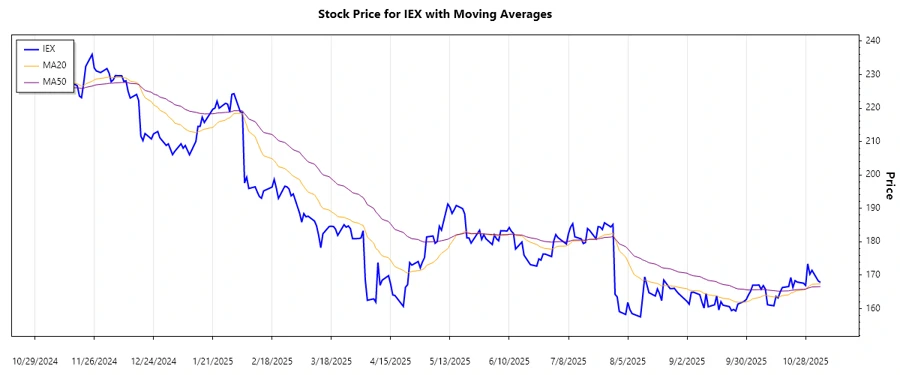

IDEX Corporation shows potential within its industry segments, adapting effectively to market demands with cutting-edge technology. However, the recent price movements hint at volatility which requires cautious monitoring. The technical indicators will provide further insight into its trend stability and potential price movements.

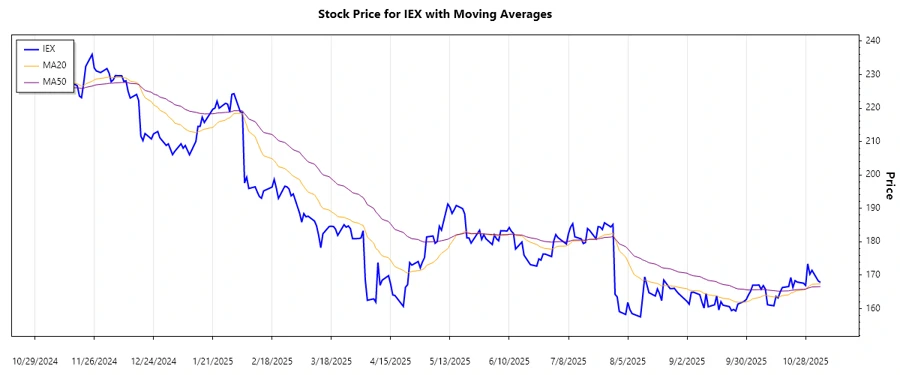

Trend Analysis

Considering the calculated EMAs from the closing prices over the past months, the current trend of IDEX Corporation can be identified. The EMA20 compared to EMA50 helps gauge the strength and direction of the trend.

| Date | Close Price | Trend |

|---|---|---|

| 2025-11-04 | 167.86 | ▼ Downward Trend |

| 2025-11-03 | 168.25 | ▼ Downward Trend |

| 2025-10-31 | 171.46 | ▲ Upward Trend |

| 2025-10-30 | 170.3 | ▼ Downward Trend |

| 2025-10-29 | 173.4 | ▲ Upward Trend |

| 2025-10-28 | 166.95 | ▼ Downward Trend |

| 2025-10-27 | 167.6 | ▼ Downward Trend |

From the trend analysis, the stock has experienced fluctuating movements characterized by short-term volatility. This is indicative of a testing period for prices, demanding strategic trading decisions to mitigate risk.

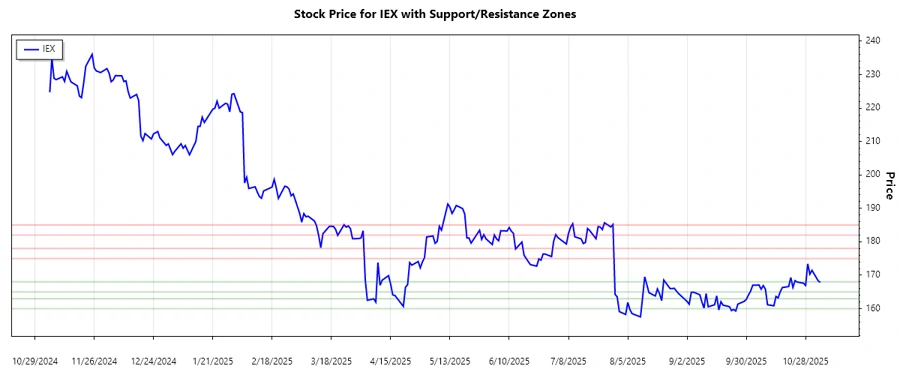

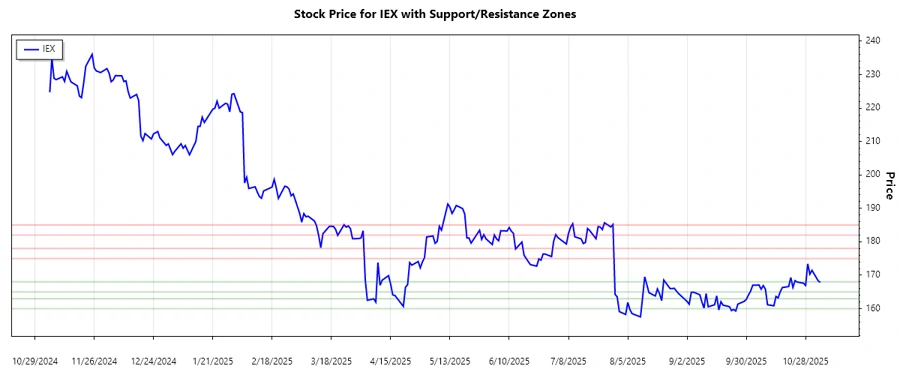

Support and Resistance

Support and resistance levels were derived from the closing prices. These zones highlight areas where the stock price has historically reversed or paused, giving traders insight into potential future price actions.

| Zone Type | From | To |

|---|---|---|

| Support 1 | 160.00 | 163.00 |

| Support 2 | 165.00 | 168.00 |

| Resistance 1 | 175.00 | 178.00 |

| Resistance 2 | 182.00 | 185.00 |

The current price appears to be gravitating towards the lower support zone, suggesting that if this area is breached, further declines could be expected. Conversely, a bounce from this zone could offer bullish opportunities.

Conclusion

Examining the IDEX Corporation's stock reveals mixed signals with potential for both upward and downward movements. The current trend displays volatility primarily encountered in its support zones, necessitating astute market assessment for traders and investors. While the stock boasts robustness in its operations and sectors, careful scrutiny of external market factors and trend developments remains vital to capitalizing on investment opportunities whilst mitigating risks.