September 11, 2025 a 02:03 pm

ICE: Trend and Support & Resistance Analysis - Intercontinental Exchange, Inc.

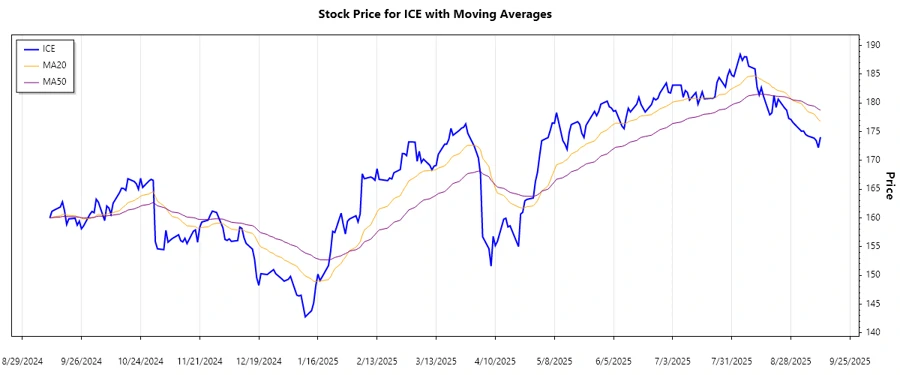

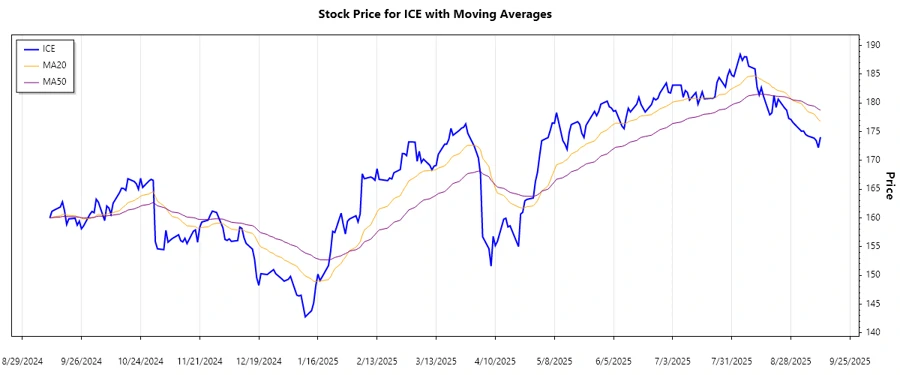

Intercontinental Exchange, Inc. (ICE) operates a global network of exchanges and clearinghouses, positioning itself as a key player in financial infrastructure. Over the last few months, the stock has experienced volatility, influenced by global economic conditions. Technical analysis indicates varied trends, suggesting both potential growth and caution for investors as the market responds to broader financial movements.

Trend Analysis

The trend analysis for ICE based on the most recent data indicates that the stock is currently experiencing a noted fluctuation. Calculations based on the Exponential Moving Averages (EMA) reveal that the 20-day EMA is slightly below the 50-day EMA, suggesting an emerging ▼ Abwärtstrend. Recent market actions echo a short-term bearish sentiment, which could be a response to broader economic factors.

| Date | Closing Price | Trend |

|---|---|---|

| 2025-09-11 | $174.07 | ▼ |

| 2025-09-10 | $172.23 | ▼ |

| 2025-09-09 | $173.46 | ▼ |

| 2025-09-08 | $173.89 | ▼ |

| 2025-09-05 | $174.27 | ▼ |

| 2025-09-04 | $174.52 | ▲ |

| 2025-09-03 | $175.13 | ▲ |

The above trend analysis suggests a transition period. Investors should consider external influences such as market conditions and company-specific news while making decisions.

Support and Resistance

The analysis of price action unveils key support and resistance zones, pivotal for traders to strategize entries and exits. Based on recent lows and highs, the following zones have been identified:

| Type | Zone From | Zone To | |

|---|---|---|---|

| Support | $172.0 | ▼ | $173.0 |

| Support | $174.0 | ▼ | $175.0 |

| Resistance | $178.0 | ▲ | $179.0 |

| Resistance | $180.0 | ▲ | $181.0 |

The current price near $174.07 is approaching a support zone, indicating potential buying pressure in this area. A break below could suggest further bearish movement, while a rebound would confirm the strength of the support.

Conclusion

The stock of Intercontinental Exchange, Inc. presents mixed signals for technical traders. The current downward trend, accompanied by defined support and resistance levels, provides fertile ground for opportunity. However, risks remain as the market is subject to global economic shifts. Analysts should pay attention to the forthcoming fiscal announcements and external financial indications. The identified zones play a critical role in dictating potential future movements, inviting a closer watch for strategic trading.