October 04, 2025 a 08:39 pm

IBM: Analysts Ratings - International Business Machines Corporation

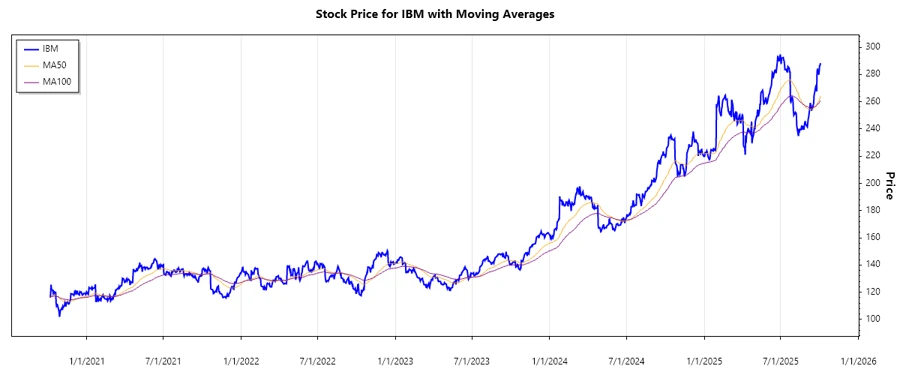

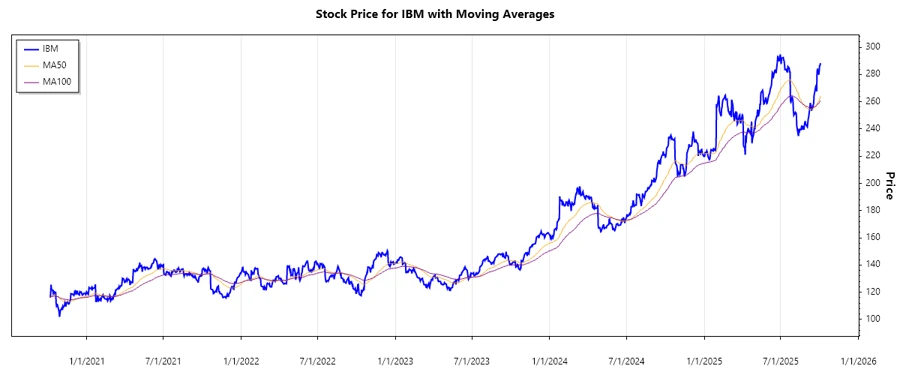

IBM, a titan in the technology sector, continues to show resilience and adaptability under market pressures. Analysts' recommendations for the company highlight a prevalent sentiment of caution with a tilt towards stability. With robust offerings spanning from hybrid cloud solutions to AI and security software, IBM remains a significant player with analysts showing a cautious optimism reflected in their ratings.

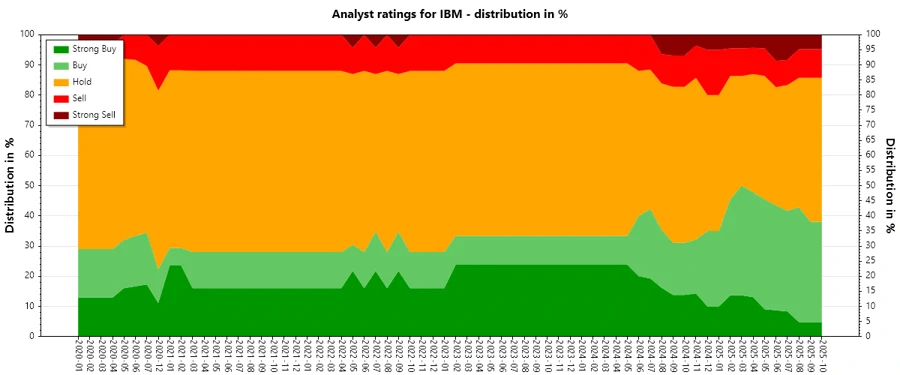

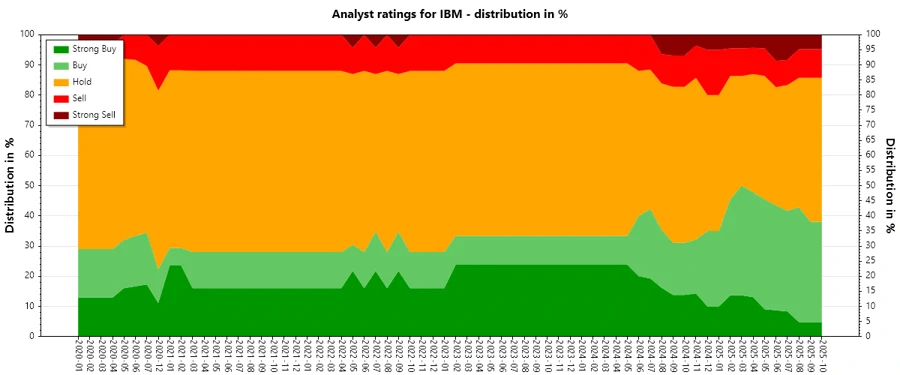

Historical Stock Grades

The most recent analysis of IBM ratings illustrates a preponderance of "Hold" recommendations, overshadowing both buy and sell suggestions. While the "Strong Buy" ratings are minimal, the market sentiment seems to be one of cautious observation rather than active buying or selling.

| Recommendation | Number of Analysts | Score |

|---|---|---|

| Strong Buy | 1 | |

| Buy | 7 | |

| Hold | 10 | |

| Sell | 2 | |

| Strong Sell | 1 |

Sentiment Development

Over the past months, IBM has seen a gradual transformation in analyst sentiment, predominantly in the Hold category, reflecting a wait-and-see approach. The ratings have stabilized with consistent "Hold" recommendations indicating a maintained market stance.

- The total number of ratings shows a mild increase, suggesting steady analyst engagement with the stock.

- A noticeable decline in "Strong Buy" recommendations highlights reduced aggressive bullish sentiment.

- The "Hold" ratings dominate, underlining ongoing cautiousness about rapid stock movements.

Percentage Trends

The data reveals subtle shifts in analysts' perceptions over time. While "Strong Sell" and "Sell" ratings have seen nominal participation, the transition towards more "Hold" recommendations is apparent, showcasing a conservative tendency in analyst outlooks.

- Strong Buy ratings have decreased from 5% to 2%, indicating reduced confidence in immediate stock appreciation.

- "Hold" ratings surged by around 10%, underlining market caution.

- "Buy" ratings remain relatively stable but lean towards a lasting neutral perspective.

Latest Analyst Recommendations

The latest analyst evaluations reiterate the current sentiment. Most recommendations maintain their prior standings, indicating stable market assessments without abrupt verdict shifts.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-07-24 | Buy | Buy | B of A Securities |

| 2025-07-24 | Sell | Sell | UBS |

| 2025-07-24 | Neutral | Neutral | JP Morgan |

| 2025-07-18 | Market Perform | Market Perform | BMO Capital |

| 2025-07-17 | Outperform | Outperform | RBC Capital |

Analyst Recommendations with Change of Opinion

Rare adjustments in recommendations have been noted, with a few analysts shifting their stances from neutral or inline states to either more positive or negative outlooks. This indicates selective reassessment of IBM's market positioning.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2024-01-19 | Outperform | In Line | Evercore ISI Group |

| 2024-01-05 | Sell | Hold | Societe Generale |

| 2023-02-06 | Hold | Buy | Edward Jones |

| 2023-02-05 | Hold | Buy | Edward Jones |

| 2023-01-19 | Market Perform | Underperform | MoffettNathanson |

Interpretation

Analysts' ratings suggest IBM's stock holds a position of caution in the market with a lack of strong conviction to either buy or sell. The prevalent "Hold" signals both apprehension and potential for stability as analysts await further performance indicators. Shifts in previous positive recommendations to more neutral or negative positions hint at growing uncertainty, whereas maintained ratings underscore a stable view. The overall sentiment appears restrained with no substantial swings in opinions.

Conclusion

IBM remains a cornerstone in the technology sector with a broad array of services. However, analyst ratings reflect a cautious market stance with predominant "Hold" recommendations. The lack of strong buy signals indicates a cautious outlook amidst industry's fast-paced development. Nevertheless, IBM's vast technological portfolio continues offering potential for future growth, albeit actualizing it depends on strategic adaptability and market conditions. Current sentiment portrays careful optimism, with changes subject to IBM’s financial results and innovation journey.