September 28, 2025 a 08:39 pm

IBKR: Analysts Ratings - Interactive Brokers Group, Inc.

Interactive Brokers Group, Inc. (IBRK) has gained considerable attention from analysts due to its robust brokerage platform and its diversified service offerings. As an automated electronic broker, it commands a significant position in the financial industry with a wide array of products and services. Its market influence, both domestically and internationally, combined with a diverse clientele, ensures it remains a formidable player. However, recent analyst ratings indicate emerging trends which may require a closer evaluation of its future performance potential.

Historical Stock Grades

Over the recent months, the analyst ratings for Interactive Brokers Group have shown a moderate yet stable sentiment with a clear preference for 'Buy' and 'Strong Buy' suggestions. The company's strategic decisions and its role in global brokerage continually attract analysts' attention. Here's a snapshot of the most current ratings:

| Recommendation | Count | Score |

|---|---|---|

| Strong Buy | 2 | |

| Buy | 4 | |

| Hold | 2 | |

| Sell | 0 | |

| Strong Sell | 1 |

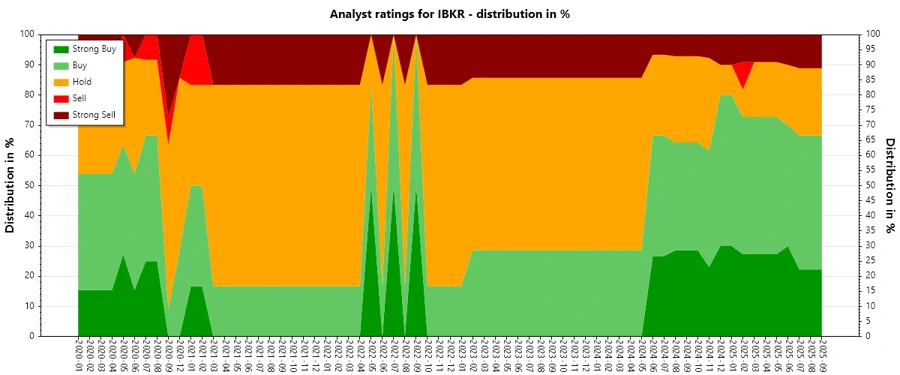

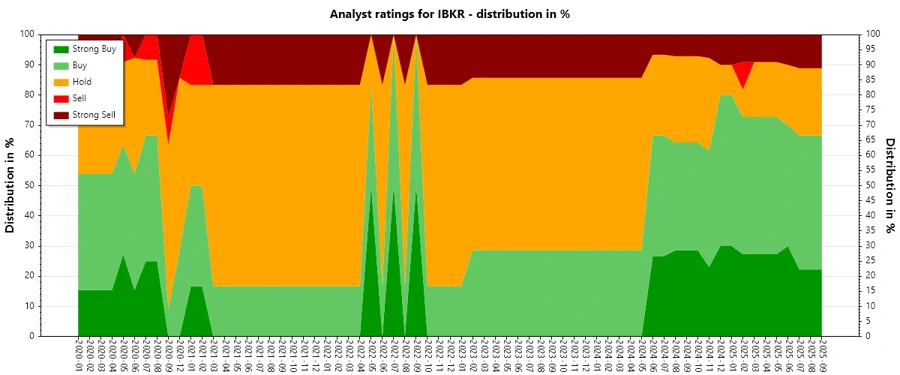

Illustration: Distribution of analyst ratings over recent periods.

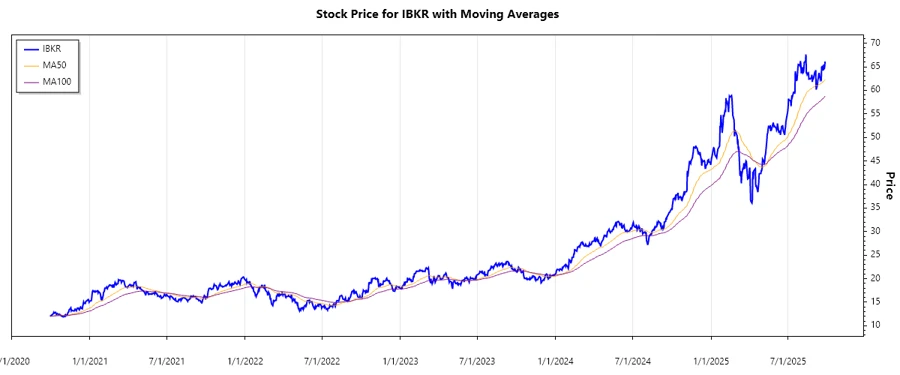

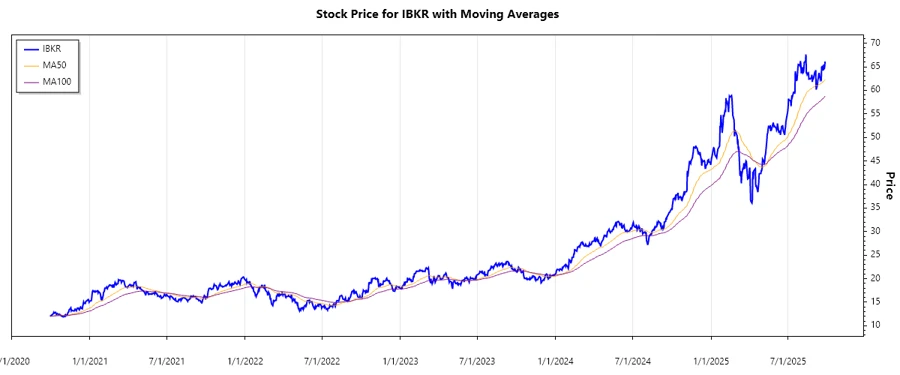

Illustration: Interactive Brokers Group's stock price movement in correlation with analyst ratings.

Sentiment Development

The sentiment for IBKR has maintained consistency, with a steady number of 'Buy' ratings dominating the analyst landscape. A few subtle shifts can be noticed in the distribution of ratings, reflecting changes in perception over minor strategic decisions of the company.

- Steadiness in 'Buy' recommendations with slight fluctuations in 'Strong Buy' ratings over recent months.

- The number of total recommendations has seen little variation, indicating a stable analyst interest and perspective.

- Hold recommendations remain steady, suggesting a consistent confidence in the company's ongoing operations.

Percentage Trends

Percentage trends give insight into shifting analyst opinions. While 'Buy' remains dominant, there has been a significant rise in 'Strong Buy' percentages earlier this year, suggesting increased confidence, which has stabilized in recent months.

- There was a noted increase in 'Strong Buy' from early in the year, stabilizing towards September 2025.

- 'Hold' ratings have shown minimal change, maintaining around 20-40% of total ratings consistently.

- Minor declines in 'Strong Buy' ratings were observed, possibly due to cautious optimism or strategic pivots by the company.

Overall, there's a clear preference for holding a 'Buy' stance while showing some caution towards overly aggressive investment recommendations.

Latest Analyst Recommendations

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-07-18 | Overweight | Overweight | Piper Sandler |

| 2025-07-18 | Overweight | Overweight | Barclays |

| 2025-07-15 | Overweight | Overweight | Piper Sandler |

| 2025-07-10 | Overweight | Overweight | Barclays |

| 2025-07-07 | Buy | Buy | Citigroup |

Analyst Recommendations with Change of Opinion

Recent changes in analysts' opinions have been rather infrequent, with minor shifts capturing attention. This signifies a stable market sentiment with minimal surprises in company performance metrics.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-06-09 | Neutral | Buy | Citigroup |

| 2024-01-09 | Buy | Neutral | Goldman Sachs |

| 2024-01-08 | Buy | Neutral | Goldman Sachs |

| 2022-01-19 | Outperform | Market Perform | Keefe, Bruyette & Woods |

| 2022-01-18 | Outperform | Market Perform | Keefe, Bruyette & Woods |

Interpretation

The overall market assessment of IBKR reflects moderate optimism. Analysts appear to have confidence in Interactive Brokers Group's capabilities and strategies, with a stable outlook across ratings. The minor shifts observed in analyst sentiment suggest caution mixed with confidence in the company's strategic growth and stability. While some hesitance may be noted in the occasional downgrading, this does not overshadow the general consensus of institutional and investor trust.

Conclusion

Interactive Brokers Group, Inc. remains a significant entity within the brokerage industry. While maintaining a majority of 'Buy' and 'Strong Buy' recommendations, recent trends illustrate a cautious optimism, driven by minor downgrades in sentiment. These shifts imply that while the company’s core operations remain sound, external market dynamics and performance metrics could impact future analyst ratings. The company's capabilities to adapt and innovate will dictate its trajectory and continued favorability among analysts.