October 09, 2025 a 07:44 pm

HUBB: Fundamental Ratio Analysis - Hubbell Incorporated

Hubbell Incorporated operates in the industrial sector with a focus on electrical and electronic products. Its diverse product offerings across two significant segments provide it with a strong market position. The stock's outlook remains stable with moderate growth expectations in the current market environment.

Fundamental Rating

The fundamental ratings suggest a fairly balanced performance across key financial metrics. The current overall score indicates moderate potential for future growth.

| Category | Score | Visual |

|---|---|---|

| Discounted Cash Flow | 4 | |

| Return on Equity | 5 | |

| Return on Assets | 5 | |

| Debt to Equity | 1 | |

| Price to Earnings | 2 | |

| Price to Book | 1 |

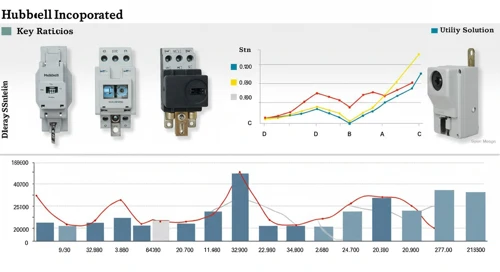

Historical Rating

The historical ratings provide insights into the changing performance trends of Hubbell's stock over time.

| Date | Overall | DCF | ROE | ROA | D/E | P/E | P/B |

|---|---|---|---|---|---|---|---|

| 2025-10-09 | 3 | 4 | 5 | 5 | 1 | 2 | 1 |

| Previous | 0 | 4 | 5 | 5 | 1 | 2 | 1 |

Analyst Price Targets

Analysts have provided consistent price targets reflecting a stable view of the stock's valuation.

| High | Low | Median | Consensus |

|---|---|---|---|

| $490 | $490 | $490 | $490 |

Analyst Sentiment

The sentiment of analysts is predominantly cautious, with a majority recommending holding the stock.

| Recommendation | Count | Visual |

|---|---|---|

| Strong Buy | 0 | |

| Buy | 6 | |

| Hold | 9 | |

| Sell | 1 | |

| Strong Sell | 0 |

Conclusion

Hubbell Incorporated stands as a robust entity in the industrial sector with a stable market presence. While the company shows strength in its return metrics, the debt to equity ratio remains an area of caution. Analysts hold a consensus of 'Hold' on the stock, indicating a balanced risk and reward scenario. Investors should weigh the steady financial growth against possible market volatilities. Overall, Hubbell's diversified product range supports its future growth prospects, though careful monitoring of financial ratios is advised.