September 29, 2025 a 09:01 am

HSIC: Analysts Ratings - Henry Schein, Inc.

Henry Schein, Inc. shares have witnessed a consistent trend in analyst ratings over recent months. While there's been stability in the overall sentiment, subtle shifts in recommendation weightings have been noted. The firm's diversification in health care products and services continues to draw varying levels of interest from market analysts.

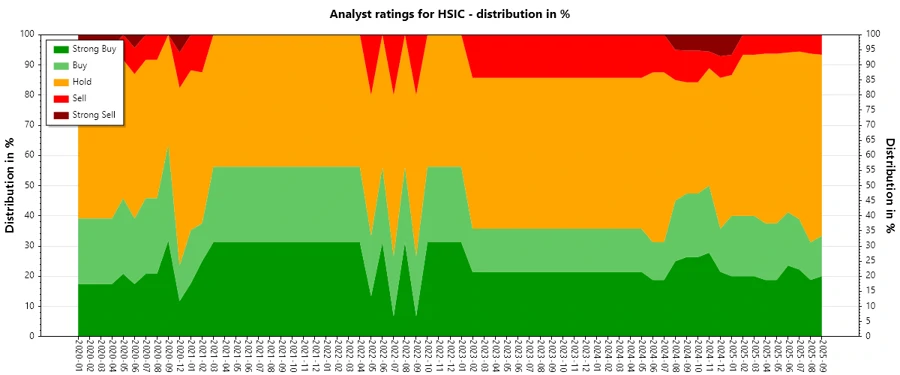

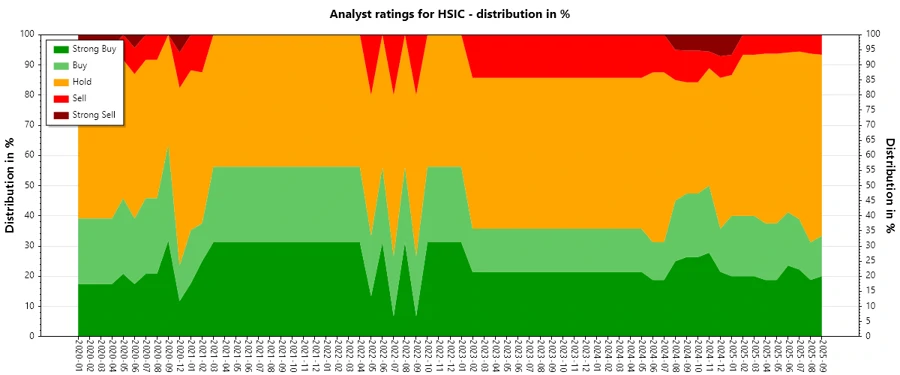

Historical Stock Grades

The latest analyst ratings for Henry Schein, Inc. as of September 2025, indicate a cautious market stance. Strong Buy recommendations remain limited, while a significant portion of analysts prefer to maintain a Hold position.

| Rating | Number of Analysts | Score |

|---|---|---|

| Strong Buy | 3 | |

| Buy | 2 | |

| Hold | 9 | |

| Sell | 1 | |

| Strong Sell | 0 |

Sentiment Development

Recent data show an increase in cautious sentiment, with stability in Hold recommendations over the months. The total number of ratings has remained relatively stable, while moderate shifts have occurred within specific categories:

- Stability in Strong Buy ratings, consistently low at 3-4 recommendations.

- An uptick in Hold ratings from earlier in the year.

- A small decrease in Buy ratings, reflected in the increased caution.

Percentage Trends

Over recent months, a notable shift towards conservative positions is evident in Henry Schein's ratings. Analyst distribution as a percentage showcases subtle shifts reflecting this strategy:

- Strong Buy ratings maintain around 20% - 25% of total recommendations.

- The percentage of Hold positions has incrementally increased, reflecting a more conservative market attitude.

- Buy recommendations show a downtrend, signaling potential market caution.

Key changes over the past 12 months indicate a decrease in bullish sentiment and a stronger emphasis on holding positions.

Latest Analyst Recommendations

Recent analyst activities highlight continued interest in maintaining existing views, with few upgrades or downgrades:

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-09-23 | Outperform | Outperform | Barrington Research |

| 2025-08-26 | Outperform | In Line | Evercore ISI Group |

| 2025-08-07 | Overweight | Overweight | JP Morgan |

| 2025-08-06 | Outperform | Outperform | Barrington Research |

| 2025-08-06 | In Line | In Line | Evercore ISI Group |

Analyst Recommendations with Change of Opinion

There have been several notable shifts over recent months, showcasing analysts' reevaluation of market conditions associated with Henry Schein, Inc.:

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-08-26 | Outperform | In Line | Evercore ISI Group |

| 2025-07-25 | Hold | Buy | Stifel |

| 2025-07-14 | Neutral | Outperform | Baird |

| 2025-01-06 | Buy | Underperform | B of A Securities |

| 2024-07-22 | Outperform | Neutral | Baird |

Interpretation

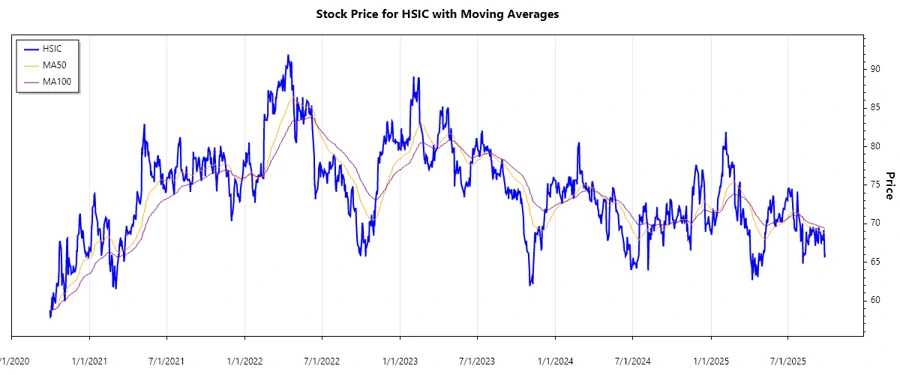

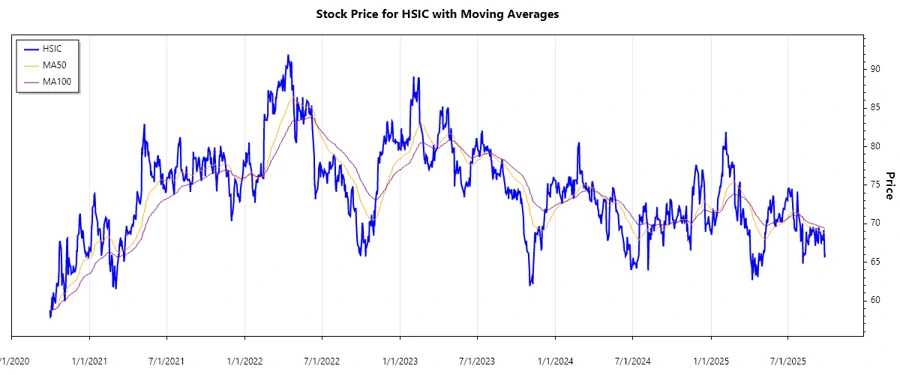

The overall market perception of Henry Schein, Inc. indicates a stable environment with slight caution. Analysts exhibit confidence in the company's sustained performance, yet some display restrained optimism due to uncertain market conditions. The current sentiment portrays a balanced stance, emphasizing the importance of strategic decisions and careful evaluation of market dynamics. This could suggest increased market volatility or cautiousness due to fluctuating economic indicators.

Conclusion

Henry Schein, Inc.'s analyst ratings underline a blend of confidence and caution, reflecting both growth potential and existing market uncertainties. The firm's stable product diversification across healthcare sectors bodes well for moderate investment strategies. However, the persistent fluctuations in ratings demonstrate the importance of being vigilant amidst potential risks. Analysts appear hesitant to fully embrace a bullish stance, prioritizing risk assessments over aggressive buying recommendations.