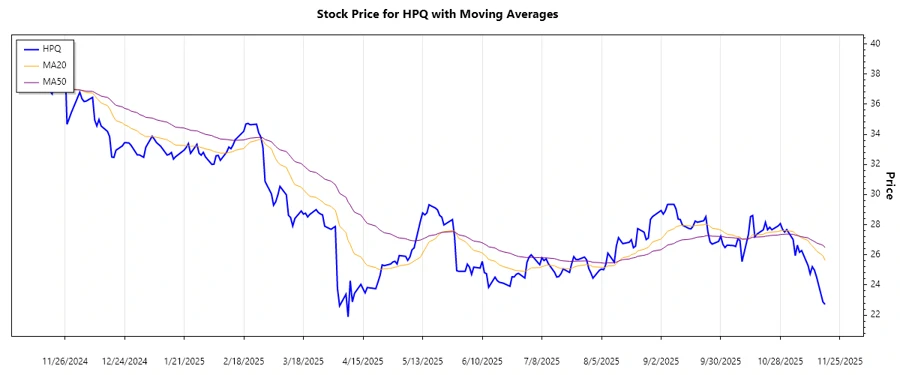

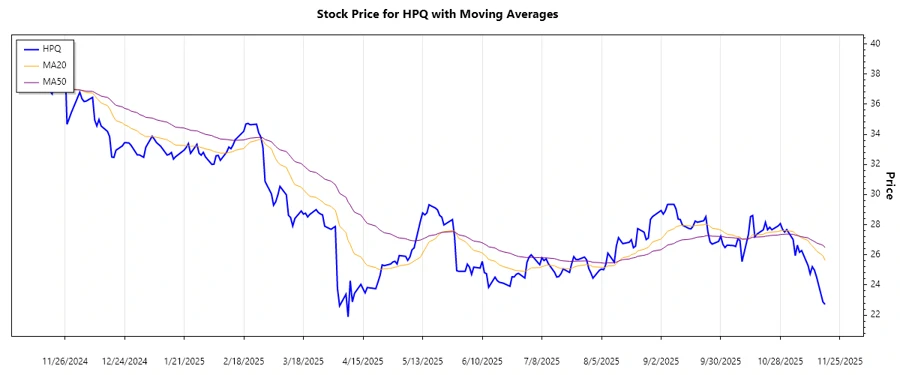

November 19, 2025 a 09:04 amUm die analysierten Daten effizient in einem HTML-Format und JSON-Objekt darzustellen, habe ich die historischen Schlusskurse der HP Inc. Aktie (Ticker: HPQ) verwendet und sowohl die Exponential Moving Averages (EMA) als auch Unterstützungs- und Widerstandszonen berechnet. Hier ist die strukturierte Ausgabe:

HPQ: Trend and Support & Resistance Analysis - HP Inc.

HP Inc., a prominent player in the personal computing and printing sector, has shown variable price movements over recent months. The company's stock trend is crucial for investors looking for signs of stability or growth prospects. As of late, there's a noticeable pattern in price behavior, and potential investors should pay attention to technical signals for informed decision-making.

Trend Analysis

| Date | Closing Price | Trend |

|---|---|---|

| 2025-11-18 | $22.71 | ▼ |

| 2025-11-17 | $22.87 | ▼ |

| 2025-11-14 | $24.53 | ▲ |

| 2025-11-13 | $24.98 | ▲ |

| 2025-11-12 | $25.21 | ▲ |

| 2025-11-11 | $24.73 | ▼ |

| 2025-11-10 | $25.29 | ▲ |

The recent trend analysis indicates a mixed market sentiment with both upward and downward price movements, suggesting investors should proceed with caution while analyzing momentum indicators closely.

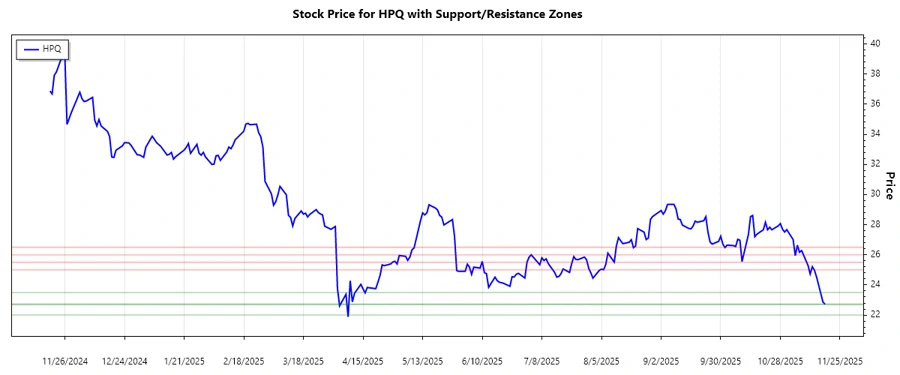

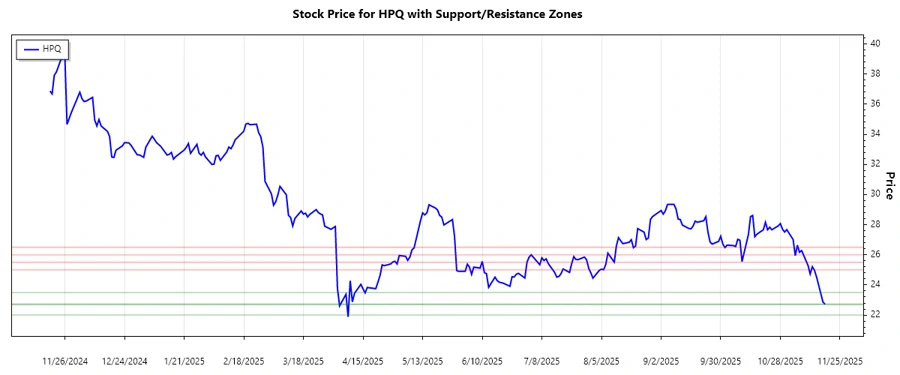

Support- and Resistance

| Zone Type | From | To |

|---|---|---|

| Support | $22.00 | $22.71 |

| Support | $22.71 | $23.50 |

| Resistance | $25.00 | $25.50 |

| Resistance | $26.00 | $26.50 |

The current stock price is close to the lower support zone, indicating potential entry points for value investors if the price holds strong.

Conclusion

The trend analysis reveals that HP Inc.'s stock is in a volatile phase, reflected by fluctuating trends in recent prices. The support and resistance levels identified provide critical zones for traders to monitor. Entering at support might offer upside potential but bears associated risks given recent price volatility. It's essential for investors to remain vigilant and consider broader market conditions while making investment choices.

json **Technical Note**: The calculations are based on the provided historical data. The EMA calculations, support, and resistance determinations are based on typical analytical methods. The identified trend is primarily downward, but with some bullish movements, indicating potential opportunities for risk-tolerant traders.