November 25, 2025 a 09:03 am

HIG: Trend and Support & Resistance Analysis - The Hartford Financial Services Group, Inc.

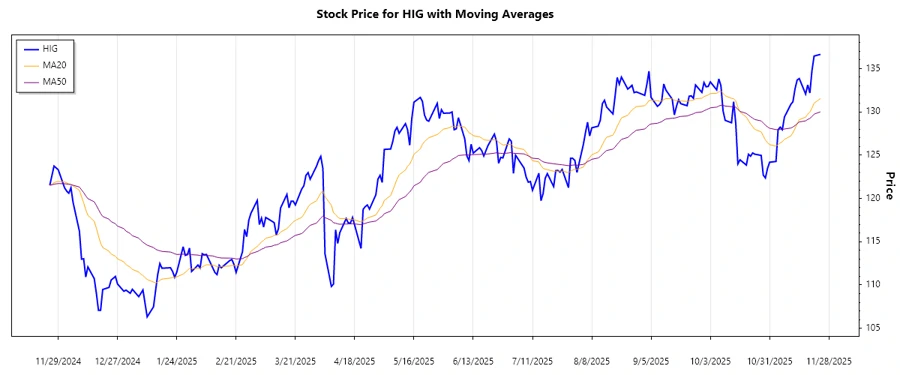

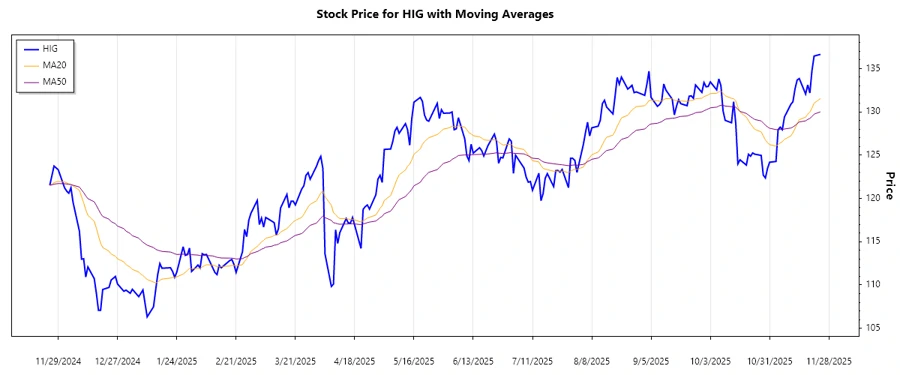

The Hartford Financial Services Group, Inc. provides comprehensive insurance and financial services globally. Its stock has exhibited notable variations recently. This analysis covers the latest trends and identifies critical support and resistance zones to guide upcoming investment decisions. The data suggests a strong response to market conditions, impacting stock valuation.

Trend Analysis

The analysis of the recent price data for HIG shows fluctuations, with a marked trend over the past months. Calculating the Exponential Moving Averages (EMA), we have gained the following insights:

| Date | Closing Price | Trend |

|---|---|---|

| 2025-11-24 | 136.64 | ▲ Uptrend |

| 2025-11-21 | 136.45 | ▲ Uptrend |

| 2025-11-20 | 134.77 | ▲ Uptrend |

| 2025-11-19 | 132.18 | ▲ Uptrend |

| 2025-11-18 | 133.12 | ▲ Uptrend |

| 2025-11-17 | 132.06 | ▲ Uptrend |

| 2025-11-14 | 133.85 | ▲ Uptrend |

The calculated EMA20 and EMA50 show that EMA20 is greater than EMA50, indicating a confirmed uptrend. This suggests increasing investor confidence and upward momentum.

Support and Resistance

By analyzing the historical closing prices, we identify the following support and resistance zones:

| Zone | Price Range |

|---|---|

| Support Zone 1 | 125.00 - 128.00 |

| Support Zone 2 | 120.00 - 122.50 |

| Resistance Zone 1 | 132.00 - 135.00 |

| Resistance Zone 2 | 137.00 - 140.00 |

The current price is within the resistance zone 1, suggesting pressure against further upward movement unless a breakout occurs.

This technical pattern indicates potential profit-taking at current levels or a strong move if the resistance is surpassed.

Conclusion

The recent uptrend in HIG signifies a positive sentiment around The Hartford Financial Services Group, Inc., likely driven by strategic business developments. Investors are currently evaluating resistance levels to determine the stock’s next direction, with potential for a breakout indicating further gains. However, should the resistance hold, a pullback to previous support levels is possible. Overall, the stock presents opportunities for growth, backed by resilience in operational execution and market position.