November 24, 2025 a 06:44 am

HIG: Fibonacci Analysis - The Hartford Financial Services Group, Inc.

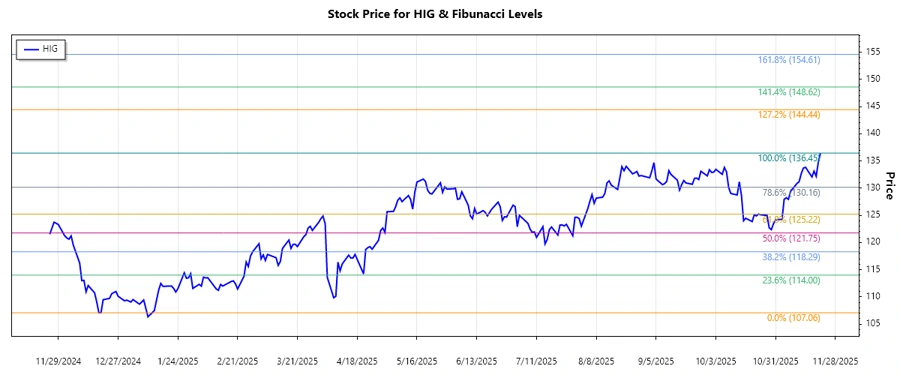

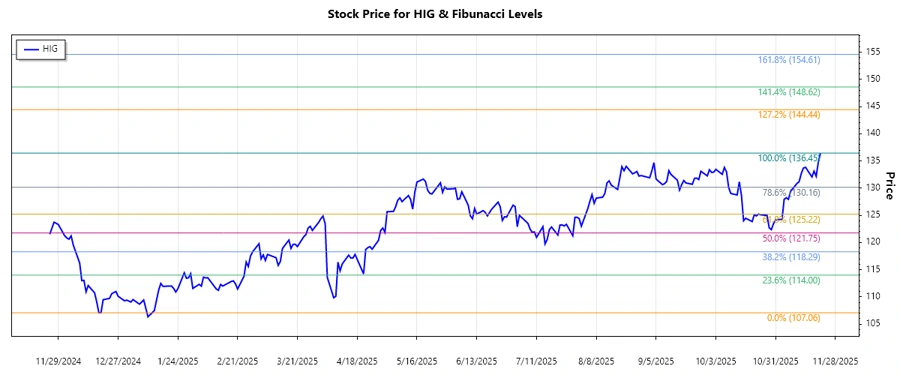

The Hartford Financial Services Group, Inc. (HIG) has demonstrated a robust upward trend over the past several months. With diverse insurance and financial services offerings, the company's stock performance is influenced by its ability to capitalize on market demands both domestically and internationally. As of the latest data, HIG's stock has been steadily rising, reflecting investor confidence in its growth trajectory. This analysis focuses on identifying critical price levels using Fibonacci Retracement to offer insights into potential future movements.

Fibonacci Analysis

| Detail | Information |

|---|---|

| Trend Start Date | 2024-11-25 |

| Trend End Date | 2025-11-21 |

| High Point | 136.45 on 2025-11-21 |

| Low Point | 107.06 on 2024-12-17 |

Fibonacci Retracement Levels

| Level | Price |

|---|---|

| 0.236 | 117.71 |

| 0.382 | 122.34 |

| 0.5 | 121.76 |

| 0.618 | 126.44 |

| 0.786 | 131.81 |

The current stock price is in the 0.786 retracement zone, suggesting a crucial resistance level that if broken, may lead to further bullish momentum. Technically, the price persistently residing above the 0.618 level indicates solid support, pointing towards sustained investor confidence.

Conclusion

The Hartford Financial Services Group, Inc. exhibits a clear upward trend, buoyed by a sound financial strategy and robust market presence. The current Fibonacci Retracement analysis underscores potential resistance at the 0.786 level, offering both challenge and opportunity. If HIG manages to break through, bullish investors might see an upswing, contingent on broader market conditions also aligning favorably. Conversely, failure to breach could instigate profit-taking, stabilizing prices temporarily. Continued monitoring is advisable for adjustment of positions based on emerging data points.