February 02, 2026 a 08:38 am

GS: Analysts Ratings - The Goldman Sachs Group, Inc.

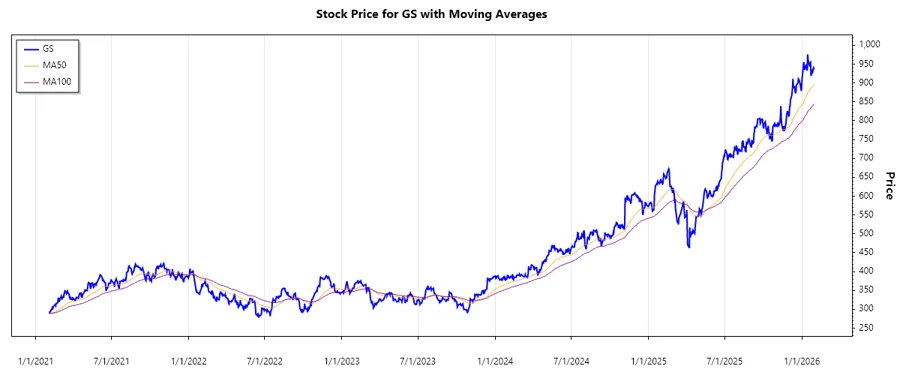

The Goldman Sachs Group, Inc. has been a notable player in the financial sector, providing a diverse range of services to corporations, institutions, and governments. While recent analyst ratings suggest a conservative market stance with a prevalence of Hold recommendations, some indicators point to potential opportunities for investors seeking stable, long-term growth. However, the market sentiment reflects a cautious approach, hinting at underlying uncertainties or market conditions influencing these perspectives.

Historical Stock Grades

| Rating | Count | Score |

|---|---|---|

| Strong Buy | 1 | |

| Buy | 7 | |

| Hold | 16 | |

| Sell | 1 | |

| Strong Sell | 1 |

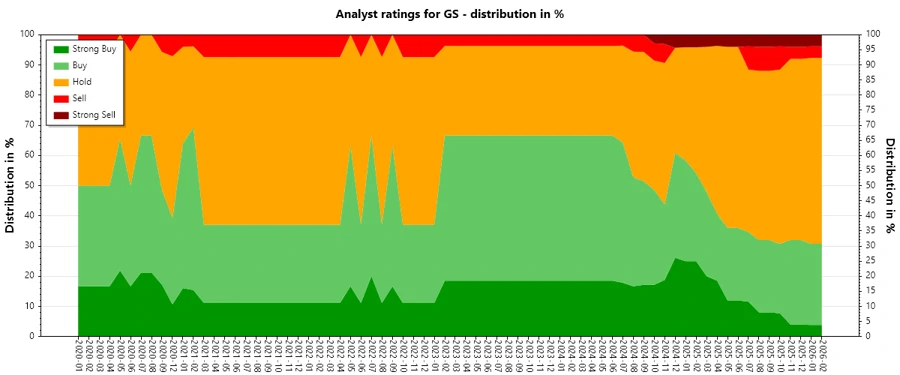

Sentiment Development

Over recent months, there has been a noticeable shift in sentiment regarding Goldman Sachs Group, Inc. While Strong Buy ratings have decreased, Hold ratings have steadily increased, suggesting a more cautious market outlook. The total number of ratings has shown an intriguing consistency or minor fluctuations, indicating that analysts are carefully weighing the company's prospects against current market challenges. Overall:

- Decrease in Strong Buy ratings over the last year.

- Increase in Hold ratings, reflecting growing caution.

- Stable presence of Buy recommendations, maintaining investor interest.

Percentage Trends

The balance between different recommendation categories has experienced notable changes, particularly with a shift from Strong Buy to Hold recommendations. This trend highlights investors' increased caution amid broader market elements. The following points summarize the percentage changes:

- Strong Buy ratings decreased from 16% to 3% in the past year.

- Hold ratings increased significantly from 35% to 68%.

- Buy ratings maintain a constant presence, reflecting persistent investor interest.

- Sell and Strong Sell ratings have remained relatively low and unchanged.

Latest Analyst Recommendations

The latest recommendations for Goldman Sachs reflect a period of stability with a consensus toward maintaining current outlooks. Most analysts opted to maintain their assessments, underscoring a potentially balanced risk-reward scenario within the sector.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2026-01-20 | Sector Perform | Sector Perform | RBC Capital |

| 2026-01-16 | Market Perform | Market Perform | Keefe, Bruyette & Woods |

| 2026-01-16 | Overweight | Overweight | Wells Fargo |

| 2026-01-08 | Neutral | Neutral | JP Morgan |

| 2026-01-05 | Overweight | Overweight | Barclays |

Analyst Recommendations with Change of Opinion

Recent changes in analyst opinions reveal significant shifts in outlook for Goldman Sachs. Such updates can serve as indicators for underlying market dynamics and potential foresight into the company's strategic adjustments. Observations include:

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-10-21 | Neutral | Overweight | JP Morgan |

| 2025-10-17 | Hold | Sell | Freedom Capital Markets |

| 2025-07-14 | Market Perform | Market Outperform | JMP Securities |

| 2025-07-08 | Reduce | Hold | HSBC |

| 2025-03-19 | Perform | Outperform | Oppenheimer |

Interpretation

The overall sentiment toward Goldman Sachs suggests a mixed yet cautious analyst stance. While confidence in the company's potential remains, as evidenced by maintained recommendations, there's a visible shift toward more balanced or cautious outlooks. This transition may indicate an increased awareness of potential market headwinds or strategic realignments by the company. Notably, the consistency of Hold recommendations underlies a stable yet cautious investor approach, suggesting a balanced view that considers both risk and opportunity.

Conclusion

The analysis of Goldman Sachs Group, Inc. reveals a company navigating through evolving market expectations with cautionary optimism. Although the prevailing sentiment leans toward hold and buy recommendations, indicating stable investor confidence, the reduction in Strong Buy ratings reflects broader market concerns or potential industry-specific challenges. The company's diversified business segments present opportunities for long-term growth, albeit with cautious acknowledgment of market volatility. Consequently, while Goldman Sachs maintains its position as a key financial player, investors should remain attentive to market conditions and strategic company decisions that could influence future performance.