November 03, 2025 a 08:38 am

GNRC: Analysts Ratings - Generac Holdings Inc.

Generac Holdings Inc. has been a significant player in the power generation solutions market, demonstrating resilience in various market conditions. The company's diverse product portfolio, aimed at the residential, light commercial, and industrial sectors, underscores its strategic positioning. Recent analyst ratings suggest a generally positive outlook, with most analysts maintaining their optimism about Generac's strategic capabilities and market positioning.

Historical Stock Grades

The latest analyst ratings for Generac Holdings (GNRC) on November 1, 2025, show a cautious optimism among market analysts. Out of the total recommendations, there is 1 Strong Buy, 10 Buy, 10 Hold, 0 Sell, and 0 Strong Sell. This indicates a notable level of confidence in the stock's potential, with a balance leaning towards moderate endorsement.

| Rating | Number of Recommendations | Score |

|---|---|---|

| Strong Buy | 1 | |

| Buy | 10 | |

| Hold | 10 | |

| Sell | 0 | |

| Strong Sell | 0 |

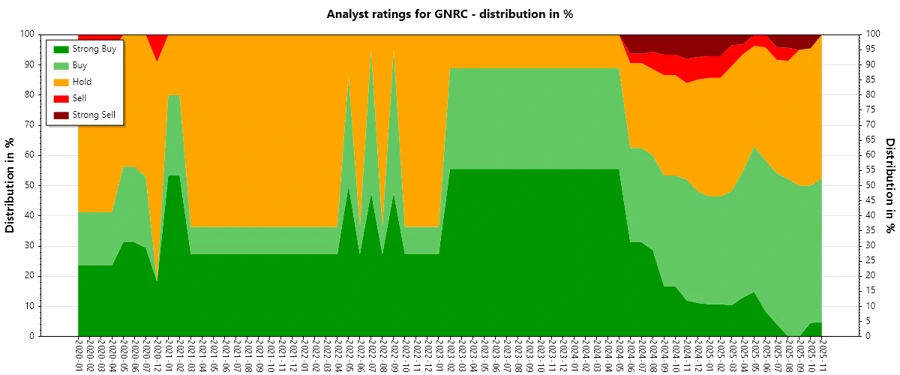

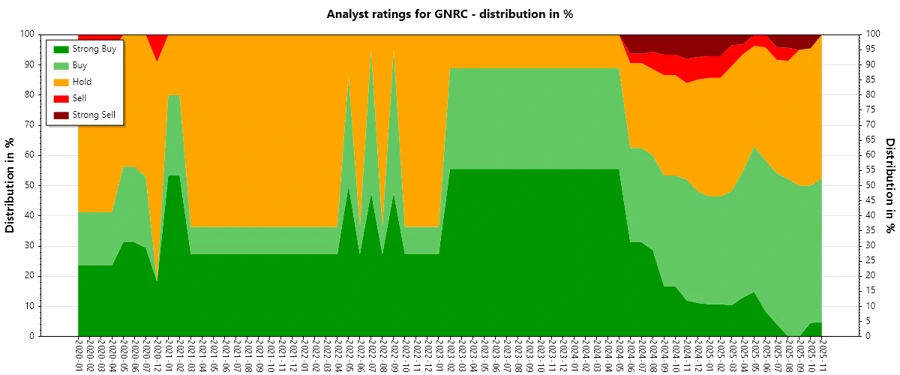

Sentiment Development

Over the recent months, the sentiment towards Generac Holdings has shown a steady composition with a slight downturn in Strong Buy recommendations, yet maintaining a solid Buy and Hold stance. The trend shows only a slight decrease in the total number of strong endorsements, indicating a shift towards more conservative evaluations.

- Decrease in Strong Buy from 2 to 1 recommendations.

- Stable number of Buy and Hold recommendations, signifying steady confidence.

- Complete absence of Sell and Strong Sell indicates minimal negative sentiment.

Percentage Trends

The transition in percentage trends over the months reflects a subtle shift from aggressive buying to a more reserved stance. The percentage of Strong Buy has decreased, while the proportion of Hold ratings has risen, suggesting a more cautious approach by analysts.

- Percentage of Strong Buy decreased from 13% to 5% over the year.

- Hold ratings makeup 50% of the total recommendations, echoing prudence.

- Over the past year, there has been increasing analyst caution, moving from aggressive support to a more balanced position.

Latest Analyst Recommendations

Recent analyst recommendations continue to support a stable outlook for Generac Holdings, with many maintaining their previous ratings. This consistency suggests ongoing confidence in the company's market positioning and long-term potential.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-10-31 | Equal Weight | Equal Weight | Barclays |

| 2025-10-30 | Buy | Buy | Canaccord Genuity |

| 2025-10-30 | Buy | Buy | UBS |

| 2025-10-21 | Neutral | Neutral | Citigroup |

| 2025-10-16 | Neutral | Neutral | JP Morgan |

Analyst Recommendations with Change of Opinion

The following ratings reflect the recent shifts in analyst perceptions with some downgrades but predominantly with upgrades, signaling emerging confidence in Generac Holdings’ future prospects.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-08-26 | Neutral | Buy | Citigroup |

| 2025-08-11 | Hold | Underperform | Jefferies |

| 2025-08-11 | Overweight | Neutral | JP Morgan |

| 2025-07-29 | Buy | Neutral | Guggenheim |

| 2025-04-17 | Buy | Neutral | Citigroup |

Interpretation

The recent analyst recommendations for Generac Holdings suggest moderate optimism balanced by caution. Shifts from Strong Buy to Buy and Hold, alongside the complete lack of Sell recommendations, hint at an underlying confidence bolstered by strategic company maneuvers. The mixed upgrades and downgrades highlight a dynamic sentiment, pointing towards a stable but vigilant outlook among analysts.

Conclusion

Generac Holdings Inc. presents a promising prospect, bolstered by its strong market position and diversified product portfolio. The cautious yet positive sentiment surrounding its stock, reflected in the stable analyst ratings, underscores confidence in its long-term potential. Analysts have shown a notable consistency in their commitment to the stock, suggesting stable growth prospects tempered by strategic vigilance. As the company navigates potential market challenges, increased attention to market dynamics will be crucial for maintaining investor trust and enhancing stock performance.