February 06, 2026 a 11:31 am

GL: Dividend Analysis - Globe Life Inc.

Globe Life Inc. (GL) presents a unique dividend profile with a long-standing history of payments. Despite a relatively low dividend yield, the consistent growth over decades and substantial capital allocation towards dividends exhibits a commitment to rewarding shareholders.

📊 Overview

Globe Life Inc. operates within the insurance sector, which is typically known for stability and predictable cash flows. The company offers a modest dividend yield of 0.77%, reflecting a strategic retention of earnings for growth while maintaining a 40-year dividend history without cuts.

| Detail | Value |

|---|---|

| Sector | Insurance |

| Dividend yield | 0.77 % |

| Current dividend per share | 0 USD |

| Dividend history | 40 years |

| Last cut or suspension | None |

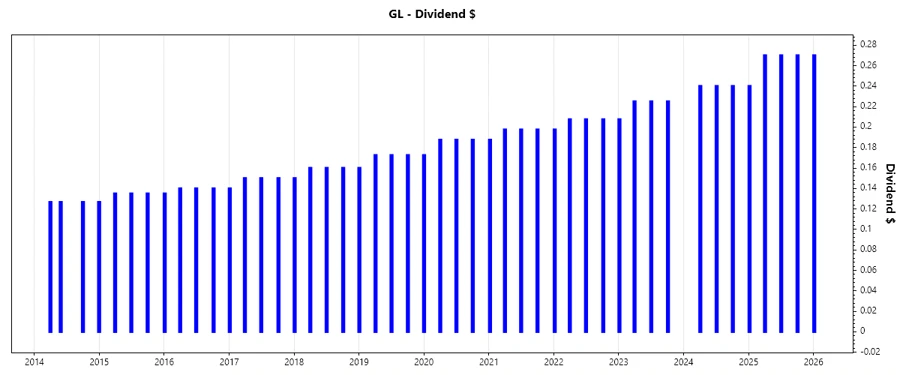

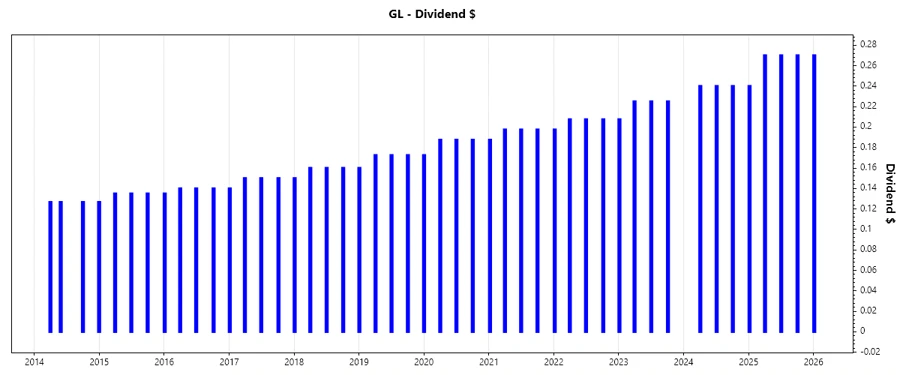

🗣️ Dividend History

The dividend history is critical when assessing the reliability of future payments. Consistency over 40 years is illustrative of the company's disciplined approach to shareholder returns.

| Year | Dividend per share (USD) |

|---|---|

| 2026 | 0.27 |

| 2025 | 1.05 |

| 2024 | 0.72 |

| 2023 | 0.8825 |

| 2022 | 0.8200 |

📈 Dividend Growth

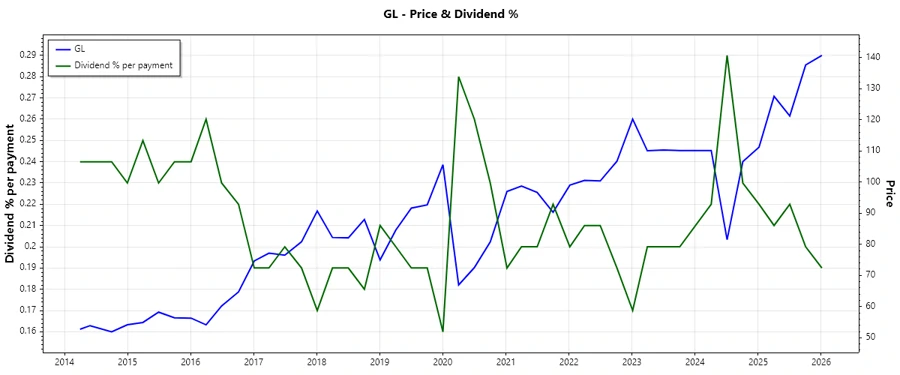

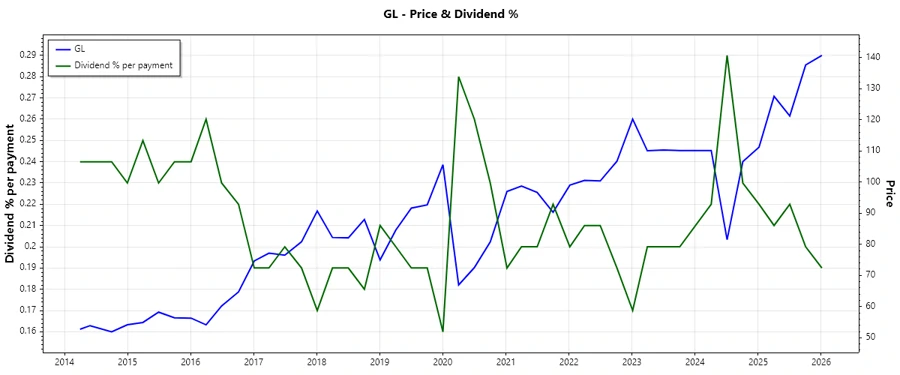

Dividend growth rates are a strong indicator of future earning power and the company's ability to increase shareholder returns. Globe Life's dividend growth of 8.59% over 3 years and 7.39% over 5 years indicates a steady upward trend.

| Time | Growth |

|---|---|

| 3 years | 8.59 % |

| 5 years | 7.39 % |

The average dividend growth is 7.39 % over 5 years. This shows moderate but steady dividend growth.

✅ Payout Ratio

The payout ratio, a measure of earnings paid as dividends, is crucial to assess sustainability. GL maintains a conservative payout structure with minimal payout ratios indicating substantial room for maintaining or increasing dividends even during profit fluctuations.

| Key figure | Ratio |

|---|---|

| EPS-based | 0 % |

| Free cash flow-based | 0 % |

The payout ratios suggest that Globe Life is highly conservative with its earnings distribution strategy, preserving significant capital to maintain financial health.

💰 Cashflow & Capital Efficiency

Understanding cash flow efficiency measures is critical for assessing the company's operational effectiveness. Globe Life demonstrates strong cash generation capabilities and prudent capital spending.

| Measure | 2023 | 2024 | 2025 |

|---|---|---|---|

| Free Cash Flow Yield | 12.38 % | 14.22 % | - |

| Earnings Yield | 8.39 % | 11.44 % | - |

| CAPEX to Operating Cash Flow | 3.34 % | 5.07 % | - |

| Stock-based Compensation to Revenue | 0 % | 0 % | - |

| Free Cash Flow / Operating Cash Flow Ratio | 96.66 % | 94.93 % | - |

The cash flow stability shows that Globe Life manages its capital efficiently, ensuring continued investment capacity and shareholder returns.

📉 Balance Sheet & Leverage Analysis

Analyzing the balance sheet provides insights into the company's financial health and debt management capabilities. Globe Life maintains robust leverage ratios, implying effective debt utilization relative to equity.

| Measure | 2023 | 2024 | 2025 |

|---|---|---|---|

| Debt-to-Equity | 47.15 % | 51.64 % | - |

| Debt-to-Assets | 7.54 % | 9.42 % | - |

| Debt-to-Capital | 32.04 % | 34.05 % | - |

| Net Debt to EBITDA | 1.55 | 1.77 | - |

| Current Ratio | 0 | 79.71 % | - |

| Quick Ratio | 79.92 % | 79.71 % | - |

| Financial Leverage | 625.20 % | 548.04 % | - |

Globe Life exhibits a strong financial structure, with leverage aligned optimally for strategic growth, balancing debt and equity effectively.

🗣️ Fundamental Strength & Profitability

Profitability metrics reflect operational success and overall financial strength. Globe Life maintains healthy return ratios, indicating strong management and market positioning.

| Measure | 2023 | 2024 | 2025 |

|---|---|---|---|

| Return on Equity | 21.64 % | 20.18 % | - |

| Return on Assets | 3.46 % | 3.68 % | - |

| Margins: Net | 17.82 % | 18.53 % | - |

| Margins: EBIT | 23.80 % | 25.16 % | - |

| Margins: EBITDA | 23.80 % | 25.16 % | - |

| Margins: Gross | 30.11 % | 32.37 % | - |

| Research & Development to Revenue | 0 % | 0 % | - |

These metrics highlight Globe Life's efficiency in generating returns on investment, underscoring their competitive advantage in the insurance industry.

Price Development

🏆 Dividend Scoring System

Our bespoke scoring system evaluates Globe Life's dividend-paying ability across several metrics:

| Criterion | Score | Score Bar |

|---|---|---|

| Dividend yield | 2 | |

| Dividend Stability | 5 | |

| Dividend growth | 4 | |

| Payout ratio | 3 | |

| Financial stability | 4 | |

| Dividend continuity | 5 | |

| Cashflow Coverage | 4 | |

| Balance Sheet Quality | 3 |

Overall Score: 30/40

🔍 Rating

Globe Life Inc. is recommended as a stable investment for income-focused portfolios given its unabated dividend history and financial robustness. However, potential investors should view its present modest yield in context of strategic growth potential and prudent financial management.