November 07, 2025 a 03:15 am

GIS: Trend and Support & Resistance Analysis - General Mills, Inc.

General Mills, Inc., a multinational company with a diverse product range, has shown market fluctuations typical of large consumer goods companies. With operations in numerous regions, it strives for resilience amidst changing market dynamics. This analysis provides insight into its recent trends and potential market positions.

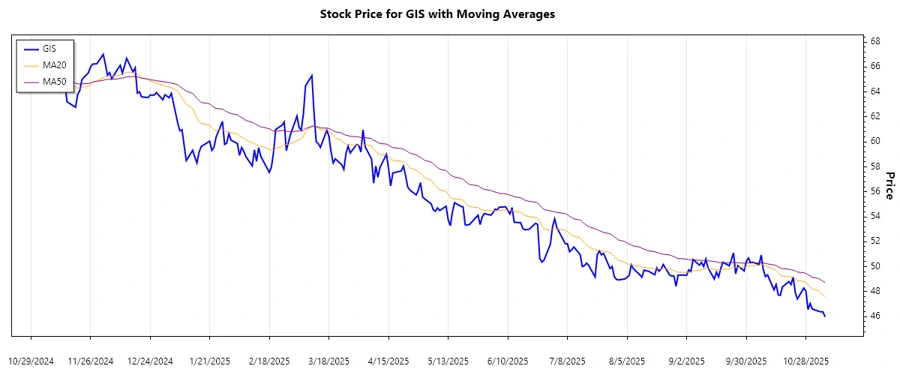

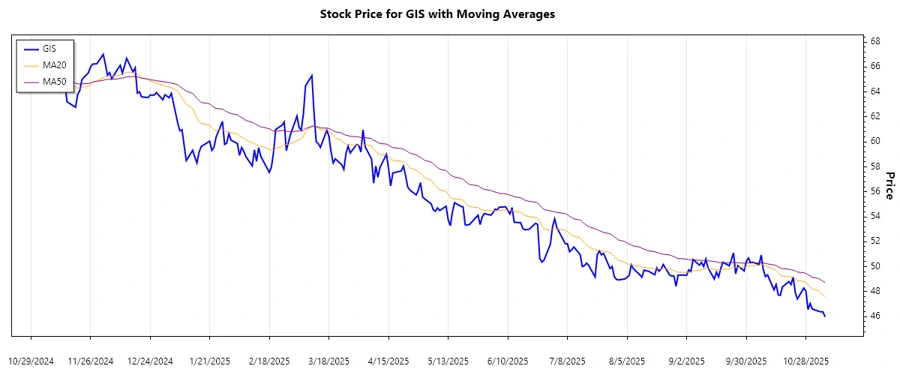

Trend Analysis

The analysis of General Mills, Inc.'s stock price movements reveals a mixed trend pattern over the recent months. Calculations of EMA20 and EMA50 are crucial to understanding the underlying momentum. These exponential moving averages act as dynamic indicators of the trend.

| Date | Closing Price | Trend |

|---|---|---|

| 2025-11-06 | 45.98 | ▼ Abwärtstrend |

| 2025-11-05 | 46.39 | ▼ Abwärtstrend |

| 2025-11-04 | 46.38 | ▼ Abwärtstrend |

| 2025-11-03 | 46.43 | ▲ Aufwärtstrend |

| 2025-10-31 | 46.61 | ⚖️ Seitwärtstrend |

| 2025-10-30 | 47.05 | ▲ Aufwärtstrend |

| 2025-10-29 | 46.57 | ▼ Abwärtstrend |

The recent data reveals a predominance of downward trends with intermittent upward corrections. The significant presence of red indicators suggests a prevailing selling momentum, which may require strategic adjustments for stakeholders.

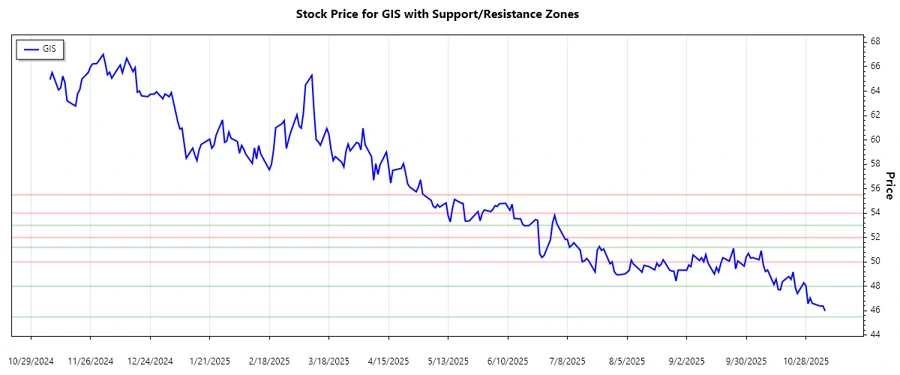

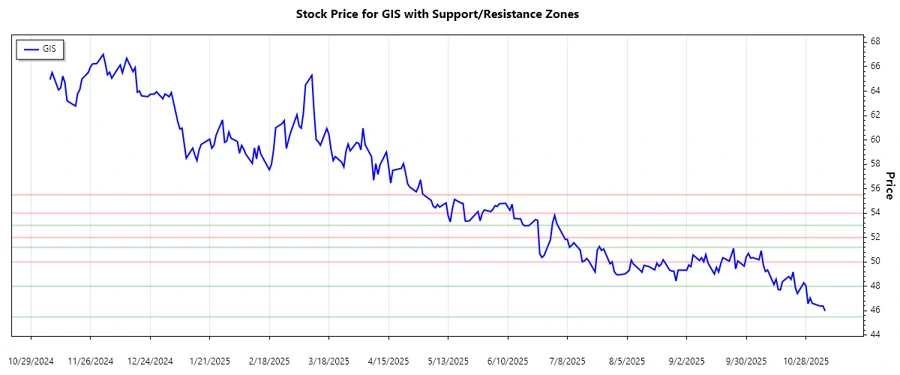

Support- and Resistance

Identifying support and resistance zones is essential for predicting future price movements. These zones reflect psychological levels where traders exhibit strong buying or selling interest.

| Zone Type | From | To |

|---|---|---|

| Support Zone 1 | 48.00 | 45.50 |

| Support Zone 2 | 53.00 | 51.20 |

| Resistance Zone 1 | 50.00 | 52.00 |

| Resistance Zone 2 | 54.00 | 55.50 |

The current price is hovering near the lower support zone, which could act as a springboard for potential upside movements. Conversely, if the support fails, it may lead to further declines. Understanding these zones aids informed decision-making for investors.

Conclusion

General Mills, Inc. is navigating a challenging period characterized by a dominant downtrend. The presence of significant support levels nearby leaves room for potential recovery, but caution is advised given the prevailing downward momentum. Investors should keep a keen eye on key support and resistance zones to devise strategic entries and exits. The broader market dynamics, along with the company's performance in various sectors, will be instrumental in determining its near-term trajectory. Despite current challenges, the company's diverse product portfolio may provide resilience in the long term.