September 22, 2025 a 08:39 am

GIS: Analysts Ratings - General Mills, Inc.

General Mills, Inc. (GIS) represents a steadfast entity within the consumer foods sector, yielding a diverse product portfolio ranging from cereals to pet foods. Recent analytical observations reveal a nuanced landscape where the majority lean towards "Hold" ratings, perhaps indicative of prevailing uncertainties or cautious market sentiment. GIS's extensive presence across global markets and its heritage as a longstanding brand continue to bolster its market standing amidst fluctuating economic conditions.

Historical Stock Grades

| Recommendation | Number | Score Bar |

|---|---|---|

| Strong Buy | 3 | |

| Buy | 2 | |

| Hold | 13 | |

| Sell | 2 | |

| Strong Sell | 1 |

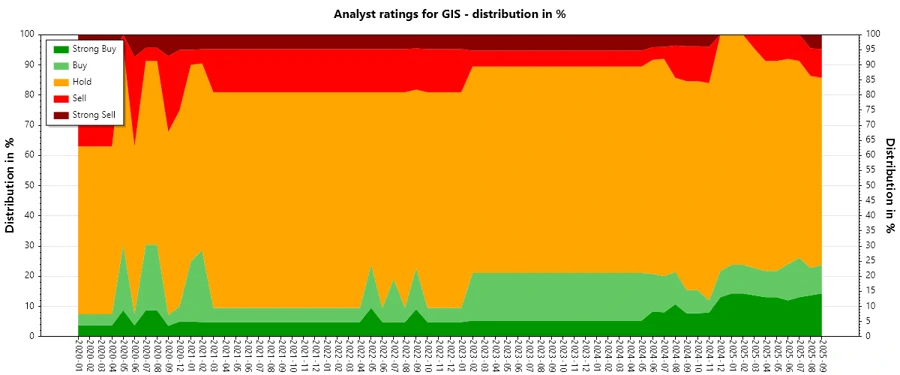

Sentiment Development

A detailed review of the sentiment data indicates an ongoing steadiness in ratings, predominantly skewed towards "Hold". However, notable observations include slight fluctuations in "Buy" and "Strong Buy" recommendations over the months, with a consistent minimal count for "Strong Sell". These insights may signal apprehension among analysts regarding short-term prospects while maintaining a watchful eye on longer-term stability.

- Stable "Hold" recommendations indicating a cautious sentiment.

- Minor fluctuations in "Buy" and "Strong Buy" ratings.

- Consistently low "Strong Sell" suggests limited negative outlooks.

Percentage Trends

The percentage analysis highlights a noticeable lean towards "Hold" over the past months. The reduction in "Strong Buy" percentages and corresponding increases in "Hold" proportions suggest a conservative stance by analysts. This shift underscores the cautious enthusiasm surrounding GIS, likely attributed to market dynamics and economic factors.

- Gradual increase in "Hold" ratings from May to September 2025.

- Sharp decline in "Buy" ratings from previous months, indicating cautious optimism.

- Stable low percentages for "Strong Sell" indicating relative confidence.

Latest Analyst Recommendations

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-09-19 | Equal Weight | Equal Weight | Barclays |

| 2025-09-19 | Neutral | Neutral | Mizuho |

| 2025-09-18 | Sell | Sell | UBS |

| 2025-09-15 | Underweight | Underweight | Morgan Stanley |

| 2025-08-20 | Underweight | Neutral | JP Morgan |

Analyst Recommendations with Change of Opinion

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-08-20 | Underweight | Neutral | JP Morgan |

| 2025-06-26 | Outperform | Sector Perform | RBC Capital |

| 2025-06-09 | Neutral | Buy | Goldman Sachs |

| 2024-12-13 | Buy | Neutral | B of A Securities |

| 2024-07-16 | Hold | Buy | Argus Research |

Interpretation

The analysts' recommendations illustrate cautious sentiments surrounding GIS, largely revolving around maintaining current ratings rather than opting for upgrades. A discernible trend of neutrality or slight conservatism underscores potential market concerns. Although the prevalent consensus remains around "Hold", the consistency and minimal volatility in ratings infer stable, albeit guarded, confidence in the company's market performance. As analysts contemplate external economic conditions and internal company dynamics, their perspectives emphasize stability over significant shifts in opinion.

Conclusion

General Mills' market outlook reflects a balanced yet cautious sentiment among analysts. The predominant "Hold" ratings underline uncertainty intertwined with confidence in its enduring market presence. While limited recommendations suggest potential for growth, systemic factors may weigh on more aggressive bullish sentiments. The overarching perception indicates a need for vigilance as General Mills navigates both industry challenges and market opportunities, emphasizing sustainability in its strategic endeavors.