November 05, 2025 a 08:38 pm

GILD: Analysts Ratings - Gilead Sciences, Inc.

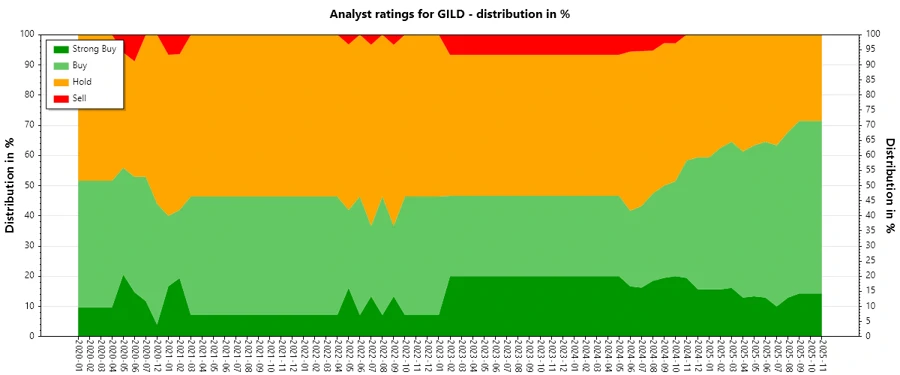

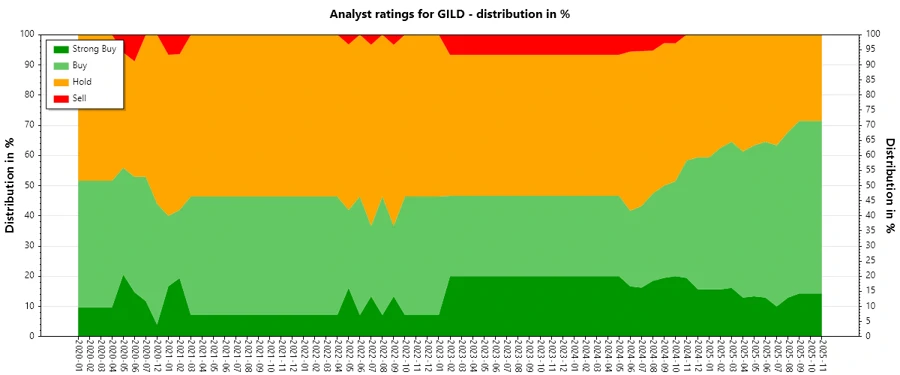

Gilead Sciences, Inc., a prominent biopharmaceutical entity, showcases a robust portfolio in areas of high unmet medical need. Analyst sentiment indicates a prevailing market confidence, with a significant number of Buy and Strong Buy recommendations. While the sentiment has remained stable over recent months, the weight of Hold ratings suggests a degree of caution among stakeholders.

Historical Stock Grades

The latest analyst ratings for Gilead Sciences as of November 2025 indicate a strong market stance with a considerable inclination toward Buy recommendations. The chart below depicts the composition of recommendations.

| Rating Type | Number | Visual |

|---|---|---|

| Strong Buy | 4 | |

| Buy | 16 | |

| Hold | 8 | |

| Sell | 0 | |

| Strong Sell | 0 |

Analyst ratings history reveals a consistent Buy trend over a period of months.

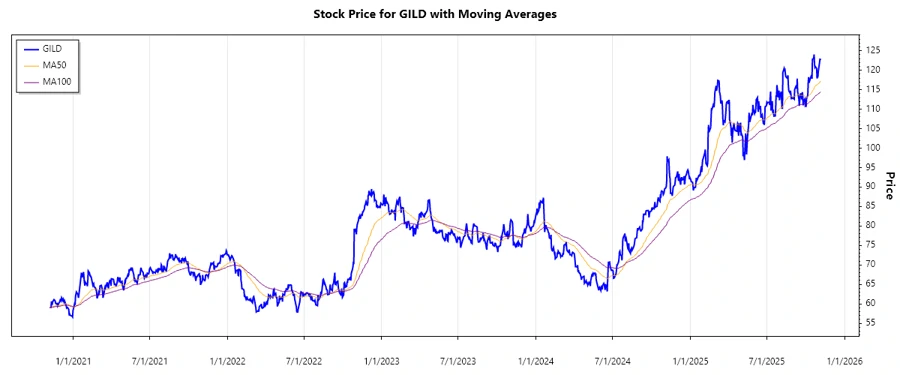

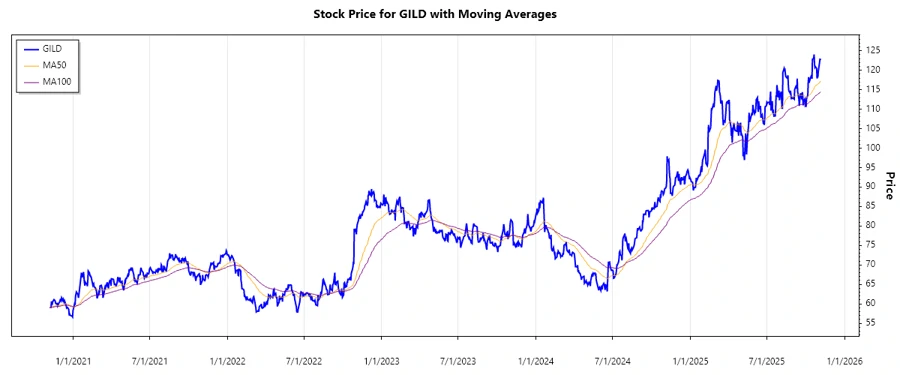

Current stock chart for Gilead Sciences illustrates recent market activity.

Sentiment Development

Over the past year, there has been a gradual increase in Buy ratings, with Strong Buy and Hold recommendations showing relative stability. Notably, there have been no Sell or Strong Sell recommendations in recent periods, indicating continued confidence in the stock.

- The total number of recommendations peaked and remained stable around 28 to 30 in recent months.

- Strong Buy ratings declined slightly while maintaining a firm standing.

Percentage Trends

The analysis of percentage trends highlights a stable market sentiment, with Buy ratings gaining a dominant share. This shift has further established a cautious optimism towards Gilead’s stock.

- Strong Buy recommendations decreased by approximately 10% over the year, reflecting a more reserved outlook.

- Buy recommendations have strengthened, covering a larger percentage of the total ratings.

- Hold recommendations occupy a consistent 28-30%, indicating measured market expectations.

Latest Analyst Recommendations

Recent updates from analysts present a sustained bullish outlook with consistent Buy recommendations maintained across major financial institutions.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-11-03 | Buy | Buy | Truist Securities |

| 2025-10-31 | Overweight | Overweight | Wells Fargo |

| 2025-10-31 | Buy | Buy | Needham |

| 2025-10-31 | Sector Perform | Sector Perform | RBC Capital |

| 2025-10-31 | Overweight | Overweight | Cantor Fitzgerald |

Analyst Recommendations with Change of Opinion

Changes in analyst opinion over the past months illustrate a positive shift, with upgrades seen from several noteworthy firms. This movement points towards a growing belief in Gilead's potential.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-08-08 | Buy | Hold | Truist Securities |

| 2025-07-25 | Buy | Hold | Needham |

| 2025-02-18 | Buy | Hold | Deutsche Bank |

| 2025-01-10 | Overweight | Equal Weight | Morgan Stanley |

| 2024-11-08 | Hold | Buy | Maxim Group |

Interpretation

Current trends in analyst recommendations suggest a prevailing confidence in Gilead Sciences' market standing. The significant volume of Buy and Strong Buy ratings is indicative of optimistic forecasts. While there is a noticeable stability in analyst sentiment, the consistent promotion to Buy or equivalent endorsements by several firms suggests escalating confidence. However, the persistence of Hold ratings reflects a cautious approach to future projections.

Conclusion

The analysis of Gilead Sciences' stock ratings depicts a balanced market perspective combining optimism with prudence. The predominance of Buy ratings advocates for a strong potential, countered by a consistent Hold sentiment articulating cautious optimism. Upcoming macroeconomic conditions and corporate developments are likely to play a crucial role in influencing further sentiment. Short-term volatility, accompanied by mid- to long-term growth prospects, presents a unique opportunity for prospective investors.Continued monitoring of consensus shifts will be paramount in navigating investment strategies.