June 30, 2025 a 08:15 am

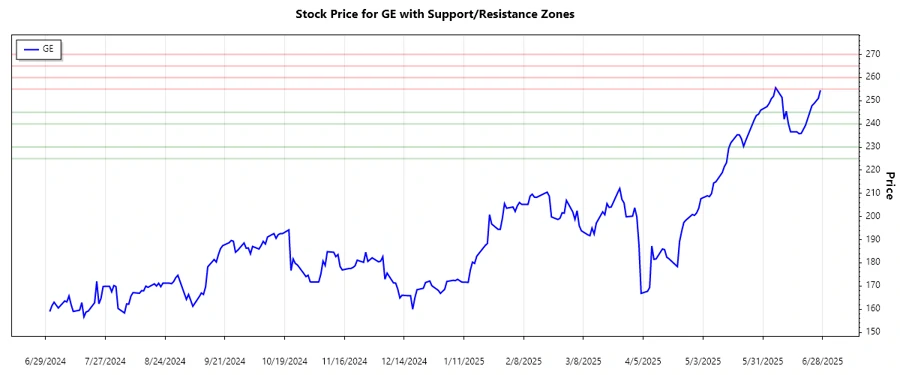

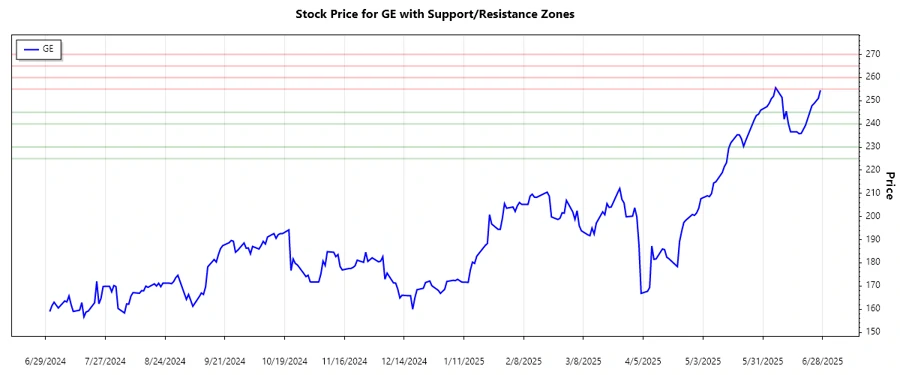

GE: Trend and Support & Resistance Analysis - General Electric Company

General Electric Company (GE) operates in a diverse environment with a focus on aerospace and aviation technologies. The recent price movements of GE stocks show significant volatility, which may be influenced by various macroeconomic factors and company performance metrics. As a major player in the aerospace industry, shifts in defense budgets and global commercial aviation demand can heavily impact its valuation. Investors should be mindful of these dynamics as they consider GE as part of their portfolio.

Trend Analysis

The trend analysis for GE over the given period reveals interesting patterns. To gain insights, we calculate the EMA20 and EMA50 using closing prices:

| Date | Closing Price | Trend |

|---|---|---|

| 2025-06-27 | 254.51 | ▲ Uptrend |

| 2025-06-26 | 251.00 | ▲ Uptrend |

| 2025-06-25 | 249.90 | ▲ Uptrend |

| 2025-06-24 | 248.75 | ▲ Uptrend |

| 2025-06-23 | 247.81 | ▲ Uptrend |

| 2025-06-20 | 239.37 | ▲ Uptrend |

| 2025-06-18 | 235.89 | ▲ Uptrend |

The EMAs indicate that the stock is experiencing an uptrend. This trend is characterized by a consistent rise in prices over the last week, suggesting market optimism.

Support and Resistance

Support and resistance zones have been identified based on historical price data:

| Zone | Range |

|---|---|

| Support Zone 1 | ▲ 225.00 - 230.00 |

| Support Zone 2 | ▲ 240.00 - 245.00 |

| Resistance Zone 1 | ▼ 255.00 - 260.00 |

| Resistance Zone 2 | ▼ 265.00 - 270.00 |

The current trading price is nearing resistance levels, indicating potential areas of sell-off unless a breakout occurs. This suggests a need for caution as traders look for confirmation signals.

Conclusion

Based on the technical indicators, GE's stock shows an uptrend momentum, although it is approaching key resistance zones. Market participants need to watch for potential signals of a breakout or reversal as prices near these levels. Economic conditions and sector-specific developments, especially within aerospace, will likely influence future price actions. Overall, GE remains a compelling equity with growth prospects, but investors should stay vigilant to technical corrections which may arise.