December 13, 2025 a 01:15 pm

GEV: Trend and Support & Resistance Analysis - GE Vernova Inc.

GE Vernova Inc., a robust player in the energy sector, shows signs of recovery with recent price movements. While currently experiencing upward momentum, the stock's future trajectory will heavily depend on its ability to maintain and break key support and resistance levels. Its diverse segments in power, wind, and electrification place it in a strong position for long-term growth, but investors should be vigilant for potential volatility common in energy markets.

Trend Analysis

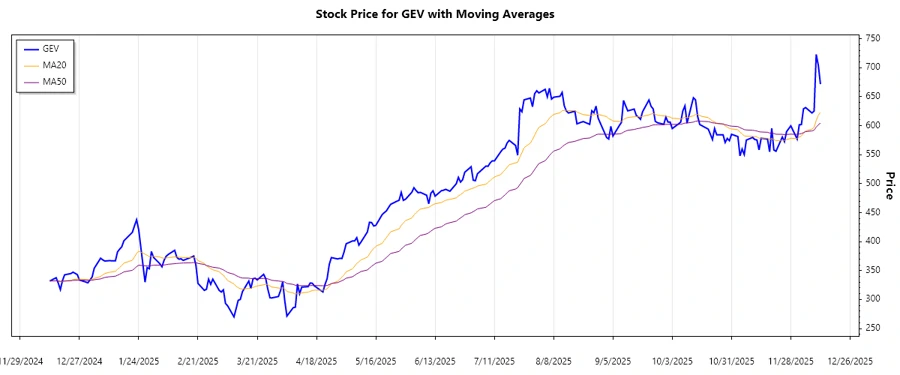

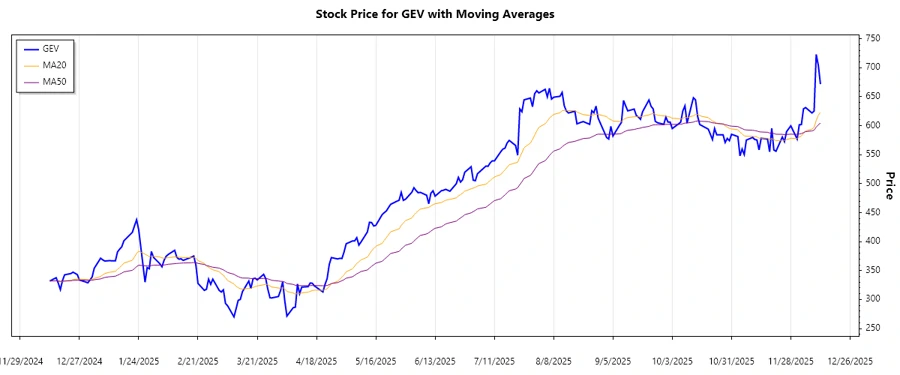

The analysis of the historical closing prices for GE Vernova Inc. indicates a recent upward trend. During the last 20 days, the stock's 20-day EMA has consistently exceeded the 50-day EMA, supporting the bullish outlook. Here's a summary of the last 7 days:

| Date | Closing Price | Trend |

|---|---|---|

| 2025-12-12 | $671.71 | ▲ |

| 2025-12-11 | $704.2 | ▲ |

| 2025-12-10 | $723.00 | ▲ |

| 2025-12-09 | $625.3 | ▲ |

| 2025-12-08 | $621.9 | ▲ |

| 2025-12-05 | $631.32 | ▲ |

| 2025-12-04 | $629.11 | ▲ |

The consistent rise in closing prices further suggests strong market sentiment in favor of GE Vernova's growth.

Support and Resistance

Upon reviewing the data, two critical support zones have been identified: (1) $570 to $590, and (2) $520 to $540. Conversely, resistance zones appear to exist at (1) $720 to $740, and (2) $680 to $700.

| Zone | Price Range |

|---|---|

| Support Zone 1 | ▼ $570 - $590 |

| Support Zone 2 | ▼ $520 - $540 |

| Resistance Zone 1 | ▲ $720 - $740 |

| Resistance Zone 2 | ▲ $680 - $700 |

Currently, the stock is approaching the upper resistance zone, indicating potential for further upward movement contingent on successful breakout.

Conclusion

GE Vernova Inc. demonstrates a promising upward trajectory with robust potential within its segments of power, wind, and electrification. The recent bullish trend aligns with strategic market positioning, yet investors should remain cautious of resistance barriers. Future growth opportunities are substantial, but reliance on energy sector stability poses inherent risks. Analysts should acknowledge GE Vernova's versatile market approach while maintaining a vigilant eye on macroeconomic influences affecting energy pricing and demand.