July 26, 2025 a 04:38 pm

GEHC: Analysts Ratings - GE HealthCare Technologies Inc.

GE HealthCare Technologies Inc. shows a promising outlook within the healthcare sector, driven by innovation in medical imaging, ultrasound, and patient care solutions. Recent analyst sentiments reveal a predominantly positive stance with a majority of buy ratings, indicating confidence in the company's strategic direction and market position.

Historical Stock Grades

Analyst sentiment over the past months suggests stability in positive ratings, with steady numbers in buy recommendations. The lack of sell ratings underscores a strong market conviction in GEHC's business model and growth strategies.

| Recommendation | Count | Score Bar |

|---|---|---|

| Strong Buy | 4 | |

| Buy | 13 | |

| Hold | 5 | |

| Sell | 0 | |

| Strong Sell | 0 |

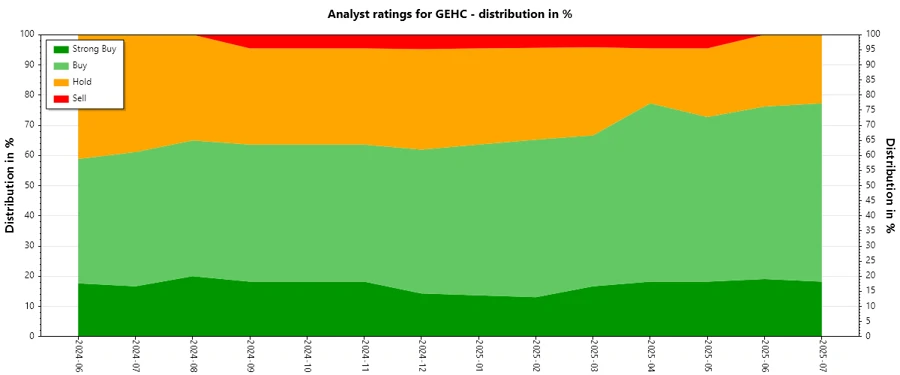

Sentiment Development

Over recent months, the cumulative number of ratings has slightly increased, with a more pronounced tilt towards "Buy". While "Strong Buy" has remained stable, a slight upward shift in "Hold" can be observed. The data indicates growing confidence, with limited fluctuations in stronger sell-side opinions.

- Steady "Strong Buy" over recent months.

- Increment in "Buy" from June to July.

- A subtle increase in "Hold" opinions.

- Consistent absence of negative (Sell/Strong Sell) ratings.

Percentage Trends

Analyst opinions indicate a robust positive sentiment. Over the past months, the distribution shows "Buy" retaining a strong majority. A slightly increasing "Hold" signals cautious optimism, with negligible presence of adverse ratings, suggesting confidence amid broader market signals.

- "Buy" consistently comprises 50% to 60% of ratings.

- The "Strong Buy" category holds a constant 15% to 20% share.

- "Hold" percentages have mildly increased, now around 20% to 25%.

Latest Analyst Recommendations

Recent analyst recommendations exhibit a stable view, with most ratings being maintained. The limited changes indicate confidence in the current valuation and strategic direction of GEHC.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-07-09 | Buy | Buy | Citigroup |

| 2025-05-06 | Equal Weight | Equal Weight | Morgan Stanley |

| 2025-05-05 | Neutral | Sell | UBS |

| 2025-05-01 | Buy | Buy | Goldman Sachs |

| 2025-05-01 | Overweight | Overweight | Wells Fargo |

Analyst Recommendations with Change of Opinion

Analyzing recent changes in recommendations, there are notable upgrades indicating improved market perception of GEHC's potential. Particularly, UBS and Goldman Sachs have reframed their views positively in recent months.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-05-05 | Neutral | Sell | UBS |

| 2025-03-11 | Buy | Neutral | Goldman Sachs |

| 2025-01-08 | Buy | Hold | Jefferies |

| 2024-09-26 | Sell | Neutral | UBS |

| 2024-09-18 | Buy | Neutral | BTIG |

Interpretation

The overall sentiment surrounding GE HealthCare Technologies Inc. is strong, with prevalent buy-side recommendations indicating an optimistic outlook. Minimal sell ratings suggest sustained confidence in the company's strategic direction. Although there is a slight increase in "Hold" ratings, this is typical of a mature company facing evolving market conditions. The stability in analysts' opinions, despite minor fluctuations, highlights a largely consistent confidence in GEHC's growth prospects.

Conclusion

GE HealthCare Technologies Inc. maintains a robust positive sentiment from analysts, backed by a majority of buy ratings and strategic market positioning. While there is a growing trend towards more cautious "Hold" recommendations, the absence of significant sell ratings highlights enduring confidence. The company's consistent performance in the dynamic healthcare technology landscape, coupled with strategic innovations, offers potential growth opportunities. Analysts appear to validate the company's resilience and adaptability, essential for sustained future success in the highly competitive healthcare market.