November 10, 2025 a 04:28 am

GBPUSD: Trend and Support & Resistance Analysis

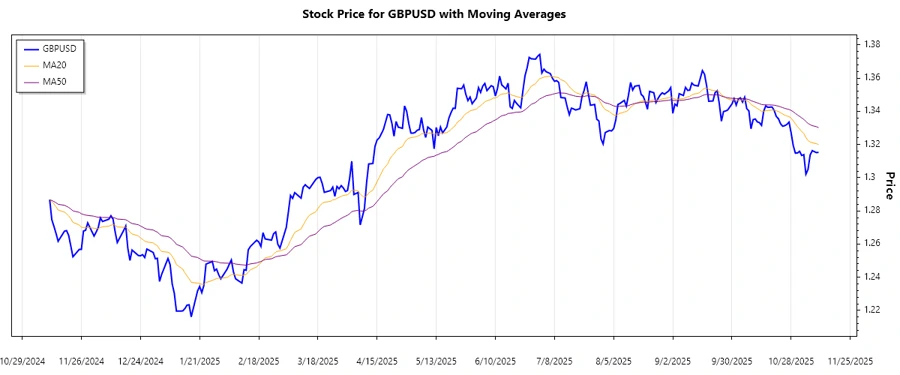

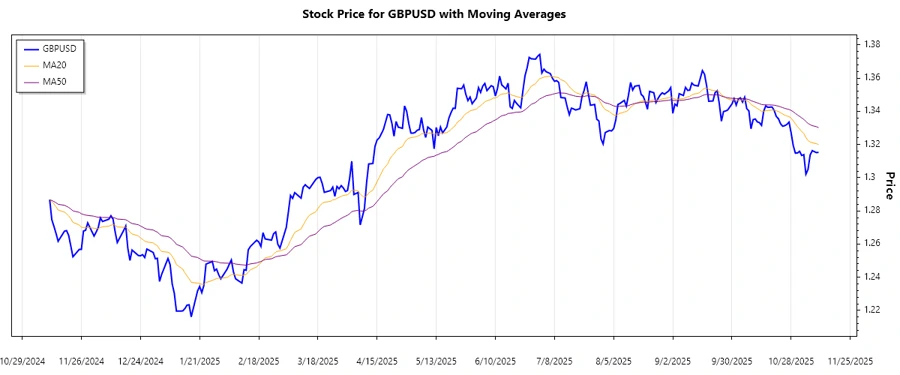

The GBPUSD exchange rate has demonstrated varying trends over the past months. Based on the calculated exponential moving averages, the pair has been in a stabilizing phase recently. Key support and resistance zones have been identified, which are critical for traders to consider when planning their entries and exits.

Trend Analysis

Analyzing GBPUSD's movements, it's clear that the pair has been struggling to maintain a strong directional trend. Calculating the EMAs from the close prices, we have recent evidence of a possible ▲ uptrend, especially when short-term moving averages cross above the longer ones.

| Date | Close Price | Trend |

|---|---|---|

| 2025-11-10 | 1.31529 | ▲ |

| 2025-11-09 | 1.31510 | ▲ |

| 2025-11-07 | 1.31628 | ▼ |

| 2025-11-06 | 1.31364 | ▼ |

| 2025-11-05 | 1.30498 | ▼ |

| 2025-11-04 | 1.30206 | ▼ |

| 2025-11-03 | 1.31390 | ▼ |

The data suggests a short-term recovery within a larger recent downtrend, signaling opportunities to catch quick reversals or breakouts. This can be seen as the market trying to test higher levels.

Support and Resistance

By examining historical price data, two key price zones have emerged for support and resistance:

| Zone | Level (From) | Level (To) |

|---|---|---|

| Support Zone 1 | 1.3020 | 1.3040 |

| Support Zone 2 | 1.2950 | 1.2990 |

| Resistance Zone 1 | 1.3150 | 1.3170 |

| Resistance Zone 2 | 1.3200 | 1.3220 |

The GBPUSD is currently positioned near the Resistance Zone 1, which could either result in a break higher or a consolidation with potential falls back to the support levels.

Today's technical landscape offers USD traders clear levels to strategize entry and exit points, particularly in recognizing and respecting these zones.

Conclusion

The GBPUSD analysis illustrates a crucial juncture as it tests key resistance, potentially leading to notable breakouts or retests of support. A prudent approach could involve watching for confirmation of directional trends, especially as the GBP encounters dynamic economic factors. Traders should remain flexible and ready to adapt to changing market conditions, acknowledging the risks of whipsaws near these pivotal price zones.