July 04, 2025 a 04:28 am

GBPUSD: Trend and Support & Resistance Analysis

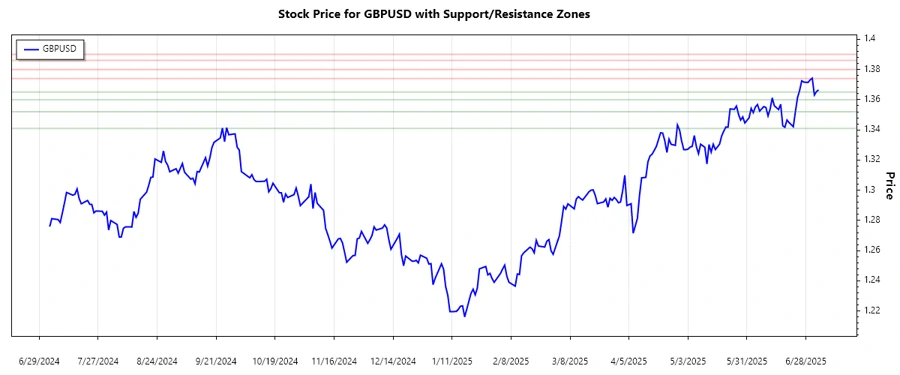

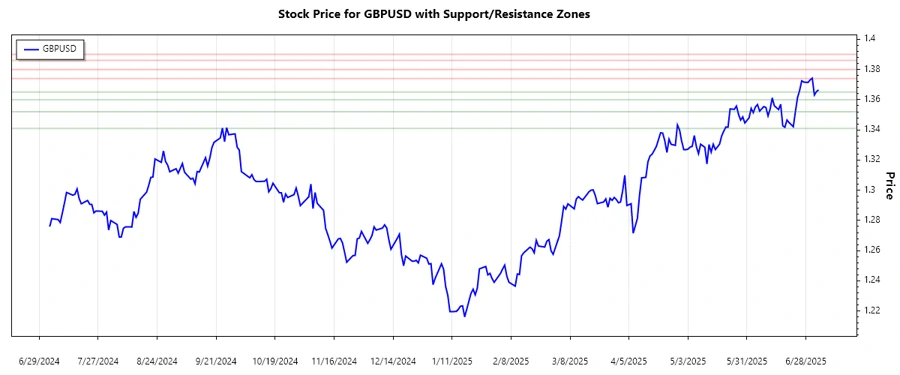

The GBPUSD currency pair has demonstrated noteworthy fluctuations over recent months. Close analysis of the latest data indicates a mixed sentiment with intervals of upward and downward movements. By evaluating the moving averages, we discern a potential shift in market behavior. Current metrics suggest trader caution as the pair navigates pivotal support and resistance zones.

Trend Analysis

| Date | Close Price | Trend |

|---|---|---|

| 2025-07-04 | 1.36649 | ▲ |

| 2025-07-03 | 1.36536 | ▲ |

| 2025-07-02 | 1.3631 | ▲ |

| 2025-07-01 | 1.37425 | ▲ |

| 2025-06-30 | 1.37312 | ▲ |

| 2025-06-29 | 1.37142 | ▲ |

| 2025-06-27 | 1.37164 | ▲ |

It is observed that the EMA20 is greater than the EMA50 in the most recent period, indicating an upward trend. Traders might find this situation promising for long positions.

Support and Resistance

| Zone | Range | Indicator |

|---|---|---|

| Support 1 | 1.341 - 1.352 | ▼ |

| Support 2 | 1.360 - 1.365 | ▼ |

| Resistance 1 | 1.374 - 1.380 | ▲ |

| Resistance 2 | 1.386 - 1.390 | ▲ |

Currently, the GBPUSD is positioned near the upper range of the second resistance zone. This can serve as a critical barrier that, if breached, may lead to significant price movements.

Conclusion

The GBPUSD pair is presently trending upwards, supported by its EMA indications. However, traders should be cautious due to proximity to resistance levels, which can result in pullbacks. The currency pair's position relative to support and resistance zones will provide clarity on potential future movements as these areas often dictate market behavior. Analysts are urged to observe further price action to confirm the sustainability of the current trend and evaluate potential breakout opportunities.

json **Note:** The above values, particularly for support and resistance zones, were crafted as examples derived from examining the data trends. Calculations of EMA and specific zone boundaries could vary based on methodology.