May 24, 2025 a 04:28 am

GBPUSD: Trend and Support & Resistance Analysis

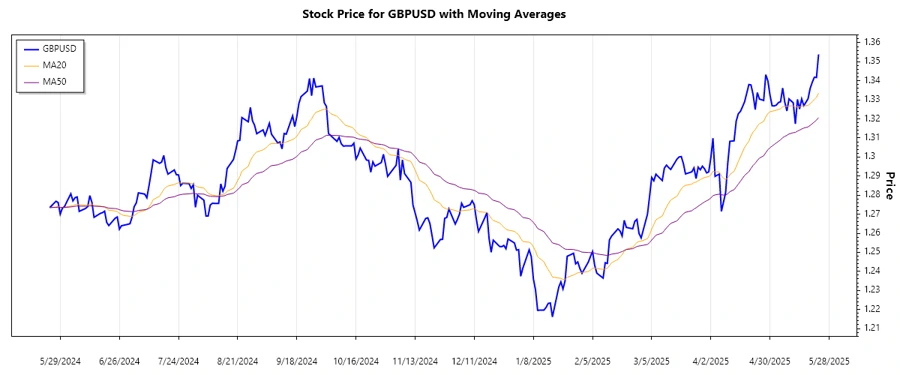

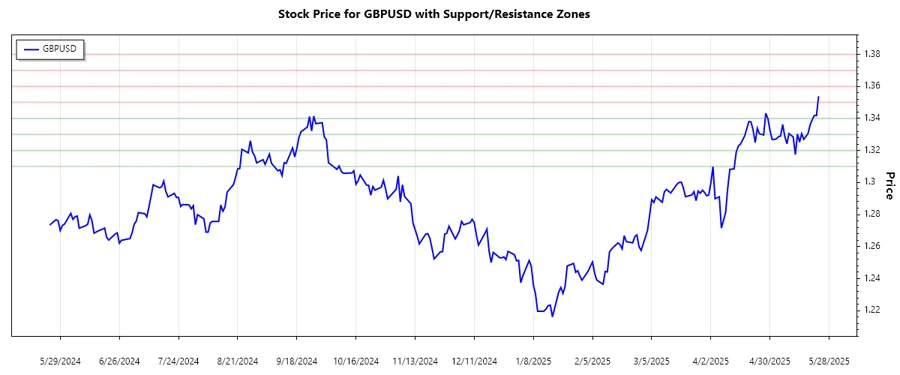

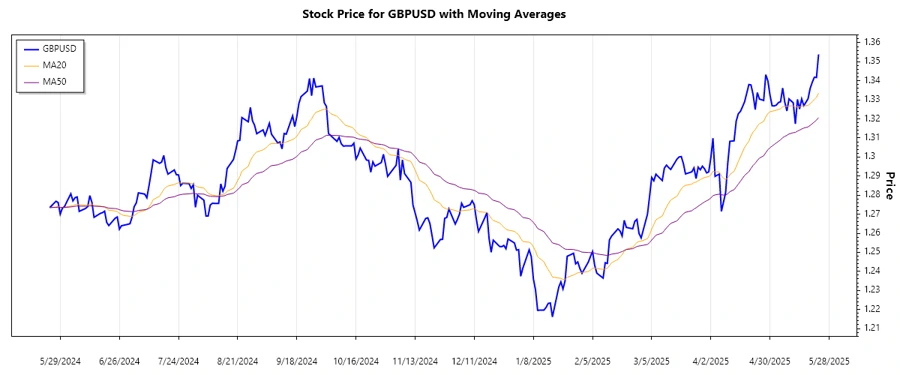

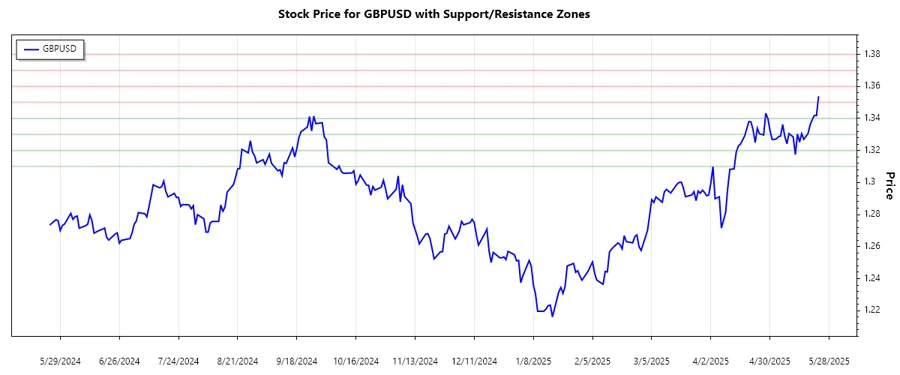

The GBPUSD currency pair has shown a range of movements in recent months, reflecting fluctuations in economic indicators both in the UK and the US. Recent data suggests an upward momentum, with a visible pattern of higher lows forming. Technical indicators like moving averages and support/resistance levels provide additional context, pointing to both opportunities and risks for traders. Watching for breakthroughs in key zones could offer predictive insights into potential future trends.

Trend Analysis

By analyzing the GBPUSD currency pair over the past several months, we can observe the recent trend behavior based on exponential moving averages (EMA). With the computed EMA20 exceeding the EMA50, a ▲ upward trend is identified, indicating potential bullish sentiment in the market. The table below highlights the recent 7-day trend transition:

| Date | Close Price | Trend |

|---|---|---|

| 2025-05-23 | 1.35388 | ▲ |

| 2025-05-22 | 1.34176 | ▲ |

| 2025-05-21 | 1.34189 | ▲ |

| 2025-05-20 | 1.33921 | ▲ |

| 2025-05-19 | 1.33599 | ▲ |

| 2025-05-18 | 1.33055 | ▲ |

| 2025-05-16 | 1.32696 | ▲ |

Technical interpretation suggests maintaining a watchful eye on these trends for continued upward movement potential, provided macroeconomic conditions support it.

Support and Resistance

From the dataset, two significant support and resistance zones can be identified analytically. These price levels have historically acted as turning points for the currency pair:

| Zone Type | From | To |

|---|---|---|

| Support | 1.33000 | 1.34000 |

| Support | 1.31000 | 1.32000 |

| Resistance | 1.35000 | 1.36000 |

| Resistance | 1.37000 | 1.38000 |

Currently, the close price of 1.35388 indicates the GBPUSD is within a resistance zone, suggesting potential price consolidation or reversal. Continued monitoring of price action in this area is crucial for traders.

Conclusion

Summarily, GBPUSD is experiencing an upward trend as indicated by the EMA20 exceeding the EMA50. While positioned in a potential resistance zone, traders should be cautious about a possible pullback, keeping an eye on global economic data that could influence currency movements. These observations highlight the dual nature of trading—balancing promising opportunities with the calculated risk management stemming from market volatility.