December 09, 2025 a 04:28 am

GBPJPY: Trend and Support & Resistance Analysis

The GBPJPY currency pair has shown varying levels of volatility over past months. Recently, it appears to have undergone a notable trend shift. The technical indicators suggest a developing pattern, with potential opportunities for traders keeping an eye on upcoming economic events. It is essential to monitor the support and resistance levels closely as they provide critical insights into market sentiment.

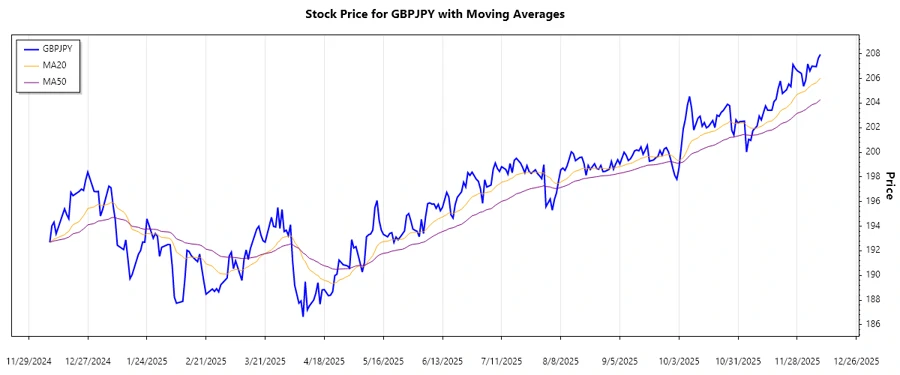

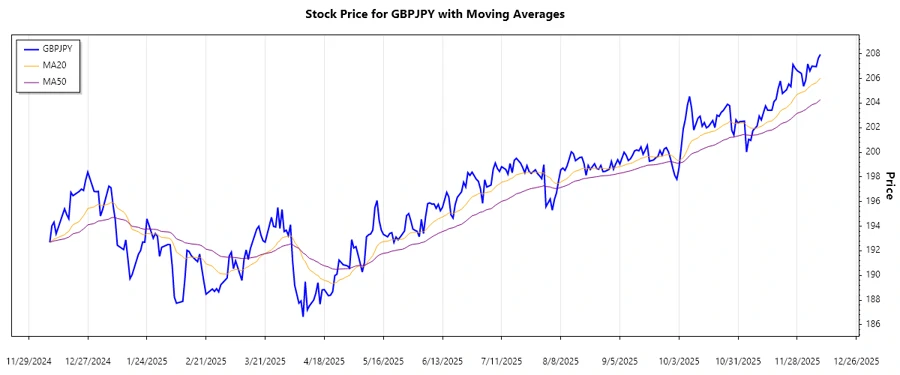

Trend Analysis

Analyzing the recent data, we find that the GBPJPY pair has shown signs of recovery, primarily moving upwards. Calculations have depicted a significant crossover in the Exponential Moving Averages (EMAs). This crossover is indicative of potential trend reversals and traders should be cautious during transitions.

| Date | Closing Price | Trend |

|---|---|---|

| 2025-12-09 | 207.955 | ▲ Up |

| 2025-12-08 | 207.648 | ▲ Up |

| 2025-12-07 | 206.960 | ▲ Up |

| 2025-12-05 | 207.001 | ▲ Up |

| 2025-12-04 | 206.611 | ▲ Up |

| 2025-12-03 | 207.179 | ▲ Up |

| 2025-12-02 | 205.846 | ▲ Up |

From the EMA calculations, with the EMA20 crossing above the EMA50, we interpret this behavior as an ongoing uptrend. Traders might consider this a bullish signal, indicating growing market confidence.

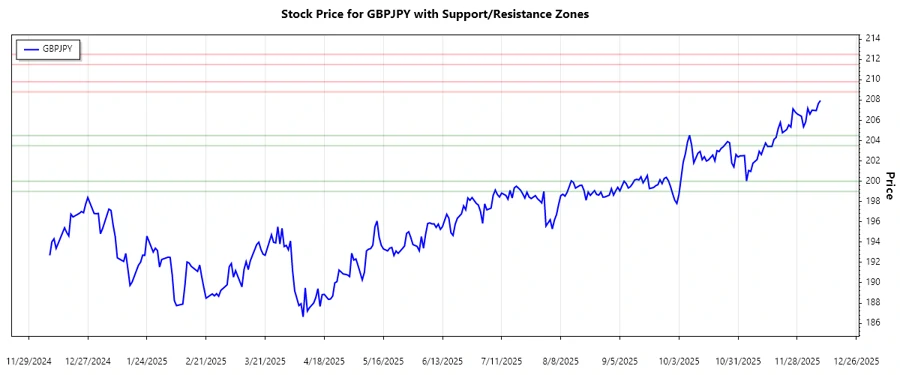

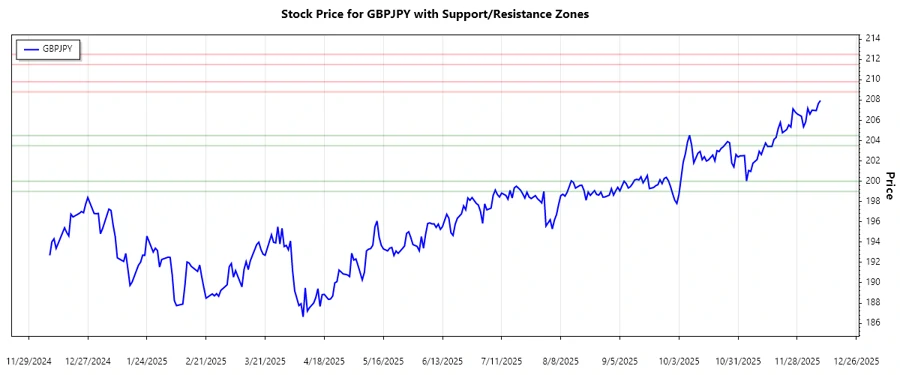

Support and Resistance

Based on recent closing prices, critical support and resistance zones have formed. These levels may act as price pivots, offering insights on possible market movements in the coming weeks.

| Support/Resistance | Zone Range | |

|---|---|---|

| Support 1 | 203.50 - 204.50 | ▼ |

| Support 2 | 199.00 - 200.00 | ▼ |

| Resistance 1 | 208.80 - 209.80 | ▲ |

| Resistance 2 | 211.50 - 212.50 | ▲ |

The current closing price suggests that it lies within a resistance zone, indicating potential selling pressure. If price breaks above this level, it could present a bullish continuation signal, inviting potential buying opportunities.

Conclusion

In conclusion, GBPJPY is showcasing an upward momentum with immediate attention towards the resistance levels, which, if breached, could pave way for further advances. Conversely, a reversal could bring the support zones into focus, potentially reversing recent gains. Traders should balance optimism with caution, considering economic indicators and market news to guide their decisions. The market's current climate suggests potential positive opportunities, though vigilance is key to mitigating risks.