October 25, 2025 a 04:28 am

GBPCHF: Trend and Support & Resistance Analysis

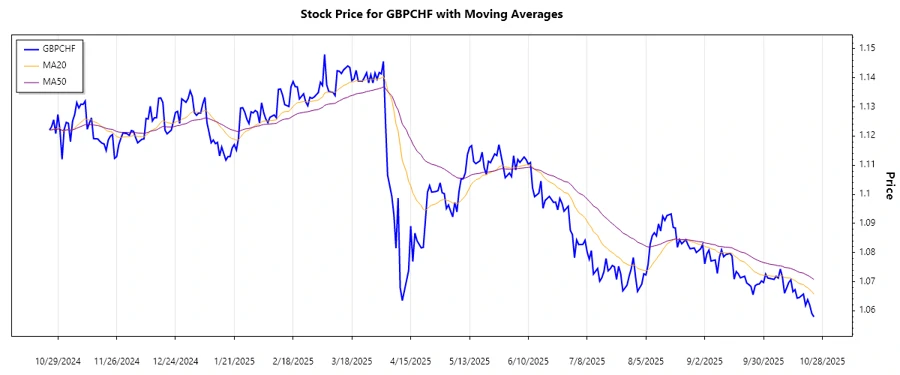

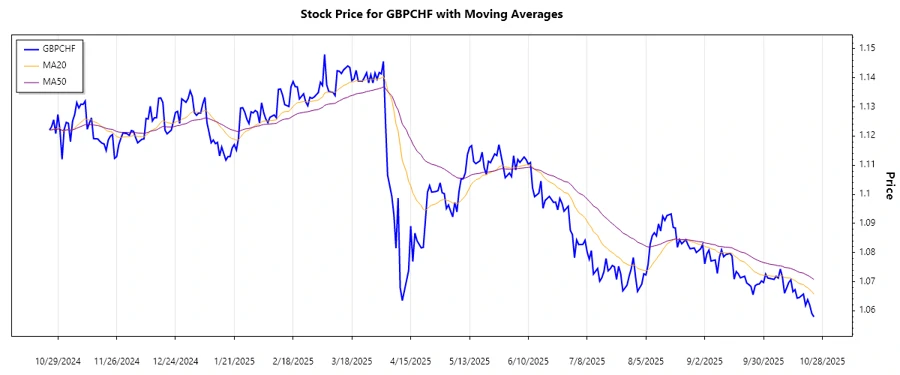

The GBPCHF currency pair has witnessed significant fluctuations recently, reflecting broader economic conditions. Analyzing the past data reveals a dominant downward trend, with periodic recoveries. Technical indicators suggest cautious optimism as traders look out for potential support levels. Market volatility remains high, requiring careful monitoring by analysts.

Trend Analysis

Recent analysis of the GBPCHF currency pair indicates a prominent downward trend. Calculations of the exponential moving averages, EMA20 and EMA50, confirm this as EMA20 has consistently stayed below EMA50. This declining trend is reflective of broader market pressures impacting the pair, warranting attention to potential intervention points.

| Date | Close Price | Trend |

|---|---|---|

| 2025-10-24 | 1.05791 | ▼ |

| 2025-10-23 | 1.05904 | ▼ |

| 2025-10-22 | 1.06191 | ▼ |

| 2025-10-21 | 1.06383 | ▼ |

| 2025-10-20 | 1.06182 | ▼ |

| 2025-10-19 | 1.06574 | ▼ |

| 2025-10-17 | 1.06455 | ▼ |

In conclusion, the persistent downward trend in GBPCHF calls for close observation. Traders should remain vigilant of any deviations indicating a potential trend reversal.

Support and Resistance

The GBPCHF pair currently sits at critical levels, with support and resistance zones identified through historical price patterns. Current analysis places key support between 1.061 and 1.064, while resistance appears between 1.070 and 1.073. Prices lingering around these thresholds warrant strategic responses by market participants.

| Zone Type | From | To | |

|---|---|---|---|

| Support | 1.061 | 1.064 | ▲ |

| Support | 1.050 | 1.053 | ▲ |

| Resistance | 1.070 | 1.073 | ▼ |

| Resistance | 1.080 | 1.083 | ▼ |

At present, the GBPCHF is positioned within the support zone of 1.061 to 1.064, indicating a potential bounce or continuation of the downward trend depending on breaking news and economic data.

Conclusion

The GBPCHF currency pair is entrenched in a downward trend with occasional rallies, influenced by macroeconomic variables. Its current position within identified support zones suggests potential opportunities for long positions upon confirmation of a rebound. However, the prevailing downtrend caution remains imperative. Traders should monitor global economic announcements that could affect this pair's future trajectory. Strategic planning based on chart patterns and key technical indicators will be critical for navigating the coming weeks.