January 09, 2026 a 05:08 am

GBPAUD: Fibonacci Analysis

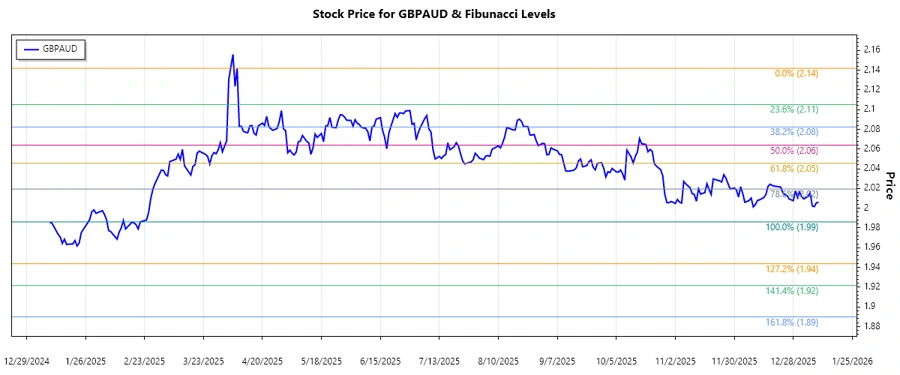

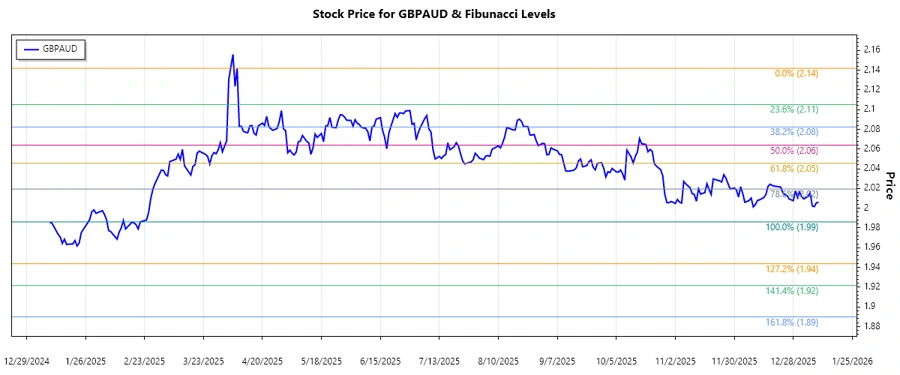

The GBPAUD currency pair has experienced periods of volatility over recent months. Currently, the data points towards an overall downtrend. This suggests market sentiment is favoring the Australian dollar over the British pound in this timeframe. With the recent movements, there’s potential for retracement levels to act as significant points for gauging entry and exit strategies.

Fibonacci Analysis

| Parameter | Value |

|---|---|

| Start Date | 2025-04-08 |

| End Date | 2026-01-09 |

| High Price | 2.14188 (2025-04-08) |

| Low Price | 1.98612 (2025-12-21) |

Calculated Fibonacci Levels:

| Level | Price |

|---|---|

| 0.236 | 2.029 |

| 0.382 | 2.051 |

| 0.5 | 2.064 |

| 0.618 | 2.078 |

| 0.786 | 2.099 |

The current price appears to be within the 0.236 retracement level. This can be an indication of potential support, implying a possible area to watch for price reversals.

From a technical perspective, these levels may serve as support or resistance zones, suggesting entry or exit points depending on the overall market strategy.

Conclusion

The GBPAUD pair illustrates a primary downtrend which can continue to offer potential trading opportunities. Identifying and understanding retracement zones helps in planning trades around key levels where price action may consolidate or reverse. For traders, being aware of the Fibonacci levels can provide insights into future price dynamics. However, as with all market analyses, potential external factors and sudden market changes must be considered. Caution and diversified strategies are advised with ongoing monitoring of key economic indicators from both Australia and the UK that can influence this pair.