August 11, 2025 a 05:08 am

GBPAUD: Fibonacci Analysis

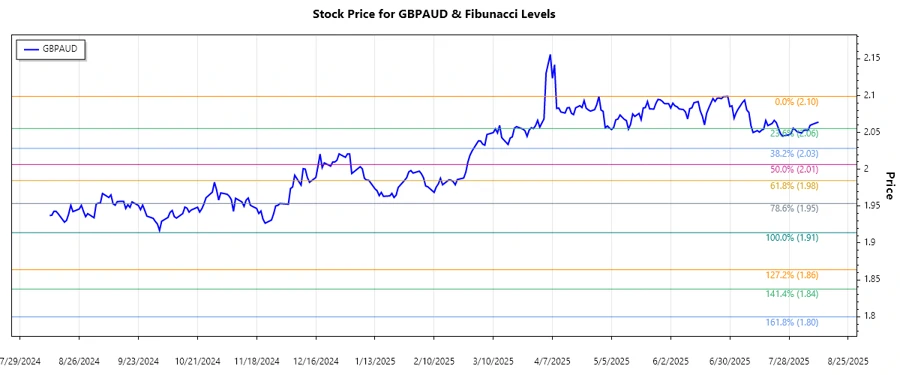

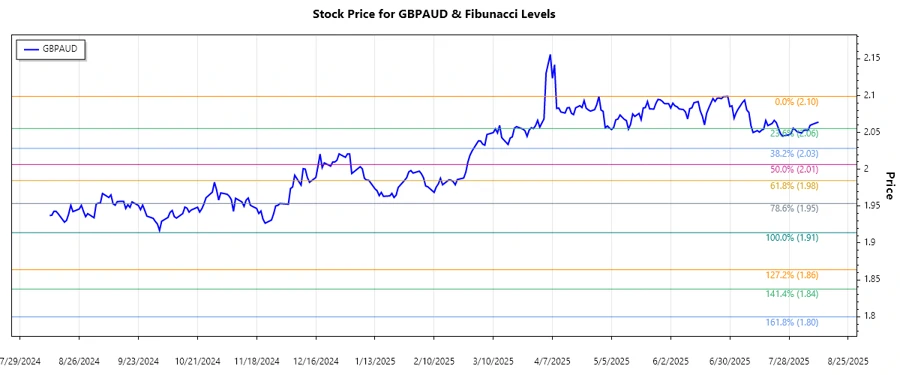

The GBPAUD currency pair has shown varied movements over recent months, with fluctuations driven by both economic events in the UK and Australia. The Australian economy's reliance on commodity exports and the UK's monetary policy decisions are key drivers behind these shifts. Technically, understanding Fibonacci retracement levels can help in predicting future support and resistance zones in this pair.

Fibonacci Analysis

| Description | Details |

|---|---|

| Start Date | 2024-12-02 |

| End Date | 2025-08-11 |

| High Price | 2.09902 (2025-06-29) |

| Low Price | 1.91401 (2024-10-03) |

| Fibonacci 0.236 | 1.96988 |

| Fibonacci 0.382 | 2.00280 |

| Fibonacci 0.5 | 2.03152 |

| Fibonacci 0.618 | 2.06024 |

| Fibonacci 0.786 | 2.09705 |

The current price of GBPAUD sits at 2.064, which indicates that the pair is currently experiencing a retracement around the 0.618 Fibonacci level. This area can be seen as a significant support zone, offering potential for upward momentum if the price holds.

Conclusion

The analysis of the GBPAUD indicates that the currency pair is in a crucial stage of retracement at the 0.618 level, which historically serves as a strong indicator for potential trend reversals. If the support holds, we could see a bullish move upward. However, if broken, further declines may occur, revisiting lower Fibonacci levels. Traders should keep an eye on forthcoming economic reports from both the UK and Australia, as these could significantly impact the path forward. Balancing these findings with fundamental analysis remains imperative for optimal decision-making.