August 11, 2025 a 06:01 pm

F: Fundamental Ratio Analysis - Ford Motor Company

The Ford Motor Company's stock presents a blend of opportunities and challenges. Positioned in the competitive auto manufacturing sector, Ford has managed to maintain a solid market presence with its diverse vehicle lineup. Investors should weigh its potential for growth against ongoing industry risks.

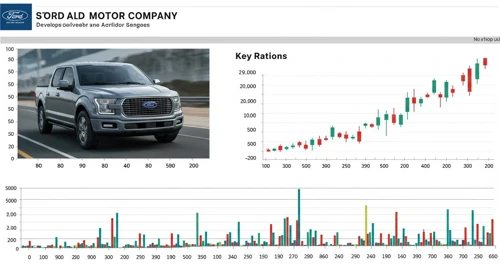

Fundamental Rating

Ford's fundamental rating reflects a balanced score with some areas of concern, particularly in debt management.

| Category | Score | Visualization |

|---|---|---|

| Discounted Cash Flow | 5 | |

| Return on Equity | 3 | |

| Return on Assets | 2 | |

| Debt to Equity | 1 | |

| Price to Earnings | 3 | |

| Price to Book | 4 |

Historical Rating

Over time, the historical scores show consistency, with room for improvement in debt management and asset efficiency.

| Date | Overall | DCF | ROE | ROA | D/E | P/E | P/B |

|---|---|---|---|---|---|---|---|

| 2025-08-11 | 3 | 5 | 3 | 2 | 1 | 3 | 4 |

| Historical | 0 | 5 | 3 | 2 | 1 | 3 | 4 |

Analyst Price Targets

Analyst estimates show mixed sentiment, with targets ranging between $9 and $11, pointing to a "Hold" consensus.

| High | Low | Median | Consensus |

|---|---|---|---|

| $11 | $9 | $11 | $10.5 |

Analyst Sentiment

Majority of analysts recommend holding the stock, with several advocating for a buy, indicating cautious optimism.

| Recommendation | Number of Ratings | Visualization |

|---|---|---|

| Strong Buy | 0 | |

| Buy | 14 | |

| Hold | 23 | |

| Sell | 7 | |

| Strong Sell | 0 |

Conclusion

Ford Motor Company remains a prominent figure in the automotive industry, showing resilience amidst market fluctuations. Its diverse product line and international reach offer growth potential, although investors must consider the company's debt profile and asset efficiency. With a general analyst consensus of "Hold," the stock may be suitable for those seeking moderate risk with stable returns. Ongoing industry challenges imply vigilance for prospective investors.