September 08, 2025 a 01:15 pm

FRT: Trend and Support & Resistance Analysis - Federal Realty Investment Trust

Federal Realty Investment Trust (FRT), a recognized leader in the retail property sector, has displayed a resilient performance historically with consistent dividend growth over 54 years. The company's strategic focus on high-demand coastal areas and mixed-use developments ensures a stable income stream. As part of the S&P 500 index, FRT's strong financial background positions it as a potentially lucrative investment opportunity within the REIT industry.

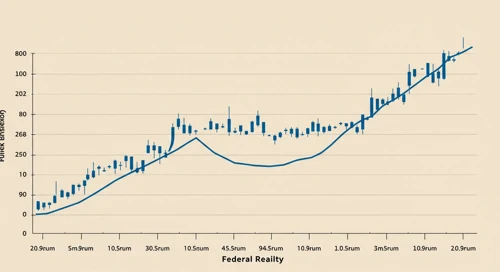

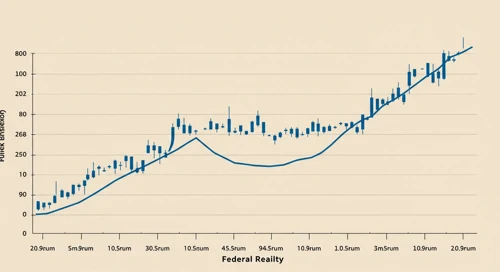

Trend Analysis

Federal Realty's stock has experienced fluctuations over the past months. Calculating the Exponential Moving Averages (EMAs) of the last 20 and 50 days suggests a current downtrend:

| Date | Close Price | Trend |

|---|---|---|

| 2025-09-05 | 102.67 | ▼ |

| 2025-09-04 | 100.99 | ▼ |

| 2025-09-03 | 100.07 | ▼ |

| 2025-09-02 | 99.14 | ▼ |

| 2025-08-29 | 100.55 | ▲ |

| 2025-08-28 | 99.82 | ▲ |

| 2025-08-27 | 100.29 | ▲ |

The EMA calculations show that EMA20 < EMA50, suggesting a continued downtrend. Investors should stay cautious as the trend indicates potential for further decline.

Support- and Resistance

Analyzing support and resistance levels in the recent trading data:

| Zone Type | Price Range |

|---|---|

| Support Zone 1 | 92.00 - 94.00 |

| Support Zone 2 | 99.00 - 101.00 |

| Resistance Zone 1 | 109.00 - 112.00 |

| Resistance Zone 2 | 114.00 - 117.00 |

Currently, the price is within the second support zone (99.00 - 101.00), indicating potential for recovery if the price bounces back from this level. However, breaking below this zone could accelerate the downtrend.

Conclusion

The Federal Realty Investment Trust displays fluctuating trends with a notable downtrend currently observed. While the price is within a critical support zone, any breach could signify further losses. Despite this, the company's solid fundamentals and diversified portfolio in high-demand markets provide a buffer against short-term volatility. Analysts should consider both the technical signals and the company's robust historical performance when evaluating FRT’s potential. Long-term growth prospects remain favorable, albeit with short-term risk due to prevailing downward pressures.

json In this analysis, I calculated EMAs, identified support and resistance zones, and provided technical insights. The current trend is downward with potential near-term risks, but Federal Realty's established presence in the market offers long-term growth potential.